What is Jeff Bezos' net worth?

Jeff Bezos is an American philanthropist, businessman, and space explorer who has a net worth of $245 billion. Perhaps needing no introduction or explanation, Jeff Bezos earned his fortune as the founder of Amazon.com. After leaving a successful career on Wall Street in the early 1990s, Bezos founded Amazon in 1994 from the garage of his Seattle home, initially as an online bookstore. The company quickly diversified into electronics, apparel, and cloud computing, building a reputation for relentless innovation and customer obsession. Over the following decades, Amazon evolved into one of the world's largest and most influential corporations, spanning e-commerce, streaming, logistics, and artificial intelligence.

When Amazon went public in 1997, Bezos owned 43% of the company, a stake worth roughly $120 million at the time. His fortune grew exponentially as Amazon's stock surged through the 2000s and 2010s. Though the dot-com crash briefly reduced his paper wealth, the company's success in cloud computing and logistics reignited its growth. By 2015, Bezos's net worth had surpassed $50 billion, and in 2017, he overtook Bill Gates to become the richest person in the world. In 2018, Amazon's market value topped $1 trillion, pushing his fortune near $170 billion, and in 2020, he became the first person to exceed $200 billion in net worth.

Jeff was the richest person in the world without interruption between October 2017 and January 2021. He regained the title of the richest person in the world in March 2024, when he surpassed Elon Musk in terms of overall net worth, but has subsequently fallen back.

In addition to Amazon, Bezos has pursued bold ventures in other industries. He founded Blue Origin in 2000 to develop commercial spaceflight, purchased The Washington Post in 2013, and made early investments in companies like Google. He stepped down as Amazon's CEO in 2021 but remains executive chairman and a defining figure in the company's strategy and culture.

Amazon Stock Holdings

When Amazon went public in 1997, Jeff Bezos owned roughly 43% of the company, a stake worth about $120 million at the time. His ownership gradually declined as Amazon expanded, added new investors, and as Bezos sold and gifted shares over the years. By 2021, when he stepped down as CEO and became executive chairman, his stake had fallen to about 14%.

The most significant single reduction came in 2019, when Bezos finalized his divorce from MacKenzie Scott and transferred 19.7 million shares to her—valued at $36 billion at the time. Even after the settlement, Bezos remained the largest individual shareholder in Amazon and one of the richest people in the world.

Through a series of planned stock sales, Bezos has steadily liquidated portions of his holdings, typically selling billions of dollars' worth of stock each year to fund other ventures and philanthropic initiatives. In 2024 and 2025 alone, he sold more than 100 million shares, generating over $10 billion in proceeds, while also gifting over half a million shares to charitable causes.

An October 2025 SEC filing revealed that Bezos' ownership stake had been reduced to 9% of Amazon's outstanding shares—marking the first time his stake has fallen below 10% in the company's history.

