For most people, July 1st is a pretty average day. It's almost the exact midpoint of summer. There are barely any professional sports events. Kids are at summer camp. Parents are drinking every evening to survive the heat and celebrate a brief respite from their children. Below is a quick list of what the most significant historical moments that happened on July 1st:

- If you live in Rwanda, July 1st marks the anniversary of the day you gained independence from Belgium.

- July 1st, 1979 was the day that Sony introduced the Walkman.

- July 1st, 1997 was the day that Britain handed Hong Kong back over to China.

- If you're Liv Tyler, Missy Elliot or Dan Aykroyd, July 1st is your birthday.

As you can tell, July 1st is kind of just a boring day, historically speaking.

On the other hand, in recent years July 1st has evolved into its own new international holiday. It's the day we celebrate the most famous contract in sports history. Of course we are talking about…

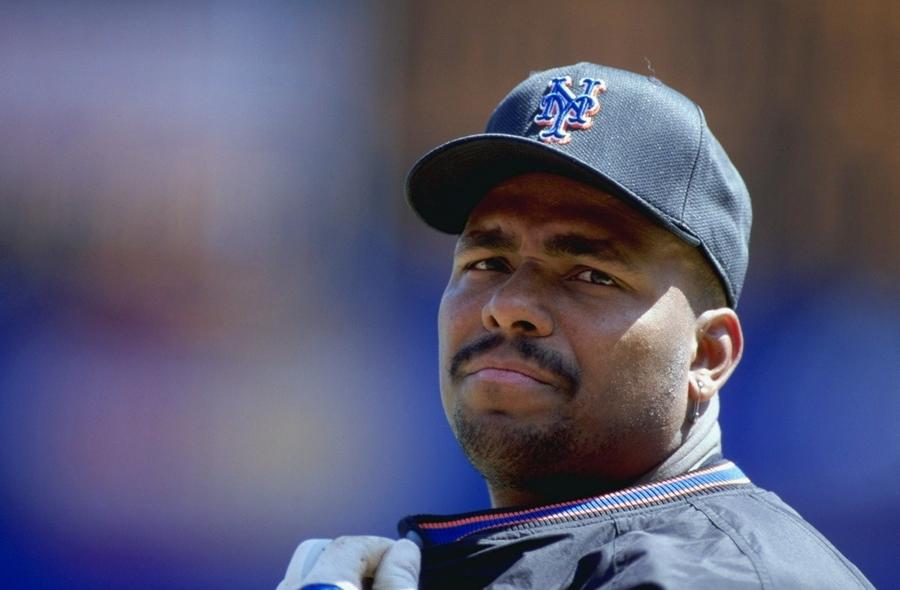

Bobby Bonilla Day

Bobby Bonilla Day is the international holiday celebrating the fact that when 59-year-old Bobby Bonilla checks the mail tomorrow, he'll find a check from the NY Mets. The amount?

$1.4 million

FYI, that's enough to make Bobby the 20th highest-paid player on the 2022 Mets roster. Why on earth is a man who is very close to qualifying for social security still getting million dollar checks from the Mets???

And YES. He gets paid with an old fashioned paper check…

Getty

A Quick History

During his career Bobby earned a combined $52 million in salary over 16 seasons between 1986 and 2001. He played third base and right field, ending his career with batting average of .279, 287 home runs and 1,173 RBIs. He was a six-time All-Star, three-time Silver Slugger and a World Series Champion in 1997.

At the peak of his career he was one of the best players in baseball, routinely hitting 20 home runs and driving in 100 RBIs each season.

In 1991, Bobby was lured away from the Pittsburgh Pirates by the New York Mets with a five-year, $29 million contract. Believe it or not, earning around $6 million per year in 1991 (roughly $12 million in today's dollars) was enough to make Bobby the highest-paid baseball player in history up to that point and the highest-paid athlete in the world.

