What Is Terrell Owens' Net Worth?

Terrell Owens is a retired professional football player who has a net worth of $500 thousand. Terrell Owens played in the NFL from 1996 to 2010, then briefly again in 2012. During his career, Terrell earned $80 million between salary and endorsements. Unfortunately, he has experienced some personal and financial difficulties in his years since leaving the league. While appearing before a court in 2011 to discuss financial obligations related to child support, Terrell claimed to be broke at that time with extremely high monthly expenses and no income. Much more about Terrell's finances throughout the article below.

Financial Problems

During his NFL career, Owens earned around $80 million in salary and endorsements. Unfortunately, by 2011, Terrell was completely broke, telling a judge that he had no monthly income and very expensive monthly obligations. At the time, he was in court asking for reductions in four separate child support cases. In documents submitted to the judge, Terrell described how he was required to pay nearly $60,000 a month to four different women in addition to $63,000 a month for all the homes that these women live in. Furthermore, his personal home in Georgia was in foreclosure, which forced him to move into a girlfriend's apartment in Los Angeles.

Terrell has been open about his financial losses. Below are four lessons Terrell has given as financial advice to other professional athletes:

1. Don't live beyond your means.

After being drafted in 1996, Owens, like many rookies, was infatuated with the flashy lifestyle the NFL could offer.

"At that time I got sucked into wanting to be like everybody else, the guys with the Mercedes and all the flashy cars and the jewelry," he says. "I think those are some of the most idiotic purchases I think players can do, especially when they don't have that money in the bank account to really pay for that stuff."

Owens continues, "My advice to any fan or athlete out there: Just don't live beyond your means. You definitely have to be smart." He adds that athletes who receive lofty signing bonuses have to remember that taxes will take a big chunk of that: "Those things have to be accounted for."

2. Take ownership over your money.

According to Owens, athletes hear from financial advisers promising to "have your best interests at heart" frequently.

"I took it for face value and I got burned," Owens says. "I can't blame them totally because I had some responsibility in that myself, because I should've been able to really manage my finances just as well as they were doing."

3. If you don't understand, ask questions.

"It's a really tricky situation when you're an athlete. You want to kinda keep a lot of things close to vest and I think the best thing to do is ask questions before it's too late," Owens says.

He continues, "Find somebody you feel that are experienced in that area to give you advice, ask them what do you think about this. Don't take anything for granted."

4. Think twice before making a purchase.

"It's like 'mo' money, mo' problems,' so to speak," Owens says. "Sometimes at that moment you think [a purchase is] very well calculated, but in the long run you're like, 'Ah, I don't think I should've bought that.'"

Early Life

Terrell Owens was born Terrell Eldorado Owens on December 7, 1973, in Alexander City, Alabama. He is the son of L.C. Russell and Marilyn Heard. Terrell and his three older siblings were raised by their mother and grandmother. He loved watching football, but his grandmother would not give him permission to play until high school. Owens went to Benjamin Russell High School and participated in basketball, track, baseball, and eventually football in his junior year. He enrolled at the University of Tennessee in Chattanooga, where he continued to play basketball and football and run track. In his sophomore year, Terrell became a starter. He participated in the Senior Bowl during his last year of high school in order to get drafted by the NFL.