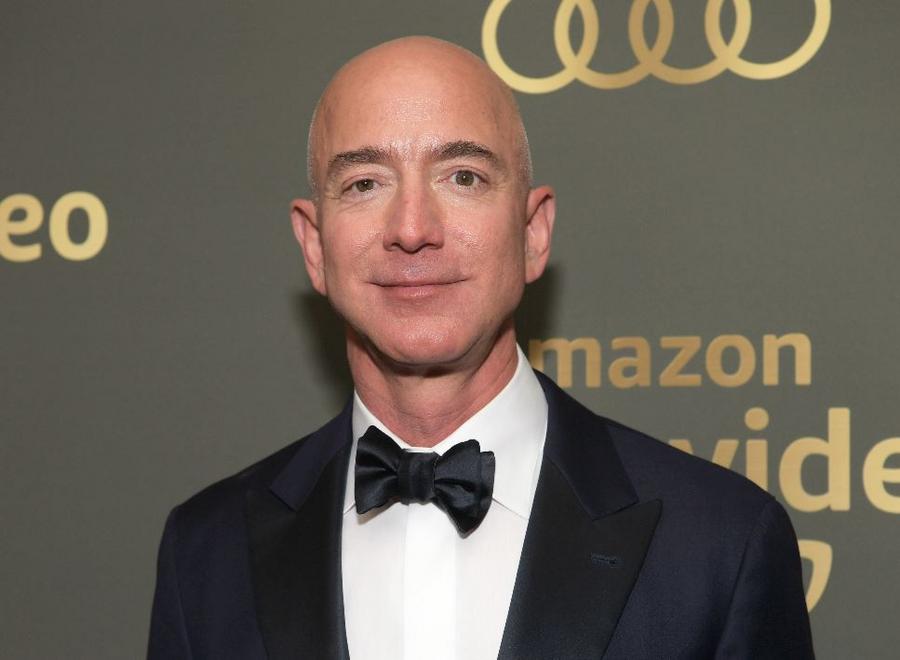

Getty Images

Was Jeff Bezos Ever the Richest Person of All Time?

No. If we compare Jeff's peak net worth of $250 billion to our list of the richest people of all time after adjusting for inflation, he does not even in the top 10. Using the $250 billion number, that would be the 11th largest fortune ever accumulated by a single human (counting inflation). For comparison, when oil tycoon John D. Rockefeller died, he was worth an inflation-adjusted $340 billion. Also, Elon Musk has routinely been worth more than $400 billion.

Could Jeff Bezos Become a Trillionaire?

Anything is possible! But it seems like an extremely lofty goal if he's just relying on his Amazon shares to get trillionaire status. As the owner of 9% of Amazon, the company's market cap would need to top $11 trillion for Jeff to become a trillionaire. If he had not reduced his holdings so dramatically through his divorce and stock sales, he would have had a much better shot. For example, if he still owned 30% of Amazon, down from the 43% he owned at IPO, Amazon would have needed a market cap of just $3 trillion.

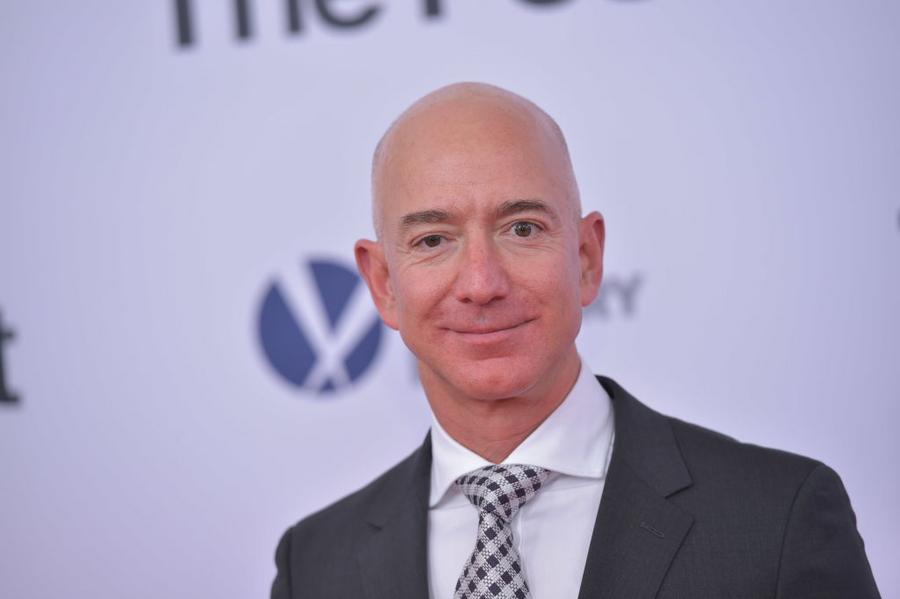

Michael M. Santiago/Getty Images

Early Life

Jeff Bezos was born on January 12, 1964, in Albuquerque, New Mexico. His mother, Jacklyn Gise, was a 17-year-old high school student when she gave birth to him, and his biological father, Ted Jorgensen, owned a local bike shop. The marriage ended when Jeff was still a toddler, and a few years later, Jacklyn married Miguel "Mike" Bezos, a Cuban immigrant who had fled his country as a teenager. Mike adopted Jeff, giving him his now-famous last name, and moved the family to Houston, Texas, where he worked as an engineer for Exxon.

