What Is Hillary Clinton's Net Worth?

Hillary Clinton is an American politician, author, and media personality who has a net worth of $120 million. That is a combined net worth with her husband, the 42nd President of the United States, Bill Clinton. Hillary Clinton served as First Lady of the United States of America from 1993 to 2001. She also served as a United States Senator for the state of New York from 2001 to 2009 and was the Secretary of State under the 44th President Barack Obama from 2009 to 2013. Hillary was the Democratic Party's nominee for president in the 2016 presidential election, becoming the first woman to win a presidential nomination by a major U.S. political party. Clinton won the popular vote but lost the Electoral College vote, thus losing the election to Donald Trump.

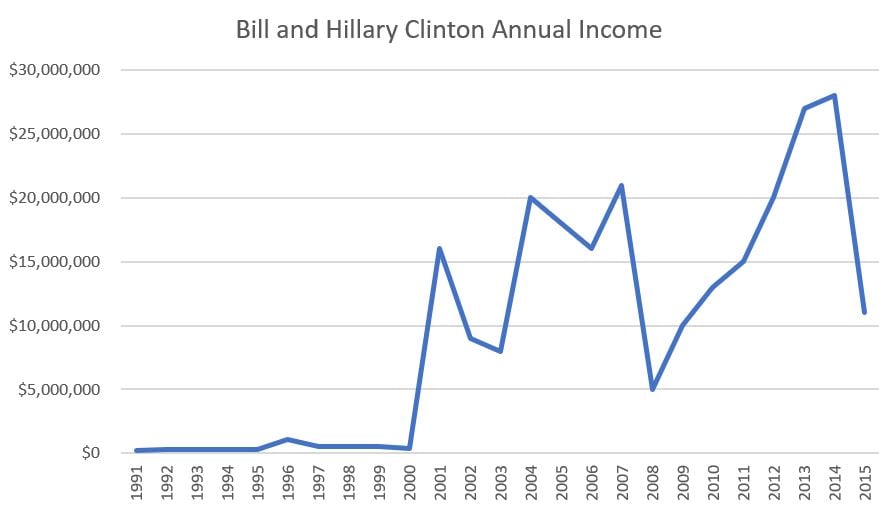

Clinton Income History

When they left the White House, the Clintons were technically millions of dollars in debt due to Bill's legal expenditures and sexual harassment settlement payments. In the decades after leaving the White House, Bill and Hillary would go on to earn more than $250 million from speaking engagements, book advances/royalties, consulting engagements, and investment income.

Before landing in the White House, Bill Clinton never earned more than $35,000 per year in salary as Attorney General and Governor of Arkansas. At the time, Hillary was the breadwinner, bringing home around $110,000 in base salary when he was a partner at a Little Rock law firm. In the late '80s and early '90s, before entering the White House, she also typically earned around $60,000 per year from corporate board fees for a total income of around $180,000.

During the first few years of Bill's Presidency, Hillary's income went to zero while he earned around $200,000 in base Presidential salary. Their income jumped to $1 million in 1996 thanks to royalties from the release of Hillary's book "It Takes A Village." She would later earn tens of millions more from royalties and advances thanks to her additional best-selling books "Living History" (2003), "Hard Choices" (2014), and "What Happened" (2017).

| Bill and Hillary Clinton Annual Income | |

| Year | Gross Income |

| 1991 | $200,000 |

| 1992 | $290,000 |

| 1993 | $293,000 |

| 1994 | $263,000 |

| 1995 | $316,000 |

| 1996 | $1,065,000 |

| 1997 | $569,000 |

| 1998 | $569,000 |

| 1999 | $504,000 |

| 2000 | $416,000 |

| 2001 | $16,000,000 |

| 2002 | $9,000,000 |

| 2003 | $8,000,000 |

| 2004 | $20,000,000 |

| 2005 | $18,000,000 |

| 2006 | $16,000,000 |

| 2007 | $21,000,000 |

| 2008 | $5,000,000 |

| 2009 | $10,000,000 |

| 2010 | $13,000,000 |

| 2011 | $15,000,000 |

| 2012 | $20,000,000 |

| 2013 | $27,000,000 |

| 2014 | $28,000,000 |

| 2015 | $11,000,000 |

| Total: | $241,485,000 |

The vast majority of their earnings since 2001 has been from speaking engagements, though they have earned at least $30 million from book advances. In 2001, Bill earned $15 million for a book advance. Years later, Hillary would earn a $14 million book advance. Bill's $15 million advance is the largest book advance of all time.

If one assumes they earned at least $10 million in 2016, 2017, 2018, and 2019, they've earned roughly $280 million since leaving the White House.

Early Life

Hillary Clinton was born Hillary Diane Rodham on October 26th, 1947, in Chicago, Illinois. She is the oldest of three siblings. During high school, she was involved in the student council and school newspaper and was selected for the National Honor Society. She was elected class vice president during her junior year of high school. Senior year, she was voted "most likely to succeed" and graduated in the top 5% of her class in 1965.

Clinton then enrolled as a political science major at Wellesley College in Massachusetts. In 1969, she graduated with departmental honors and entered Yale Law School, where she was part of the editorial board of the "Yale Review of Law and Social Action." She earned her law degree in 1973.

