We've covered the shenanigans of former WeWork CEO Adam Neumann during his time running the company he co-founded. He is, for lack of a better word, a colorful character with a unique management style. Unfortunately for him, that management style pretty much ran his company into the ground, requiring SoftBank to intervene and invest in WeWork in an attempt to get it back on track. When we last reported on Neumann it was because he had his $185 million consulting deal with WeWork canceled after he allegedly violated the agreement. Now, it looks like Neumann will get a decent payday. Reportedly, SoftBank and Neumann have been trying to settle the bitter dispute. As of this writing, SoftBank is prepared to buy $1.5 billion in stock from early investors in the shared office space company. As part of this proposed deal, about $500 million of that stock would be bought from Neumann. That's half as much as SoftBank originally planned to buy.

The deal also calls for a $50 million payout to Neumann as well as extending the $430 million loan he took out in late 2019 by five years. As part of the deal, SoftBank will also reportedly pay Neumann's $50 million in legal fees. It hasn't been revealed how much of other shareholders' legal fees SoftBank will pay. If this agreement goes through, it will allow the parties to avoid a trial currently scheduled for early March. WeWork planned to go public in 2019 and that fell apart when questions about Neumann's odd style of leadership surfaced. Additionally, the company was not only not profitable, but was facing enormous losses. At the time, Neumann stepped down as CEO and resigned from the board.

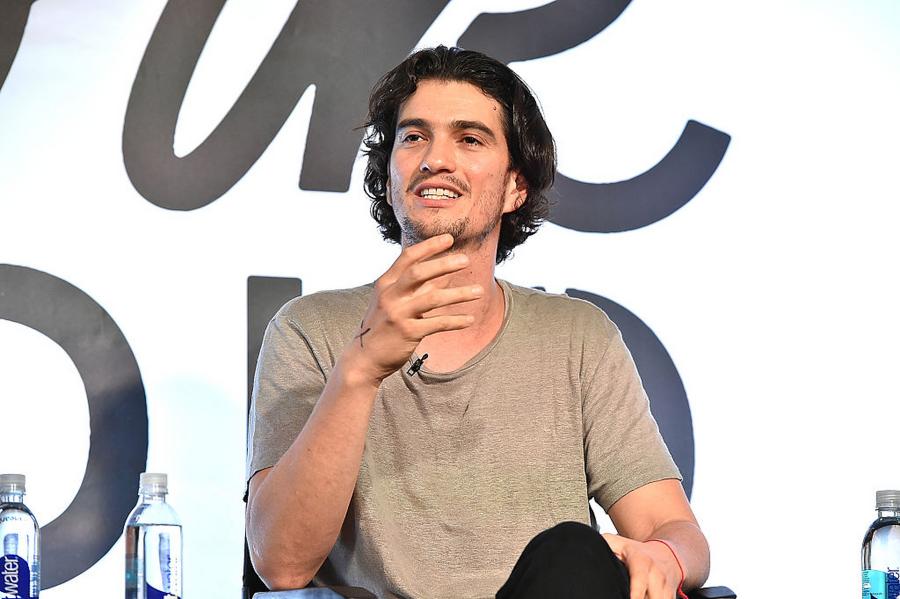

Theo Wargo/Getty Images for iHeartMedia

WeWork has been hit by the coronavirus-induced recession as much as many other businesses. However, SoftBank believes the company will be profitable by the end of 2021. The hope is that all the working from home in 2020 and 2021 will lead companies to realize they don't need such large offices. Flexible workspace, such as the space WeWork provides, will become the trend, or so SoftBank and WeWork hope. When WeWork was poised to make its IPO in September 2019, the company was seeking a valuation of $47 billion. Just a few months later, the valuation was just $8 billion. In order to be profitable, WeWork needs to have 67-68% occupancy. Before the pandemic, WeWork had somewhere between 80 and 85% occupancy. WeWork is also negotiating a separate deal with a SPAC company called BowX Acquisition Corp. that would give the company an IPO. That agreement is expected to be settled as soon as next week, assuming talks don't fall apart.

The legal drama with WeWork and SoftBank has been going on for months. It all stems from the October 2019 deal Softbank made to buy $3 billion in stock from WeWork shareholders, including $1 billion from Neumann. SoftBank stepped in to bail out WeWork after its planned IPO was canceled.

/2019/12/GettyImages-540248526.jpg)

/2020/04/GettyImages-906272946.jpg)

/2021/05/adam2.jpg)

/2019/11/GettyImages-472241102.jpg)

/2021/10/adam3.jpg)

/2019/11/GettyImages-540248526.jpg)

/2022/01/Jane-Birkin.jpg)

/2021/02/barry-sanders.jpg)

/2019/10/Paulina-Porizkova.jpg)

:strip_exif()/2020/06/taylor.png)

/2021/03/ben.jpg)

/2009/10/Peyton-Manning-1.jpg)

/2012/07/GettyImages-508683722.jpg)

/2012/09/Delta-Goodrem.jpg)

/2010/02/Jennifer-Hudson.jpg)

/2020/01/akon2-1.jpg)

/2020/01/Patrick-Duffy.jpg)

/2012/08/Archie-Manning.jpg)

/2010/12/fm.jpg)

/2019/12/jd.jpg)

/2015/09/Eli-Manning.jpg)

/2019/12/Amanda-Anisimova.jpg)

/2017/06/Lauralee-Bell-1.jpg)