Growing up in Texas, Bezos showed an early fascination with invention and problem-solving. He spent hours tinkering in his parents' garage, creating gadgets, science projects, and makeshift laboratories. Summers were spent on his grandparents' cattle ranch near Cotulla, south of San Antonio, where he helped repair windmills, vaccinate cattle, and build fences. Bezos later credited those summers with teaching him discipline, independence, and a relentless work ethic. Years later, he purchased and expanded that ranch from 25,000 acres to more than 300,000 acres.

When the family moved to Miami, Florida, Bezos attended Miami Palmetto Senior High School, where he excelled academically and took an early interest in computers. He worked part-time at McDonald's as a short-order cook, and even then, he applied a methodical, systems-oriented approach to his work. As valedictorian of his class and a National Merit Scholar, Bezos delivered a graduation speech predicting that humanity would one day colonize space—a vision that would shape much of his later life.

He attended Princeton University, intending to study physics, but soon gravitated toward computer science and electrical engineering. Graduating summa cum laude, Phi Beta Kappa, with a 4.2 GPA, Bezos went on to work at several Wall Street firms, including Fitel, Bankers Trust, and D.E. Shaw & Co. At D.E. Shaw, he rose to become one of the company's youngest senior vice presidents at age 30. It was there, while researching new internet trends, that Bezos discovered the rapid growth of online commerce—a realization that inspired him to leave his secure job and start his own online business.

Amazon

In 1994, Jeff Bezos made the defining decision of his career when he left a comfortable senior position at the hedge fund D.E. Shaw & Co. and drove across the country to start an online bookstore. The idea came to him after he read a statistic that web usage was growing at 2,300% per year. Seeing an opportunity to ride that exponential growth, Bezos decided that selling books online—an infinite inventory model that no physical store could match—was the perfect entry point. He and his wife, MacKenzie Scott, packed their belongings into a car, mapped out a business plan during the trip from New York to Seattle, and began operating out of the garage of a rented house with a handful of employees and a couple of desks made from old doors.

Bezos named the company Amazon after the world's largest river, a reflection of his ambition to build the world's largest store. The site officially launched in July 1995 and almost immediately exceeded expectations. Within the first month, Amazon was selling books in all 50 states and in more than 40 countries. Bezos reinvested every dollar of revenue into expansion, customer experience, and logistics. He insisted on two principles that would define the company for decades: relentless customer focus and a willingness to sacrifice short-term profits for long-term dominance.

The company went public in 1997 at $18 per share, giving it a market capitalization of about $300 million. At that point, Bezos owned 43% of the company, making his initial stake worth roughly $120 million. While Wall Street skeptics derided Amazon as a risky experiment that would never turn a profit, Bezos pressed ahead, expanding into new product categories—first CDs and DVDs, then electronics, apparel, toys, and household goods. By the early 2000s, Amazon had become the dominant player in e-commerce, using a distribution model that emphasized speed, efficiency, and customer satisfaction above all else.

Bezos's long-term vision extended far beyond retail. In the mid-2000s, Amazon launched Amazon Web Services (AWS), a cloud computing division that allowed businesses to rent data storage and processing power. Initially dismissed as a side project, AWS grew into one of the most profitable enterprises in modern corporate history, generating tens of billions in annual revenue and effectively funding Amazon's retail expansion. The introduction of Amazon Prime in 2005—offering free two-day shipping for an annual fee—further cemented customer loyalty and changed consumer expectations across the entire retail sector.

The 2010s marked Amazon's transformation into a global technology empire. The company expanded into streaming with Amazon Video and Amazon Music, acquired Whole Foods Market in 2017 for $13.7 billion, and became a major player in artificial intelligence through its Alexa-powered Echo devices. Each move reflected Bezos's strategy of building interconnected ecosystems that kept customers within the Amazon universe—shopping, streaming, reading, and even speaking to the company's devices daily.