Career

Following Bill Clinton's election as governor of Arkansas, Hillary became the state's first lady in January 1979. She held that title for a total of 12 years (from 1979 to 1981 and then again from 1983 to 1992). Bill appointed Hillary as the chair of the Rural Health Advisory Committee, and in the role, she secured federal funds that expanded medical facilities in Arkansas's most impoverished areas without affecting doctors' fees.

In 1979, Clinton also became the first woman to be make full partner at Rose Law Firm, which is headquartered in Little Rock. (It was not until the Clintons entered the White House that Bill began making a higher salary than Clinton.)

In 1990, when Bill was considering not running again for governor, Hillary thought about running herself. In the end, he decided to run and was re-elected for his final term.

Clinton became First Lady of the United States in January 1993. She broke a great deal of norms that had been set by first ladies before her—she was the first to have a postgraduate degree and her own professional career prior to entering the White House. Not to mention, she was also the first president's wife to have an office in the West Wing, in addition to the usual first lady offices in the East Wing.

(Photo by Drew Angerer/Getty Images)

After moving to the state of New York, Clinton was elected to the United States Senate in 2000. Again, Hillary broke societal norms by being the first former first lady to run for public office and the first female senator to represent the state of New York. In 2006, Senator Clinton was re-elected by a wide margin.

Continuing with her political momentum, Clinton ran for president in 2008. She was one of the leading Democratic candidates in the race but lost out on the Democratic Party nomination to Barack Obama. On November 20, 2008, Clinton joined Obama's Cabinet as Secretary of State.

On April 12, 2015, Hillary announced her second run for the presidency and was formally nominated at the 2016 Democratic National Convention in Philadelphia on July 26, 2016. This nomination made her the first woman to ever be nominated for president by a major political party. Clinton selected Virginia Senator Tim Kaine as her running mate and ultimately lost the general election to Donald Trump later that year. (She is the fifth presidential candidate in United States history to win the popular vote but lose the election due to the electoral college.)

Since February 2023, Clinton has served on the faculty of the School of International and Public Affairs at Columbia University.

Clinton has co-authored and authored several books over the years, including the memoirs "Living History" (2003), "Hard Choices" (2014), and "What Happened" (2017).

Secretary of State Salary:

When she was Secretary of State, Hillary earned $186,000 per year. That made her the fourth highest-paid government official in the United States behind the President ($400,000), the Vice President ($225,551), and the Secretary of Treasury ($191,300).

Personal Life

Hillary began dating fellow law student Bill Clinton in the spring of 1971. Shortly after Hillary graduated from Yale Law School in 1973, Bill proposed. Clinton declined but eventually agreed to marry him after they purchased a house together in Fayetteville, Arkansas, two years later. Today, this home serves as the Clinton House Museum.

The couple tied the knot in their living room on October 11, 1975, during a Methodist ceremony. (Clinton has been a part of the United Methodist Church her entire life.)

Hillary gave birth to the couple's only child, Chelsea Victoria Clinton, on February 27, 1980. Hillary is a grandmother to Chelsea's three children.

In 2016, the Clintons purchased a home in Chappaqua, New York, for $1.6 million.

Notable Salaries

Often addressing Wall Street firms or business conventions, Clinton earns between $200,000–$225,000 per speaking engagement.

Over a 15-month span that concluded in March 2015, Clinton earned more than $11 million from her speeches alone.

Between 2007 and 2014, the Clintons collectively earned nearly $141 million. During this time, they paid about $56 million in federal and state taxes and also donated approximately $15 million to charity.

Controversy

In March 2015, the State Department's inspector general revealed that Clinton had used personal email accounts on a non-government, privately maintained server exclusively, rather than email accounts maintained on federal government servers while conducting official business during her tenure as the Secretary of State.

The State Department's internal review of 33,000 emails that Hillary had turned over concluded in September 2019. The review found 588 violations of security procedures and found that Clinton's use of a personal email server increased the risk of compromising State Department information. The investigation established that there was "no persuasive evidence of systemic, deliberate mishandling of classified information."

/2009/11/Hillary-Clinton.jpg)

/2009/09/Bill-Clinton.jpg)

/2009/11/Barack-Obama-1.jpg)

/2009/11/Joe-Biden.jpg)

/2010/07/Chelsea-Clinton.jpg)

:strip_exif()/2009/09/donald.jpg)

/2022/04/Diogo-Jota.jpg)

/2019/08/ng.jpg)

/2016/03/T.K.-Kirkland.jpg)

/2010/12/GettyImages-479295285-e1751559767128.jpg)

/2019/09/Taylor-Fritz.jpg)

/2010/02/Ron-Jeremy.jpg)

/2014/10/GettyImages-450841722.jpg)

/2019/04/Kathy-Griffin.jpg)

/2021/07/Jessica-Chastain.jpg)

/2015/05/Al-Horford1.jpg)

/2020/01/Tammy-Faye-Messner.jpg)

/2009/11/Hillary-Clinton.jpg)

/2009/09/Bill-Clinton.jpg)

/2016/09/hilllll.jpg)

/2015/06/Lynn-Forester-de-Rothschild.jpg)

/2016/11/GettyImages-621958726.jpg)

/2014/06/GettyImages-104333005.jpg)

/2016/10/GettyImages-617806568.jpg)