In many ways, Ellen Gordon is a typical Midwestern grandma. Actually, great-grandma. She has a friendly smile, a perfectly coiffed hairdo that looks like it's refreshed at the salon once a month, and a signature wardrobe of blazer-and-turtleneck combos, often finished with a matching brooch. And just like my own grandmother, I'd bet good money Ellen has a piece of candy tucked away in her purse, ready to be slyly slipped into a grateful little hand.

But for Ellen's grandkids and great-grandkids, it probably won't be a Werther's Original. Odds are, it'll be a Tootsie Roll.

Ellen Gordon isn't just your ordinary candy-purse-hiding grandmother. She doesn't own a stash of Tootsie Rolls bought from a store. She owns Tootsie Roll. The whole company. And even better, she's not a disconnected heiress passively cashing dividend checks. She's the CEO! Even at 93 years old, she's still the active, day-to-day CEO of Tootsie Roll Industries, which is a publicly traded company! Oh. One more thing that makes Ellen Gordon slightly different from most grandmas. She's a billionaire.

(UPI Photo/Bill Greenblatt via Alamy)

Before I dive into Ellen's story, I want to highlight how much I love stumbling across a random brand I always assumed was just another cog in some massive corporate machine, only to find out it's actually a publicly traded company. Tootsie Roll is definitely my favorite, but here are some other fun examples:

Take LaCroix, for example. Most people probably assume that La Croix is one of a thousand brands owned by a massive beverage conglomerate like Pepsi or Coca-Cola. Nope. It's publicly traded under the ticker "FIZZ." FIZZ also owns Shasta and the Juggalo-approved Faygo.

WD-40? Public. Crocs? Public!

Even Build-A-Bear Workshop is publicly traded and has absolutely ripped in the last year! FYI: In the last 12 months, Build-A-Bear's stock price (ticker: BBW) has increased 120%. That's more than 10x the returns of the S&P 500 in the same time period. Unfortunately, the same can't be said for Crocs (ticker: CROX), which is down 40% in the last year thanks to tariffs hitting its overseas manufacturing in Vietnam, China, and Mexico.

A Candy That Wouldn't Melt

The origin of the Tootsie Roll starts with an Austrian immigrant named Leo Hirshfield (sometimes spelled "Hirshfeld"), who landed in the United States in 1884 and settled in Brooklyn. Leo came from a family of candy makers. It was all he knew how to do. And by 1896, he had opened his own small candy shop specializing in traditional Austrian chocolate bars.

But there was a problem.

Leo quickly learned that traditional Austrian chocolate bars melted into a messy liquid after sitting in the New York City summer heat for just a few minutes. Furthermore, if he wanted to mass-produce and sell candy bars around the US, most would be ruined by the same heat during transportation. So, Leo decided he would try to invent a candy that tasted and looked like chocolate, but wouldn't melt in the heat. He also forced himself to use economically affordable chocolate alternatives so the end result would be cheap enough for a kid to buy. He named the candy after his daughter Clara, who, since she was a baby, had gone by the name "Tootsie."

The "Tootsie Roll" was a smash hit in the New York Area right out of the gate. Kids and adults alike loved this little chocolate treat that could sit in a pocket for hours on a hot summer day and still taste as fresh as ever.

In 1917, Leo reincorporated as "The Sweets Company of America." In 1922, the company was publicly listed on the New York Stock Exchange. Throughout it all, Leo continued inventing new candies. One of those inventions, the Tootsie Pop, became especially popular during the Great Depression and Dust Bowl era. At a time when the majority of Americans were dealing with unimaginable financial stresses, the Tootsie Pop was an affordable yet fun treat that brought a little bit of joy to a mostly joyless time.

New Owners & WW2

Despite their product's popularity, like most American companies, during the early 1930s, the Sweets Company of America fell on hard times. In 1935, a man named Bernard D. Rubin successfully pulled off a semi-hostile takeover of the company and replaced Leo as President. One of his first directions as President was to increase the size of the Tootsie Roll. He also tweaked the original formula slightly to make it even more chocolate-like.

In 1938, Bernard moved the manufacturing facilities out of Manhattan to nearby Hoboken, New Jersey, where both rent and labor were slightly less expensive. These small improvements went a long way to revitalizing the company's fortunes, but it was the Second World War that made them bigger than ever.

During World War II, Tootsie Rolls were included in every American soldier's field rations. Once again, the fact that the candy stood up well in both extreme heat and extreme cold made the Tootsie Roll a perfect treat for a soldier at war.

Ellen & Melvin

When Bernard Rubin took over in 1935, the Sweets Company of America was generating $1 million a year in revenue. That's the same as $23 million today after adjusting for inflation. By the time he died in 1948, the company was generating $12 million a year. That's equal to roughly $160 million after adjusting for inflation.

Upon Bernard's death, the company passed to his brother William B. Rubin. After William became ill in 1962, he passed the reins to his 30-year-old daughter, Ellen. Technically, Ellen became President and Chief Operating Officer, and her husband, Melvin Gordon, became CEO. Melvin had been on the company's board of directors since 1952. Ellen and Melvin married in 1950. In 1962, they changed the company name from the Sweets Company of America to Tootsie Roll Industries. Around this time, the company's corporate headquarters was moved to Chicago, Illinois.

Over the next five decades, Ellen and Melvin steadily co-ran Tootsie Roll Industries together. The company launched or acquired a handful of new brands, including Charleston Chew, Junior Mints, Sugar Babies, Blow Pops, and Dubble Bubble.