As Amazon's reach expanded, so did its market capitalization and Bezos's personal wealth. In 2015, Amazon shares surpassed $500 for the first time, pushing his net worth above $50 billion. By mid-2017, Amazon's valuation had crossed $500 billion, and Bezos overtook Bill Gates to become the richest person in the world. The company hit a $1 trillion market cap in September 2018, briefly joining Apple as only the second U.S. firm to reach that milestone. Bezos's net worth at that point was estimated around $170 billion, and within two years, amid the pandemic-fueled e-commerce boom, it climbed past $200 billion—making him the first person in modern history to reach that figure.

Throughout Amazon's rise, Bezos remained known for his focus on innovation, experimentation, and data-driven decision-making. He championed a "Day One" philosophy, warning employees never to act like a mature company that had lost its entrepreneurial edge. Under his leadership, Amazon became not only a retail powerhouse but also one of the largest employers in the world, with over 1.5 million workers, a vast logistics network, and fulfillment centers in nearly every major market.

In 2021, after 27 years as CEO, Bezos stepped down from the role to become Amazon's executive chairman, handing day-to-day operations to longtime lieutenant Andy Jassy. The transition allowed Bezos to focus more on his other ventures—especially Blue Origin and philanthropy—while maintaining influence over the company's strategic direction. Even after stepping back, his imprint remains embedded in Amazon's DNA: a company defined by customer obsession, constant reinvention, and the bold pursuit of ideas that others deem impossible.

Google Venture Capital Investment

In addition to building Amazon, Jeff Bezos quietly made one of the most lucrative personal investments in Silicon Valley history. In 1998, he was introduced to Google co-founders Larry Page and Sergey Brin through venture capitalist Ram Shriram, who at the time had recently sold a company to Amazon. Impressed by Google's search technology and the founders' vision, Bezos decided to invest despite Google being little more than a fledgling startup operating out of a Menlo Park garage. He contributed $250,000 to Google's first funding round—a small check by today's standards, but one that would eventually yield a staggering return. When Google went public in 2004, that early investment translated into roughly 3.3 million shares, which would have been worth more than $1 billion within just a few years. Even if Bezos later sold part of the stake, analysts estimate that his remaining holdings in Google's parent company, Alphabet Inc., are still worth well over $1 billion today.

Billionaire Parents and Siblings

Jeff Bezos's first and most loyal investors were his parents, Mike and Jacklyn Bezos. In 1995, when Jeff was preparing to launch Amazon from his Seattle garage, his parents invested a large portion of their life savings—reportedly around $245,000—to help fund the startup. At the time, they had no guarantee the business would succeed, and Jeff warned them that there was a good chance they could lose everything. That early faith turned out to be one of the most successful family investments in history. Over the years, the Bezos family quietly maintained their holdings as Amazon stock split and skyrocketed in value. By most estimates, Mike and Jacklyn's shares alone are now worth between $40 billion and $50 billion, making them among the wealthiest parents in the world. Jeff's siblings, Mark and Christina Bezos, were also early backers in the company's first funding rounds and have each accumulated fortunes that likely make them paper billionaires as well. Their early belief in Jeff's vision helped build not only one of the most valuable companies in modern history but also one of the richest families in America.

(Photo by Phillip Faraone/Getty Images)

Personal Life

Jeff Bezos married MacKenzie Scott (then MacKenzie Tuttle) in 1993, two years before founding Amazon. The two met while working at the hedge fund D.E. Shaw in New York, where she was a research associate and he was a senior vice president. They moved to Seattle together and built Amazon from their garage during the company's early days, with MacKenzie handling much of the initial accounting and business operations. Over the course of their 25-year marriage, they had four children—three sons and one adopted daughter from China—and became one of the most high-profile couples in corporate America.

In January 2019, the couple announced their divorce after a long period of separation, just months before Jeff's relationship with former television anchor Lauren Sánchez became public. The divorce settlement, finalized that April, transferred 19.7 million Amazon shares to MacKenzie, then worth $36 billion, instantly making her one of the wealthiest women in the world. Despite the separation, the two maintained a cordial relationship and continued co-parenting their children.

Since 2019, Bezos has been in a relationship with Sánchez, a former news anchor, helicopter pilot, and founder of Black Ops Aviation, a company specializing in aerial filming. The couple frequently appears at major cultural and philanthropic events. They became engaged in 2023 and married in 2025. Together, they have embraced a more public lifestyle, often traveling between Bezos's properties in Miami, Beverly Hills, and Washington, D.C.