(Photo by Rick Stewart/Getty Images)

Highest-paid athletes in the world in 1992:

- #1: Bobby Bonilla – $5.9 million

- #2: Patrick Ewing – $5.5 million

- #3: Dan Marino – $5 million

- #4: Wayne Gretzky – $3.1 million

Bobby ended up bouncing over the Orioles a few years later, then the Florida Marlins and the LA Dodgers before landing back with the Mets.

In 1999, with one year left on his contract with the Mets, Bobby averaged just .160 with four home runs and 18 RBIs. He spent much of the season arguing with the team's manager and the season ended with an embarrassing incident in which Bobby and teammate Rickey Henderson were caught playing cards in the dugout while their team lost the final game of the NLCS.

Needless to say, there wasn't much love between Bonilla and the Mets organization.

Unfortunately, the Mets still owed Bobby $5.9 million.

Getty

An Unusual Contract Proposal

Knowing that his best years were behind him and that this $5.9 million would be his last big paycheck, Bobby and his agent went to the Mets management with a proposal.

Instead of paying him $5.9 million that he was owed the following year, they proposed that the Mets pay $29.8 million over 25 years… with the first payment not due until 2011. So in other words, $1.2 million per year every year, starting in 2011 and ending in 2035.

And where did this idea come from? This was actually not the first unusual contract Bobby negotiated with the Mets. Back in 1994 the Mets agreed to take half of the $6 million he was owed for the 1994-1995 season and pay it in $250,000 installments over 25 years starting in 2003.

So technically, Bobby was proposing that the Mets pay him $1.4 million per year long into his retirement.

And that's when the story takes a quick detour into the world of…

Bernie Madoff

Hiroko Masuike/Getty Images

From 1986 until September 2020, the Mets were owned by a guy named Fred Wilpon. Fred first became an owner when he bought 50% of the team in 1986 for an undisclosed amount. He became majority owner in 2002 with a $135 million purchase. In 2020 Fred sold the Mets to hedge fund manager Steve Cohen for $2.35 billion.

But let's jump back to the late 1990s. Back then Fred and the Mets were heavily invested with Bernie Madoff. The Mets and Wilpon basically used Madoff's fund as a private bank.

For a number of years, this was a very wise decision because, before the fraud was exposed, Fred was reliably getting 13% average annual returns through Madoff.

When he was considering Bobby's deferred contract offer in 1999, Fred did some quick math in his head. He soon realized that Bobby's proposal was actually a bargain for the team.

Even if the Mets "only" got an 8% return on the $5.9 million they saved in 1999, over 30 years that saved money would balloon to nearly $60-70 million. And $60-70 million is much larger than $29.8 million. Simple math.

Unfortunately, as we all know now, Madoff was one of the largest fraudsters in history. Fred Wilpon personally wound up losing $700 million because of Madoff, including $160 million in fake profits that were clawed back. Fred came perilously close to being forced to sell the Mets in 2009/2010.

Obviously the fraud also wiped out the math that made Bobby Bonilla's 25-year contract deferment compute.

But that doesn't mean the Mets are off the hook!

Every year between now and 2028, Bobby will earn $1.4 million every July 1st ($1.2 million +225k from the two contracts). Then from 2028 through 2035 he'll earn $1.2 million (because the first unusual contract will have run out).

How Does Bobby Bonilla Receive The Money?

So how exactly does Bobby receive his $1.4 million on Bobby Bonilla Day? For many years, I assumed wire transfer. According to an NPR "Planet Money" interview with Bobby, he actually receives a PAPER CHECK every year. A paper check that he physically drives to the bank to deposit.

Does Bobby not have a smart phone with a mobile deposit app? Or maybe you can't mobile deposit check that big? Hopefully someday I'll face that same question so I can report back.

As a parting fact, including this year's payment, Bobby has received $14.3 million to date from the Mets. He has around $15.5 million left to go over the next 13 years.