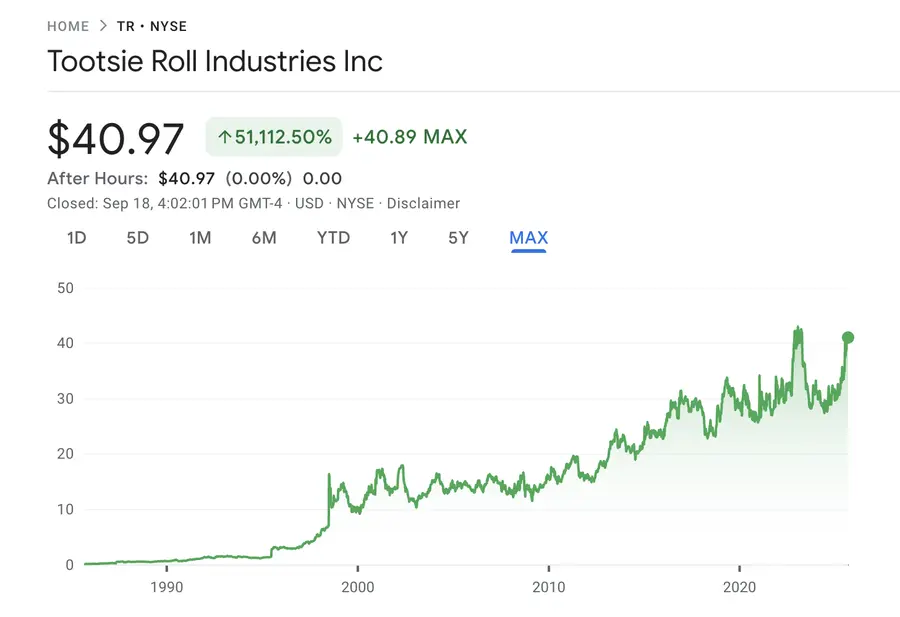

Ellen and Melvin were not typical Wall Street CEOs. Pretty much every single publicly traded firm on earth produces glossy quarterly reports, has an entire team dedicated to investor relations, holds quarter analyst calls, and puts on an annual promotional conference for investors. Tootsie Roll Industries, by contrast, never spoke to reporters. They didn't hold investor conferences. Didn't conduct quarterly earnings calls. And its quarterly earnings releases were typically badly scanned PDF files. It may have been unorthodox, but it worked. Below is a chart of TR's stock price over the last 40 years, since 1985. As you can see, it's a slow and steady march upwards:

Quiet Candy Billionaires

At the time of Melvin's death in January 2015, at the age of 95, Tootsie Roll had a $2 billion market cap. Ellen and Melvin owned 49% of the company's equity. That gave them a combined paper net worth of $980 million.

On the day Melvin's death was announced, TR's stock price actually jumped 7% on the idea that maybe it would now be in play as an acquisition target. Nope. Fast forward a decade to the present, and Ellen has continued her slow and steady stewardship of the 103-year-old company.

Today, Tootsie Roll's market cap is $3.25 billion. The stock is trading near an all-time high. Ellen directly owns 48.67% of the company's shares. Using the company's current $3.25 billion market cap, that means Ellen Gordon's net worth is $1.58 billion.

What makes Ellen and Tootsie Roll's story even more stunning is that by all reasonable logic, at some point in the last century, the company absolutely should have been swallowed up by Mars, Hershey, Warren Buffett, or a dozen other candy-minded suitors.

Consider the fate of fellow Chicago candy magnate Wrigley Company. William Wrigley took his gum empire public in 1919. Fast forward 89 years to 2008, and Mars acquired Wrigley for $23 billion. Care to guess who Mars partnered with to seal the deal?

Warren Buffett.

Warren's company, Berkshire Hathaway, provided $4.4 billion of the $23 billion purchase price.

And Tootsie Roll could not be a more perfect acquisition target for Buffett. First off, he's 95, just two years older than Ellen. So they probably have a lot in common and a lot of shared experiences. But more importantly, it's a family-run business with a beloved brand, Midwestern values, and steady cash flow. Also, Warren is famously obsessed with candy and sweets. Berkshire Hathaway owns roughly 9% of Coca-Cola's shares, and it wholly owns See's Candies. I'd bet my life Warren has Ellen's phone number on speed dial.

Ellen Gordon may look like a typical Midwestern grandmother, but she's a 93-year-old billionaire CEO who controls one of America's most iconic candy companies — proof that appearances can be deliciously deceiving.

Full disclosure: I do not own any shares of Tootsie Roll (or any of the other stocks mentioned earlier in this article). I do own a few Berkshire Hathaway Class B shares.

PS: In case you were wondering, the rumor that you get a free bag of Tootsie Pops from the factory if you find an Indian shooting a star on your wrapper… is false. It's actually never been true in the company's entire history, and they have no idea where that story came from. To this day, they get hundreds of letters every week from people all over the world looking for their free bag of lollipops.

/2019/01/war3.jpg)

/2014/07/stock2-e1404971174213-1.jpg)

/2025/08/coca-cola.jpg)

/2023/11/GettyImages-534941692.jpg)

/2024/01/bill-gates.jpg)

/2022/01/tim-cook.jpg)

/2020/02/Angelina-Jolie.png)

/2009/09/Jennifer-Aniston.jpg)

/2009/11/George-Clooney.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2019/10/denzel-washington-1.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2018/03/GettyImages-821622848.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2019/04/rr.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2009/09/Brad-Pitt.jpg)

/2017/02/GettyImages-528215436.jpg)

/2020/04/Megan-Fox.jpg)

/2020/01/lopez3.jpg)

/2020/06/taylor.png)