Real Estate And Other Toys

For around three decades, Jeff was a resident of Seattle, Washington. In November 2023, he announced his plan to move full-time to Miami. In the previous two months, he paid $150 million for two properties on a private island in Miami called Indian Creek Village, which is also known as the "Billionaire Bunker." The properties are side-by-side, and the assumption is that he will tear them both down to build a new massive mansion. In April 2024, it was revealed that Jeff had bought a THIRD mansion on Indian Creek. In this third transaction, he paid $90 million for a six-bedroom home that he reportedly plans to live in while tearing down the other two mansions to construct a new super-estate.

In 2007, Jeff and MacKenzie paid $24.5 million for a mansion on two prime acres in Beverly Hills, California. In 2018, they paid $12.9 million for the home next door. MacKenzie received this now-combined two-home property as part of their 2019 divorce settlement. In August 2022, MacKenzie announced that she had donated the properties to a charity called the California Community Foundation. At the time of the donation, the combined compound was worth an estimated $55 million.

On February 12, 2020, it was revealed that Jeff had paid $255 million for two properties in Beverly Hills. The first property, known as the Jack L. Warner estate, cost $165 million. The estate covers 10 lush acres in the heart of Beverly Hills and features a 13,600-square-foot main house. The seller was entertainment mogul David Geffen, who bought the property in 1990 for $47.5 million.

The second property Bezos was reported to have bought in February 2020 was a 120-acre vacant hilltop called Enchanted Hill. The seller was the estate of late Microsoft founder Paul Allen, who purchased the land in 1997 for $20 million. Though mostly overrun with weeds, the property does have a 1.5-mile driveway and a manicured bluff at its peak. A month after the purchase was reported, the deal actually fell through. So Jeff's total February 2020 real estate spree was the $165 million Jack L. Warner estate.

Other real estate assets:

- $23 million mansion in Washington, D.C., acquired in 2018. A former museum comprised of two buildings that measure 27,000 square feet of living space

- 300,000 acres in Texas, including multiple ranches

- 100,000 additional acres in various parts of the country

- Three units in 25 Central Park West in Manhattan

- $10 million 5-acre property in Medina, Washington, acquired in 1999

- $50 million mansion next door to his property in Medina, acquired in 2005

Drew Angerer/Getty Images

Blue Origin

Jeff Bezos's lifelong interest in space exploration led him to found Blue Origin in 2000, long before private spaceflight became fashionable. The company was built around Bezos's conviction that humanity must eventually expand beyond Earth to ensure its survival. Blue Origin's mission is to make space travel accessible and sustainable by dramatically lowering the cost of launching people and payloads into orbit.

For years, Blue Origin operated quietly out of public view while Bezos personally funded its development. Its motto, Gradatim Ferociter—Latin for "step by step, ferociously"—reflects Bezos's belief in slow, steady progress. In 2006, Blue Origin acquired vast land in West Texas for a private launch and test facility, where the company has since conducted numerous successful rocket tests.

Blue Origin's New Shepard suborbital rocket made its first successful flight in 2015, and in July 2021, Bezos himself flew aboard the vehicle on its first crewed mission, marking one of the milestones in commercial space travel. The company is also developing the larger New Glenn orbital rocket and working on long-term projects like lunar landers and infrastructure for future space colonies.

Bezos often describes his investment in Blue Origin as the most important work of his life, pledging to sell roughly $1 billion of Amazon stock each year to fund the venture. In addition to Blue Origin, Bezos also purchased "The Washington Post" in 2013, revitalizing the newspaper through digital innovation and new leadership. His twin pursuits—commercial spaceflight and journalism—reflect both his entrepreneurial ambition and his broader desire to leave a lasting impact on humanity's future.

