Pop quiz: Name the Bay Area-based tech company that surpassed Microsoft to become the most valuable company in the world after its stock increased 4,000% in under five years.

Here's another hint: This company earned its fortune selling proverbial "picks and shovels" during a technological "gold rush" that Wall Street and every major corporation on the planet became obsessed with practically overnight.

Did you guess NVIDIA?

If so… that is… incorrect! The correct answer is actually… Cisco Systems. All the rest is true, but NVIDIA has "only" gained 1,300% in the last five years.

The rise of NVIDIA is extremely similar to the late 1990s rise of Cisco. NVIDIA became the most valuable company in the world because it makes advanced computer chips that power crypto mining, video gaming, and Large Language Model "AI" chat programs like ChatGPT.

Cisco, which derived its name from the city where it was founded, San Francisco, became the most valuable company in the world because it made the best network routers, which were crucial to the burgeoning dotcom industry.

Between January 1995 and March 2000, Cisco's stock price increased 4,000% as the dotcom bubble grew and grew and grew. In March 2000, Cisco's stock hit an all-time high, and the company's $500 billion market cap made it the most valuable company in the world, topping Microsoft.

If that sounds familiar, it's because NVIDIA has done the same thing in the last five years. On June 18, 2024, NVIDIA became the most valuable company in the world when its $3.34 trillion market cap surpassed Microsoft's $3.32 trillion market cap. On July 9, 2025, NVIDIA's market cap topped $4 trillion for the first time. As I type this article, NVIDIA's market cap is $4.45 trillion. Just three years ago, its market cap was $300 billion. That certainly seems… frothy, no?

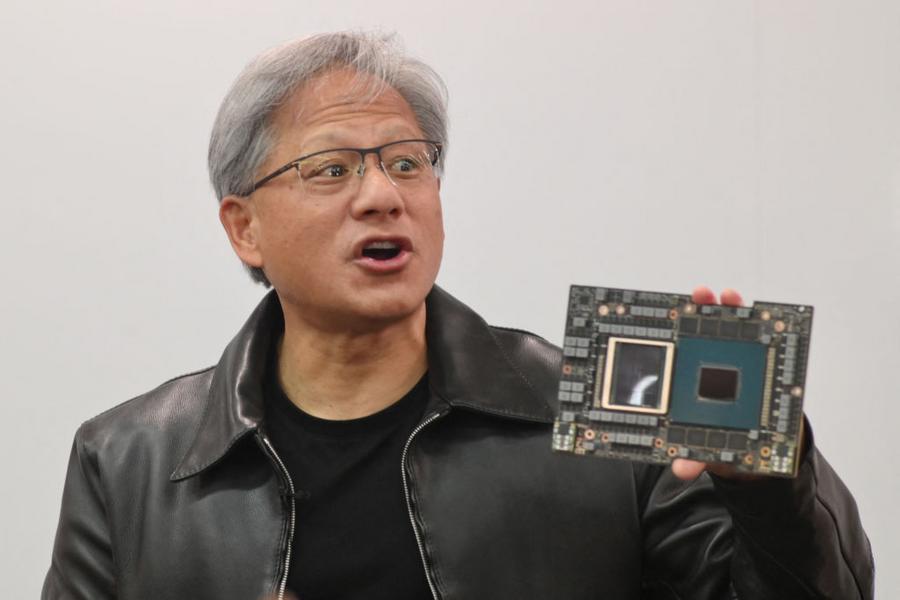

(Photo by SAM YEH/AFP via Getty Images)

What Happened to Cisco?

Cisco was founded by Leonard Bosack and Sandra Lerner. Leonard and Sandy met at Stanford, married in 1980, and co-founded Cisco in 1984. Cisco went public in 1990 at a market cap of $224 million. Before going public, Cisco's venture capital funders installed a new CEO and a team of senior-level professional managers.

For reasons I could not ascertain, Sandra did not get along with the professional managers and the new CEO. Six months after the IPO, she was fired. Leonard quit the same day. Soon thereafter, they sold every single share they owned for a pre-tax total of $170 million. A few years later, they divorced.

