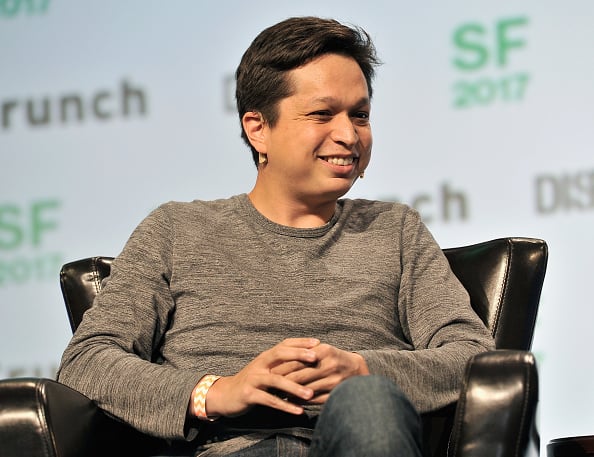

What Is Ben Silbermann's Net Worth?

Ben Silbermann is an American Internet entrepreneur who has a net worth of $1.6 billion. Ben Silbermann earned his fortune as the co-founder and executive chairman of the photo bookmarking site Pinterest. The company has over 518 million monthly users worldwide. In 2012, "Fast Company" named him among the "100 Most Creative People in Business" for his contributions to the tech industry.

Early Life

Ben Silbermann was born on July 14, 1982, in Des Moines, Iowa. He is the son of Jane Wang and Neil Silbermann, who are both ophthalmologists. Ben attended the Research Science Institute at MIT in 1998 and graduated from Des Moines Central Academy and Des Moines Roosevelt the following year. He then graduated from Yale University in the spring of 2003 with a degree in Political Science.

Getty

Before launching the first desktop version of Pinterest in March 2010, Silbermann worked at Google in the online advertising division but left after a short period with the company to design his own iPhone apps with friends. He created his first application named Tote which failed to take off. Ben then collaborated with Evan Sharp to create a pinboard app that would eventually become what we now know as Pinterest.

Silbermann's journey to creating Pinterest began with his childhood hobby of collecting things. One day, as he browsed the web, he realized there was no platform where people could showcase their genuine interests, and this niche sparked the idea for Pinterest. Raising the initial capital for Pinterest was tough at first, but Ben wasn't going to let that come in the way of his dream. He enrolled in the NYU Stern Business Plan Competition whose prize was a meeting with venture capitalists from First Mark Capital in New York. He won the competition and shared his vision with the First Mark team who gave him half of the needed funding.

The company started taking baby steps, with Silbermann himself reaching out to the first 5,000 users one by one. Nine months in, the young entrepreneurs hadn't even hit the 10,000-user mark, but they still pressed on, driven by their conviction in their vision and the gradual but steady increase in their user base. They switched all their focus to their loyal early adopters and tailored the platform to their needs. Their fan meetups were also a game changer for them.

In 2011, they launched the app on iPhone, and it took off like wildfire, getting more downloads than anticipated. From that moment, they only soared higher. Fast-forward to 2019, and Pinterest went public with a valuation of around $12 billion.

On June 28, 2022, news broke that Silberman planned to resign as CEO and become Executive Chairman. Google's Bill Ready was appointed as the new CEO and member of the Board of Directors.

(Josh Edelson/Getty Images)

Awards & Achievements

In 2012, "Fast Company" included Silbermann in its list of the "100 Most Creative People in Business." In 2019, he was inducted into the Iowa Business Hall of Fame. That same year, he also received the Lieberman Award for Outstanding Achievement in Technology and Business at CEE's 2019 Congressional Luncheon sponsored by Regeneron.

Personal Life

Silbermann is married to Divya Bhaskaran, and they have two children together. The couple took a bold step by signing the Giving Pledge, promising to donate over half of their fortune to charitable causes. Through their foundation, Tambourine, they've contributed significantly to improving global health and technology.

/2016/04/GettyImages-486577213.jpg)

/2013/12/Chris-Pirillo.jpg)

/2015/12/paul.jpg)

/2014/07/neil-clark-warren.jpg)

/2024/03/Jason-Citron.jpg)

/2012/03/Kevin-Systrom.jpg)

/2013/09/reggie.jpg)

/2023/10/Stefan-Quandt.png)

/2014/08/GettyImages-87126722.jpg)

/2012/07/Johanna-Quandt.png)

/2010/03/chip2.jpg)

/2020/07/tom-green.jpg)

/2010/11/Tyson-Beckford.jpg)

/2009/11/seal2.jpg)

/2019/11/Jerry-Jones-1.jpg)

/2021/08/Billy-Ocean.jpg)

/2012/01/peter-ostrum.jpg)

/2016/04/GettyImages-486577213.jpg)

/2015/12/paul.jpg)

/2019/03/GettyImages-1073325572.jpg)

/2013/12/Chris-Pirillo.jpg)

/2012/06/Robin-Li-1.jpg)

/2021/09/canva.jpg)

/2015/12/GettyImages-495431362.jpg)

/2018/08/GettyImages-455691914.jpg)