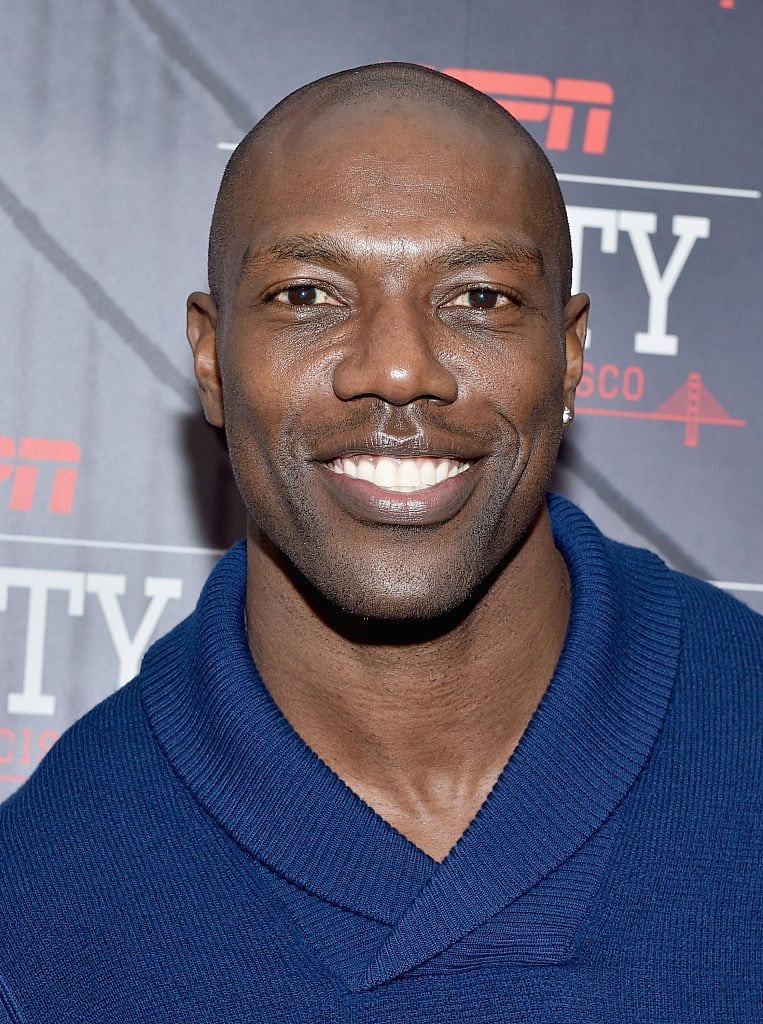

Ethan Miller/Getty Images

NFL Career

In 1996, the San Francisco 49ers drafted Owens. His first pro game was against the New Orleans Saints. Owens' first professional touchdown was on October 20, 1996, against the Cincinnati Bengals. Terrell had a record-breaking day in 2000 with 20 catches in a 17-0 win over the Chicago Bears. By 2004, Owens was ready to leave the 49ers. In a controversial move, he became a free agent and negotiated with other teams before he signed a contract for $49 million for seven years with the Philadelphia Eagles. He suffered a severely sprained ankle and fractured fibula on one of his first games with the team and had to sit out the rest of the season. However, Owens ignored the advice of his physicians and played in Super Bowl XXXIX, where the Eagles lost to the Patriots. After two years of a tense relationship with fellow teammates, coaching staff, and fans, the Eagles released Owens and he signed a three-year, $25 million deal with the Dallas Cowboys four days later, in March 2006. The following year was a career-high for Terrell, setting records left and right and becoming the first player in NFL history with at least one touchdown and six receptions in seven straight games.

(Photo by Joe Robbins/Getty Images)

However, at the end of the year, on December 22nd, he suffered another debilitating ankle sprain that kept him out of the remainder of the regular season. In a move that Owens claims blindsided him, he was released from the Cowboys on March 4, 2009. Four days later, he signed with the Buffalo Bills for a one-year contract. He finished his only season with the Bills with 55 catches and 5 receiving touchdowns. Owens went on to play another year with the Cincinnati Bengals, but they chose not to re-sign him for 2011. Terrell signed a six-figure contract with the Allen Wranglers, an Indoor Football League. He played for them from January 2012 until his release on May 29, 2012. The Wranglers stated Owens was released due to a lack of effort on and off the field. Terrell signed a contract with the Seattle Seahawks on August 6, 2012, only to be released by August 26, 2012. Owens returned to professional football in 2022 in the Fan Controlled Football (FCF) League with the FCF Zappers and Knights of Degen.

Terrell Owens was inducted into the Football Hall of Fame in 2018. The six-time Pro Bowler and five-time First-Team All-Pro finished his NFL career with 1,078 receptions for 15,934 yards and 153 receiving touchdowns.

Career Earnings

During his NFL career, Terrell earned a bit under $67 million in salary alone. He earned approximately $13 million on top of that from endorsements for total career earnings of $80 million. Unfortunately, he has struggled financially since leaving the NFL, as we detail later in this article.

