What is Peter Lynch's net worth?

Peter Lynch is an American investor and mutual fund manager who has a net worth of $450 million. In 2006, Peter estimated his net worth at $352 million. That was enough to make him the 33rd richest resident of Boston, according to Boston Magazine. He has given away tens of millions of dollars, perhaps as much as $100 million, to various charities.

As the manager of the Magellan Fund for Fidelity Investments between 1977 and 1990, Peter averaged an unprecedented 29.2% annual return. During his tenure, the fund achieved record growth and became the best-performing mutual fund on the planet. Under Peter, assets under management went from $18 million up to $14 billion. Peter Lynch has co-authored several books and papers about investing. He coined the phrases "ten bagger" and "invest in what you know".

Early Life and Education

Peter Lynch was born on January 19, 1944 in Newton, Massachusetts. Early in his life, his father passed away, leaving him to be raised by his mother. To help support the family, Lynch worked as a caddie as a teenager. For his higher education, he went to Boston College, paying for his tuition by making profits from his purchase of Flying Tiger Airlines shares. After graduating in 1965, Lynch went on to obtain an MBA from the Wharton School of the University of Pennsylvania.

Career Beginnings at Fidelity

In 1966, Lynch became an intern at Fidelity Investments; previously, he had caddied for the corporation's president D. George Sullivan, a connection that helped him land the gig. Initially, Lynch handled the paper, publishing, and chemical industries for Fidelity. He then took two years off to serve in the Army. Upon his return in 1969, Lynch was made a permanent hire at Fidelity. As an employee, he was tasked with following the mining, textiles, and metals industries. From 1974 to 1977, Lynch was the director of research at Fidelity.

Fidelity Magellan Fund

Lynch began his biggest venture in 1977 when he became the head of the Magellan Fund, a mutual fund that at the time had a mere $18 million in assets. Over the course of his 13-year tenure as manager of the Magellan Fund through 1990, the fund grew to over $14 billion in assets with more than 1,000 individual stock positions. Moreover, the Magellan Fund averaged a 29.2% annual return, becoming one of the world's best-performing mutual funds. Lynch was able to accomplish this record growth largely because he took over the fund when it was still small, and so he had few restrictions on what assets he could purchase. He placed his focus on individual companies, starting with large American companies and gradually shifting to international and smaller stocks. Lynch achieved success in a wide array of stocks from various industries. Among his most profitable picks were Ford, General Electric, Lowe's, Kemper, Fannie Mae, and Volvo.

Books and Articles

Lynch has written or co-written several books and articles about investing strategies. With John Rothchild, he has co-authored "One Up on Wall Street," "Beating the Street," and "Learn to Earn." The former title, which has sold over a million copies, focuses on investment techniques related to stock classifications and portfolio design, among other topics. Lynch also penned a series of articles on investment for Worth magazine.

Investment Philosophy

Lynch's investment philosophy has become among the most popular in the modern financial world. He is particularly well known for his mantra "invest in what you know," which is founded on the economic concept of local knowledge. Lynch also coined the term "ten bagger," referring to an investment that's worth ten times its original purchase price. Meanwhile, he helped popularize the stock investment strategy known as GARP, or "Growth At a Reasonable Price," a hybrid approach that balances growth-investing potential for share-price increases with the discipline of value-investing for avoiding overpriced stocks. The GARP model is employed by many major funds.

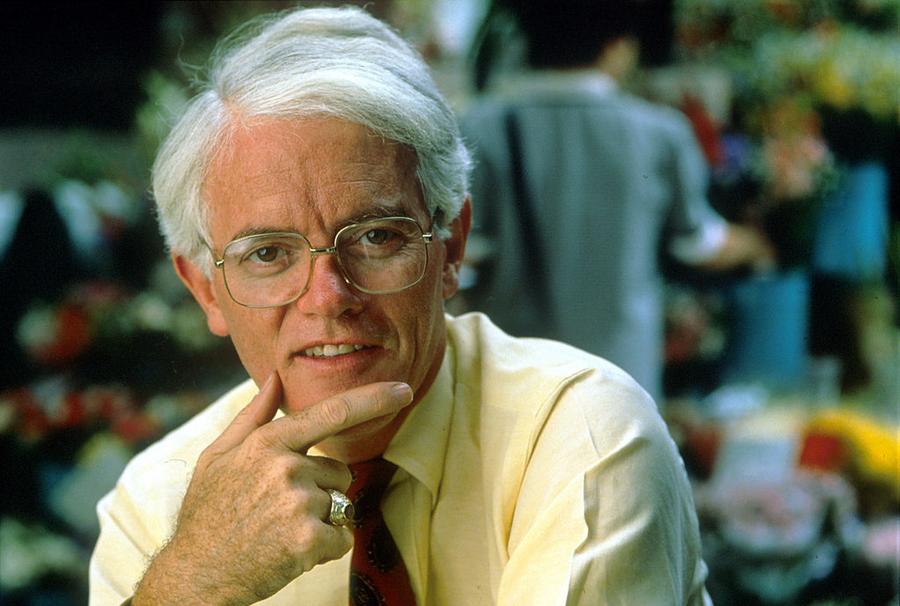

(Photo by James Schnepf/Liaison)

Philanthropy

While serving as vice chairman of Fidelity Investments' adviser arm, Fidelity Management & Research Co., Lynch has spent much of his time mentoring fledgling young analysts. He also devotes a great deal of his time to other various philanthropic endeavors. Through his and his wife's Lynch Foundation, which broadly supports organizations in the education, health, and cultural spheres, he has given away millions of dollars in grants. He has also donated money as an individual, including to his alma mater Boston College. Other projects supported by Lynch include the New Year's Eve cultural celebration First Night; the global health and development nonprofit AmeriCares; and the education nonprofits City Year and Teach For America.

Personal Life

In 1968, Lynch married his wife Carolyn Hoff, with whom he has three daughters named Mary, Annie, and Elizabeth. The couple co-founded the Lynch Foundation. They remained together until Hoff's passing from leukemia in 2015.

/2019/01/peter-lynch.jpg)

/2010/09/edward-johnson.jpg)

/2014/02/kf.jpg)

/2010/09/aj.jpg)

/2010/07/John-Bogle.jpg)

/2009/09/Warren-Buffett.jpg)

/2015/07/ghc.jpg)

/2023/01/Julian-McMahon.png)

/2018/03/Matt-Stonie.jpg)

/2022/06/joey-chestnut.png)

/2014/07/keith2.jpg)

/2010/05/Lenny-Kravitz-1.jpg)

/2009/11/Sigourney-Weaver.jpg)

/2012/09/Takeru-Kobayashi-1.jpg)

/2011/03/Rickie-Fowler-1.jpg)

/2010/12/Dannii-Minogue.jpg)

/2010/03/tw.jpg)

/2019/01/peter-lynch.jpg)

/2009/09/Warren-Buffett.jpg)

/2010/09/edward-johnson.jpg)

/2010/09/aj.jpg)

/2014/02/kf.jpg)

/2010/09/dalio.jpg)

/2010/07/John-Bogle.jpg)

/2023/02/David-Tepper.jpg)