- Category:

- Richest Business › Wall Street

- Net Worth:

- $8 Billion

- Birthdate:

- Jan 6, 1944 (80 years old)

- Birthplace:

- Tulsa

- Gender:

- Male

- Profession:

- Entrepreneur, Businessperson, Investor, Financier

- Nationality:

- United States of America

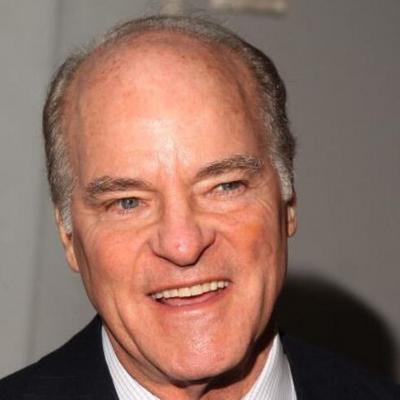

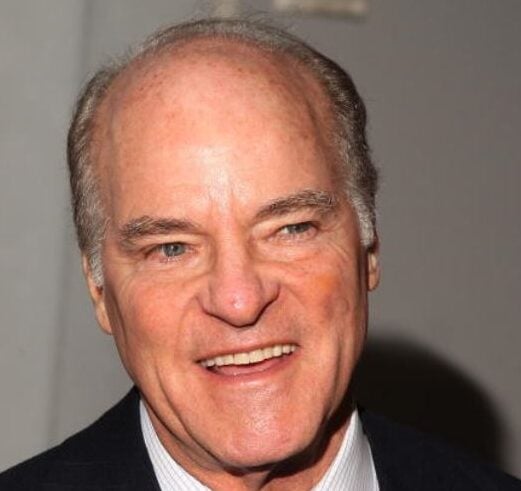

What is Henry Kravis's Net Worth and Salary?

Henry Kravis is an American businessman and investor who has a net worth of $8 billion. Henry Kravis earned his fortune as the co-founder of the investment company Kohlberg Kravis Roberts & Co, a multinational private equity firm specializing in leveraged buyouts.. He co-founded the firm in 1976 with his business partners Jerome Kohlberg Jr. and George R. Roberts. He completed numerous transactions through the company over the years, including the notorious leveraged buyout of RJR Nabisco in 1989. Kravis's predilection for leveraged buyouts has drawn significant criticism, as has his support of Donald Trump.

Early Life and Education

Henry Kravis was born on January 6, 1944 in Tulsa, Oklahoma to Jewish parents Bessie and Raymond. His father was a successful oil engineer in Tulsa who had previously been a business partner of Joseph Kennedy. As a youth, Kravis went to Eaglebrook School, an independent boarding and day school in Deerfield, Massachusetts. Following this, he attended the college preparatory institute Loomis Chaffee School in Windsor, Connecticut. In his senior year there, Kravis was elected student council vice president. For his higher education, he went to Claremont McKenna College as an economics major; for all four of his years there, he played varsity golf. Kravis went on to attend Columbia Business School, earning his MBA in 1969.

Bear Stearns

After graduating from Columbia, Kravis joined the staff of the New York City-based investment firm Bear Stearns. His cousin George R. Roberts also joined at the same time. Together, the two worked under corporate finance manager Jerome Kohlberg Jr. In the early 70s, Kravis, Roberts, and Kohlberg made a number of notable investments and completed some of the earliest leveraged buyouts in private equity history. They bought out such companies as Incom, Cobblers Industries, and Boren Clay.

Kohlberg Kravis Roberts

Due to tensions that developed with Bear Stearns executive Cy Lewis, Kravis, Kohlberg, and Roberts left the firm in 1976 to found their own investment company, called Kohlberg Kravis Roberts. The company was supported by such early investors as the Griffith and Hillman families. After Kohlberg resigned in 1987, KKR continued to be run by Kravis and Roberts. The two subsequently became responsible for the notorious leveraged buyout of RJR Nabisco in 1989, which was the biggest buyout in history at the time at $31.4 billion. However, by early 1995, KKR had divested its holdings in the company, resulting in an overall loss on the transaction. KKR has since had more profitable investments in companies including Playtex, Safeway, Borden, and Regal Entertainment Group. The firm also completed lucrative takeovers of battery manufacturer Duracell and the retail electricity provider TXU Energy. KKR went public on the New York Stock Exchange in 2010.

In late 2013, KKR closed on its first real estate investment fund, which raised around $1.2 billion. The firm made numerous other investments over the subsequent years. In the summer of 2017, Kravis and Roberts announced that they would be stepping down from their positions as co-CEOs and would be succeeded by Scott C. Nuttall and Joseph Y. Bae. The succession eventually took place in October of 2021. By the end of that year, KKR had completed over 650 private equity investments in its portfolio companies, amassing around $675 billion of total enterprise value.

Getty

Philanthropy

Beyond KKR, Kravis has been involved in numerous philanthropic endeavors. He funds the Kravis Leadership Institute at his alma mater of Claremont McKenna College, which administers the Kravis Prize to exceptional leaders of non-profit organizations. Kravis has also funded the construction of facilities at his other alma maters, Eaglebrook School and the Loomis Chaffee School, as well as at Middlesex School and Deerfield Academy.

Among his other philanthropic activities, Kravis donated $15 million to Mount Sinai Medical Hospital for the establishment of a cardiovascular health center. He is also a trustee of the hospital. Additionally, Kravis sits on the boards of the Metropolitan Museum of Art and the Partnership for New York City, and chairs the non-profit organization Sponsors for Educational Opportunity. He also co-chairs the Columbia Business School Board of Overseers.

Politics

A Republican, Kravis has done fundraising for such presidential candidates as George H. W. Bush, George W. Bush, and John McCain. In 1997, he established the Republican Leadership Council with financier Lewis M. Eisenberg. Later, in 2017, Kravis donated $1 million to Donald Trump.

Personal Life

With his first wife Hedi Shulman, Kravis had three children named Harrison, Robert, and Kimberly. The couple eventually divorced. In 1985, Kravis wed his second wife, socialite and fashion designer Carolyne Roehm. The pair later divorced in 1993. The year after that, Kravis married Canadian businesswoman Marie-Josée Drouin. Although he mostly resides in New York City, Kravis also owns houses in Palm Beach, Florida; Sharon, Connecticut; and Paris, France, among other places.

In the media, Kravis was portrayed by actor Jonathan Pryce in the 1993 television film "Barbarians at the Gate," based on the eponymous book detailing the 1989 buyout of RJR Nabisco.