| Terrell Owens Salary History | |

| 2010 | $4 million |

| 2009 | $6.2 million |

| 2008 | $13.7 million |

| 2007 | $8 million |

| 2006 | $10 million |

| 2005 | $2.7 million |

| 2004 | $9.1 million |

| 2003 | $4.7 million |

| 2002 | $4.1 million |

| 2001 | $2.4 million |

| 2000 | $1.8 million |

| Total: | $66.8 million |

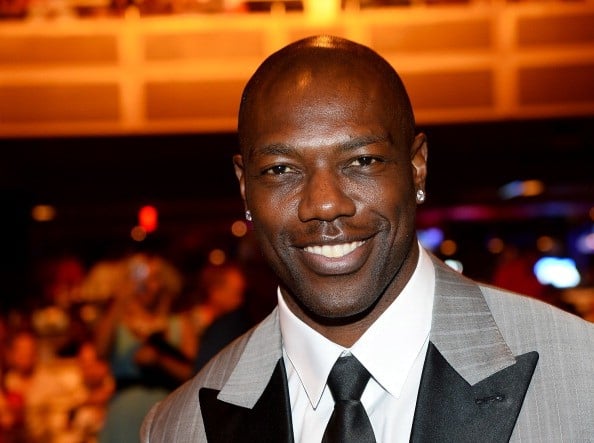

Mike Windle/Getty Images

Other Ventures

In 2009, VH1 premiered "The T.O. Show," which aired for a total of three seasons. He also launched his own podcast in 2013 called "Time Out with T.O." In 2015, Owens joined the cast of the hit NBC television series Celebrity Apprentice with Donald Trump, on which he competed in a variety of business-related challenges with his fellow celebrity cast-mates. Later that year, he also appeared on the hit reality television series "Celebrity Wife Swap," on which he traded lives with actor Robert Carradine. Terrell has also appeared on "Dancing with the Stars" and the MTV reality series "The Challenge."

Controversies

Terrell Owens was notorious for racking up controversy throughout his NFL career. He was mainly known for garnering criticism and attention for his overly flamboyant celebrations upon scoring a touchdown. The teams he was part of were often given penalties and fined due to Owens' "excessive celebration."

A police report filed on September 26, 2006, seemed to confirm a suicide attempt by Owens. It was said that his publicist found him unresponsive next to an empty bottle of painkillers, and he was transported by ambulance to Baylor Medical Center. The police report confirmed that both Owens and his publicist claimed he was depressed; however, his publicist later refuted the report and said Terrell had had an allergic reaction. At a news conference after he was released from the hospital, he denied having attempted suicide. The Dallas Police Department, after a dispute between the chief of police and Owens' publicist, closed the case and called it an accidental overdose.

Falcons cornerback DeAngelo Hall claimed Owens spat in his face after a play early in a game on December 16, 2006. Terrell confirmed and apologized but was fined $35,000 for the incident by the NFL.

Owens is the father of four children by four different mothers. He was sued in 2011 by Melanie Paige Smith III for failure to pay child support. Three out of four mothers appeared on the Dr. Phil show in 2012 to accuse Owens of not paying child support.

Despite being ranked statistically near the top of every NFL receiving category, Owens was not voted into the Pro Football Hall of Fame in his first two years of eligibility. Voters attributed this to his off-the-field behavior. When he was enshrined in 2018, Owens skipped the official celebration in Canton, Ohio, and held his own party in McKenzie Arena on the campus of the University of Tennessee at Chattanooga, his alma mater. Terrell Owens is the only inductee to skip his induction and host a separate ceremony.

Personal Life

Terrell is the father of four children: two daughters and two sons. His daughter Kylee plays volleyball for Prairie View A&M University.

Owens and his estranged wife, Rachel Snider, listed their Sherman Oaks home for sale in 2015 for $2.35 million. It sold later in the year for $2 million.

The infamous home where Terrell answered interview questions while doing sit-ups during his contract dispute was a big loss for the wide receiver. He bought the property in 2004 for $3.9 million and listed it for $3.4 million in 2007. It sold in 2010 for just $1.7 million.

Owens is a Christian. He was raised as a Christian by his grandmother and has been baptized.

/2016/06/GettyImages-462498100.jpg)

/2010/05/Marshawn-Lynch.jpg)

/2015/08/Julio-Jones.jpg)

/2023/11/George-Kittle.jpg)

/2010/09/Randy-Moss.jpg)

/2010/08/Jerry-Rice.jpg)

/2023/05/Gary-Numan.jpg)

/2020/10/neil-young.jpg)

/2014/09/Jarvis-Cocker.jpg)

/2021/01/Daryl-Hannah.jpg)

/2010/12/John-Fogerty.jpg)

/2022/03/Stephen-Stills.jpg)

/2018/01/jm2.jpg)

/2009/10/Jerry-Bruckheimer.jpg)

/2014/03/Deontay-Wilder-1.jpg)

/2019/07/ns2.jpg)

/2021/10/Ed-Orgeron.jpg)

/2016/06/GettyImages-462498100.jpg)

/2010/09/Randy-Moss.jpg)

/2018/01/GettyImages-902732688.jpg)

/2015/08/Julio-Jones.jpg)

/2010/05/Marshawn-Lynch.jpg)

/2010/03/Chad-Johnson.jpg)

/2023/11/George-Kittle.jpg)