When Microsoft first went public, Bill owned 45% of the company's shares. Over the next few decades, he sold so many shares as a part of a wealth diversification plan that today he only owns around 1.3% of the company. Let's say Bill maintained 30% of Microsoft. In early 2024, when Microsoft's market cap topped $3 trillion for the first time, Bill Gates would have become the world's first trillionaire.

On Tuesday, December 10, 2024, Elon Musk's net worth hit $400 billion for the first time. He is the first human ever to have a net worth of $400 billion. The very next day, his net worth rose to $450 billion. A few days later, his net worth briefly touched $485 billion. A few days after that, he flirted with $500 billion before dropping back down to the mid-$400-billion range. Until today.

Earlier today, Elon's net worth surpassed $600 billion. Actually, it soared all the way to $640 billion.

The growth of Elon's fortune is absolutely stunning. Just five years ago, you could have bought all of Tesla for around $50 billion. And today, Tesla isn't even Elon's only trillion-dollar company. So that begs a literal trillion-dollar question:

What would it take for Elon Musk to become a trillionaire?

Elon Musk's net worth is currently $640 billion. Elon's fortune is built on several assets:

- Tesla

- SpaceX

- xAI

- Various other ventures

Let's start with Tesla.

Tesla

As I type this article, Tesla's market cap is a bit over $1.5 trillion. Due to a variety of factors, including options and debt collateral, Elon's Tesla stake is worth in the range of $250 billion.

SpaceX

Prior to today, Elon owned 43% of SpaceX, and the company's latest funding round valued the company at $400 billion. Therefore, prior to today, Elon's stake was worth $160 billion. Earlier today, it was revealed that SpaceX insiders sold shares in the company at an $800 billion valuation. Therefore, Elon's 43% stake is now worth $344 billion on paper.

xAI

Elon owns 33% of xAI holdings, and the company was most recently valued at $100 billion. Therefore, his stake is worth around $35 billion.

Other Ventures

Elon owns stakes in various other ventures, notably Neuralink and The Boring Company. These add another roughly $10 billion.

$250+ $344 + 35 + 10 = $639 billion

(Photo by Maja Hitij/Getty Images)

What Would It Take To Hit $1 Trillion?

We ran the numbers. I'll spare you the details. Here's a viable circumstance that would allow Elon Musk to become a trillionaire:

#1: Tesla's market cap grows to $3 trillion – double today's $1.5 trillion market cap. At that level, Elon's stake would be worth $500 billion.

#2: SpaceX's value (either private or as a public company) reaches $1.5 trillion – up from today's $800 billion valuation. Assuming he maintains a 35% stake at that level, after some dilution, his shares would be worth $525 billion.

$500 + $525 = $1.025 trillion… without even counting any other assets!

Let's say all his other assets and debt levels stay exactly where they are right now. If Tesla and SpaceX grow to those market caps, those two investments combined would be worth $975 billion. Rounding out for some debt and other assets, notably xAI, and I think it's safe to say Elon would be a trillionaire at these levels.

But There's An $8.5 Trillion Catch!

The math we just ran assumes Elon's Tesla equity stake does not increase. Thanks to a new extremely generous and aggressive bonus plan, that's not what will happen if the company's market cap keeps growing.