Net Worth Details And History

The day Amazon went public, Amazon's market cap was $300 million. Jeff owned 43% of the company at the time, giving him a net worth of $120 million (on paper, pre-tax). Within a year, he was worth $1 billion. At the peak of the dotcom bubble, Jeff's net worth topped $10 billion. After the bubble burst, Amazon's stock price sank to an all-time low of $5 per share in October of 2001. At that point, Jeff's net worth sank to $1-2 billion.

If you had been smart enough to take $10,000 and buy shares of Amazon in October of 2001, today you would have more than $15 million before counting any dividends.

MANDEL NGAN/AFP/Getty Images

Net Worth Milestones

- May 1997 – $120 million on the company's IPO date.

- June 1998 – $1 billion for the first time

- June 1999 – $10 billion

- July 2015 – $50 billion

- January 2018 – $100 billion

- July 2018 – $150 billion

- September 2018 – $170 billion

- January 2019 – Jeff announces he is divorcing his wife of 25 years, MacKenzie. Clearly, the outcome of this divorce will have an enormous impact on Jeff's $150 billion net worth.

- April 4, 2019 – Jeff and MacKenzie announced that they had reached an amicable resolution of their divorce, where she will be given $36 billion worth of Amazon stock. Jeff will retain 75% of his former stake and will have voting control over MacKenzie's shares. She will not have any ownership in The Washington Post or Jeff's space company, Blue Origin. It's unclear how the couple decided to split their various homes and jets. Jeff's net worth immediately following the announcement became $114 billion.

- March 9, 2020 – $111 billion

- July 1, 2020 – $172 billion

- July 9, 2020 – $190 billion

- August 26, 2020 – $202 billion

- December 2022 – $117 billion

- January 2023 – $107 billion

If you're keeping track, it took Jeff just three years to become a billionaire after launching in 1995. It took him 20 years to make $50 billion, but then only 2.5 years to make his second $50 billion, for a total of $100 billion. And then it only took seven months to make his third $50 billion, for a total of $150 billion. And then he lost $36 billion in an instant with the stroke of a pen.

| Jeff Bezos' Net Worth Over Time | |

| June 1997 | $150 million |

| June 1998 | $1 billion |

| June 1999 | $10 billion |

| March 2000 | $6 billion |

| December 2000 | $2 billion |

| September 2001 | $1.5 billion |

| September 2003 | $2.5 billion |

| September 2004 | $5.1 billion |

| September 2005 | $4.1 billion |

| September 2006 | $4.3 billion |

| September 2007 | $8.7 billion |

| September 2008 | $8.2 billion |

| September 2009 | $6.8 billion |

| September 2010 | $12.6 billion |

| September 2011 | $18 billion |

| December 2012 | $23.2 billion |

| October 2013 | $29 billion |

| December 2014 | $30.5 billion |

| July 2015 | $50 billion |

| October 2016 | $45 billion |

| December 2017 | $73 billion |

| July 2018 | $150 billion |

| September 2018 | $170 billion |

| April 2019 | $114 billion |

| July 2020 | $190 billion |

| July 2021 | $213 billion |

| November 2022 | $117 billion |

| November 2023 | $170 billion |

| May 2024 | $208 billion |

| September 2025 | $260 billion |

/2020/06/jb2.jpg)

/2021/06/mackth.jpg)

/2010/06/Elon-Musk.jpg)

/2010/07/Ram-Shriram.jpg)

/2009/09/Bill-Gates.jpg)

/2009/09/Bernard-Arnault-2.jpg)

/2009/09/Brad-Pitt.jpg)

/2018/03/GettyImages-821622848.jpg)

/2009/11/George-Clooney.jpg)

/2019/04/rr.jpg)

/2019/10/denzel-washington-1.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2020/01/lopez3.jpg)

/2020/02/Angelina-Jolie.png)

/2019/11/GettyImages-1094653148.jpg)

/2020/06/taylor.png)

/2020/06/jb2.jpg)

/2009/09/Bernard-Arnault-2.jpg)

/2013/10/GettyImages-456443982.jpg)

/2019/01/thumb.jpg)

/2021/04/jeff-1.jpg)

/2017/11/Jeff-Bezos.jpg)

/2025/05/bezos.jpg)

/2017/04/GettyImages-1648064.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2017/02/GettyImages-528215436.jpg)