So, in March 2000, when Cisco became the most valuable company in the world with a market cap of $500 billion, Leonard and Sandra did NOT own any shares. If they did, at that point, their combined equity would have made them the richest people in the world, with a net worth north of $100 billion.

March 2000 would prove to be the peak for Cisco and an entire ecosystem of newly-launched dotcom companies. Then, the bubble burst. By the end of 2002, Cisco's stock price had collapsed 85%.

Even two decades later, with multiple additional tech revolutions, Cisco is still nowhere near that March 2000 high point. As I type this article, its market cap is around $270 billion. Certainly, nothing to sneeze at, but a far cry from $500 billion and not even a tenth of Microsoft's current $3.8 trillion market cap.

Could the same thing happen to NVIDIA?

Obviously, anything COULD happen. I have no idea what WILL happen. Consider the following comparisons:

- NVIDIA is currently trading at around 50X one-year forward price-to-earnings ratio. The NASDAQ 100 Index trades at 30x.

- In 2000, Cisco traded at 150X forward earnings. The NASDAQ 100 traded at 200X.

Based on those numbers, one could certainly argue that NVIDIA and the wider tech market are nowhere near being in a bubble right now, at least compared to the 2000s dotcom bubble.

In my opinion, on the other hand, we are in an AI bubble. Admittedly, I'm somewhat biased because I am very perturbed by AI-generated content and chat programs that steal information from websites like CNW and regurgitate it without the need to actually visit or compensate the original source. Beyond my personal biases, what do you think of all this? Do you use AI in any way? Do you enjoy Google's AI answers? How has AI changed your life? I'd love to be proven wrong.

A 2024 Barclays financial report predicted that companies are about to spend $170 billion on AI cumulatively. Barclays points out that $170 billion is enough to build 12,000 ChatGPTs. If I'm struggling to come up with one solid use for ChatGPT, why do we need to spend the equivalent of 12,000 ChatGPTs?

By comparison, the world was objectively more difficult before the Internet. The advent of websites, instant access to news, eCommerce, email, etc… all drastically improved all of our lives almost overnight. What is the AI equivalent?

Would You Sell?

As NVIDIA's stock has soared, its employees have gotten extremely rich. Company co-founder/CEO Jensen Huang has seen his net worth increase from $3 billion to over $140 billion in the last few years. He's currently one of the 15 richest people in the world, and 99% of his net worth is on paper.

Consider these tweets from a year ago. And keep in mind, NVIDIA's stock has increased 20% since they were published:

If you joined Nvidia 5 years ago as a mid-level product manager with an annual $70K stock grant over four years, just that initial grant would be worth ~$10.6M today.

— Ben Lang (@benln) June 19, 2024

And that's if you took a mid-level job. If you were a superstar developer who was recruited by NVIDIA in 2013, you likely received a 4-year-vesting, $400,000 equity grant. By mid-2024, those fully vested shares were worth $100 million.

In the first half of 2024, NVIDIA employees sold over $700 million worth of their shares, double what they sold in all of 2023. Roughly $100 million of those $700 million worth of sales were done by CEO Jensen Huang through a prearranged stock trading plan.

NVIDIA insiders probably should be selling.

If you were sitting on $10 million worth of NVIDIA shares right now, and that constituted 99.99% of your net worth, what would you do? Let it ride? Or take some chips off the table? FYI: I don't own any shares of NVIDIA, and this article should not be construed by any means as investment advice. I have no idea what's going to happen with NVIDIA, but I can tell you what happened with Cisco.

/2025/06/jensen.jpg)

/2025/10/curtis-2.png)

/2021/11/Satya-Nadella.jpg)

/2015/02/cook.jpg)

/2025/06/larry-bill.jpg)

/2025/07/gates.png)

/2019/11/GettyImages-1094653148.jpg)

/2017/02/GettyImages-528215436.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2018/03/GettyImages-821622848.jpg)

/2020/02/Angelina-Jolie.png)

/2020/01/lopez3.jpg)

/2020/06/taylor.png)

/2020/04/Megan-Fox.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2019/10/denzel-washington-1.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2009/09/Brad-Pitt.jpg)

/2009/11/George-Clooney.jpg)

/2019/04/rr.jpg)