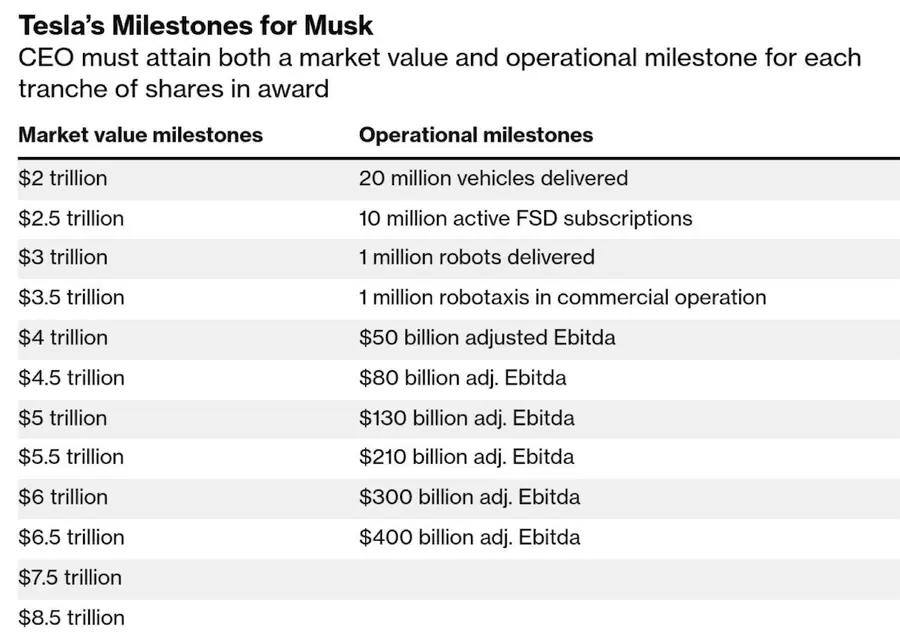

In September of this year, Tesla unveiled an ambitious new compensation plan for Elon that could ultimately award him an addtional 12% stake in Tesla – up to 35 million shares – based on a combination of market cap and performance milestones. The highest level market cap in the plan is $8.5 trillion, but he can also unlock additional shares along the way at lower-level milestones, starting at $2 trillion market cap. At the time this plan was announced, Tesla's market cap was $1.1 trillion. Here's a chart summarizing the compensation plan and each milestone:

As you can see in the chart above, the 2025 CEO Performance Award is split into 12 tranches. Each time a market-cap milestone is matched with an operational milestone, Elon unlocks roughly ~1% of Tesla (≈ one tranche). Starting baseline used here: ~21% ownership. Here's another visualization:

| Market-cap milestone (paired with operational milestone) | Tranche unlocked | Approx. ownership after unlock |

|---|---|---|

| $2T + 20M vehicles delivered | 1st tranche (~1%) | ~22% |

| $2.5T + 10M active FSD subscriptions | 2nd tranche (~1%) | ~23% |

| $3T + 1M robots delivered | 3rd tranche (~1%) | ~24% |

| $3.5T + 1M robotaxis in commercial operation | 4th tranche (~1%) | ~25% |

| $4T + $50B adjusted EBITDA | 5th tranche (~1%) | ~26% |

| $4.5T + $80B adjusted EBITDA | 6th tranche (~1%) | ~27% |

| $5T + $130B adjusted EBITDA | 7th tranche (~1%) | ~28% |

| $5.5T + $210B adjusted EBITDA | 8th tranche (~1%) | ~29% |

| $6T + $300B adjusted EBITDA | 9th tranche (~1%) | ~30% |

| $6.5T + $400B adjusted EBITDA | 10th tranche (~1%) | ~31% |

| $7.5T + (paired leadership/plan requirements) | 11th tranche (~1%) | ~32% |

| $8.5T + (paired leadership/plan requirements) | 12th tranche (~1%) | ~33% |

In the math we just ran to determine when Elon would become a trillionaire, we used a fixed stake in Tesla, but that's not actually what would happen. If Tesla gets to a market cap of $2 trillion, Elon gets another 1% of the company. At that point, his ownership stake would be worth around $440 billion. If the company continues its ascent to a market cap of $3 trillion, he would unlock the third tranche, bringing his overall Tesla stake to around $720 billion.

Let's say he just gets Tesla to $2 trillion, which is not that far from today's $1.5 trillion. At that level, his Tesla stake would be worth $440 billion. If SpaceX reaches a $1.5 trillion valuation, that would add $525 billion, bringing his net worth to $965 billion. If his stakes in xAI and his other ventures remain flat, that would add another $45 billion, bringing Elon's net worth to exactly $1 trillion. In other words, all he would need to do is hit the first Tesla milestone ($2 trillion) and the SpaceX IPO target ($1.5 trillion), and trillionaire status would be unlocked.

/2021/10/elon2.jpg)

/2019/12/GettyImages-1181925987.jpg)

/2019/10/GettyImages-464172224.jpg)

/2021/10/elon-musk-1.jpg)

/2020/07/elon-1.jpg)

/2023/07/elon-arms.jpg)

/2017/02/GettyImages-528215436.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2020/01/lopez3.jpg)

/2019/04/rr.jpg)

/2009/11/George-Clooney.jpg)

/2020/02/Angelina-Jolie.png)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2018/03/GettyImages-821622848.jpg)

/2020/04/Megan-Fox.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2019/10/denzel-washington-1.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2009/09/Brad-Pitt.jpg)

/2020/06/taylor.png)