What is Bill Gates' net worth?

Bill Gates is an American billionaire entrepreneur, author, and philanthropist who has a net worth of $180 billion. And while you might assume that the vast majority of Bill Gates' net worth is connected to the company he co-founded, Microsoft, that is actually NOT the case. Today, he "only" owns 103 million shares of Microsoft, which, assuming a $370 price per share, equates to "just" $38 billion of his net worth today. The remaining roughly $100+ billion net worth comes from an extremely diverse portfolio of investments and assets that are primarily controlled by his investment vehicle, Cascade Investments. We'll detail more about Cascade throughout this article, but through Cascade, Bill owns the majority of Four Seasons Hotel and Resorts and is the largest private owner of farmland in the United States.

When Microsoft went public in 1986, Bill owned 45% of the company. Steve Ballmer owned 8%, and Paul Allen owned 25%. Through stock sales, by 2000, Bill's Microsoft stake had been reduced to 14%. Today, he owns a little less than 1.4% of Microsoft, around 103 million shares. That does not make him the company's largest individual shareholder. That honor belongs to Bill's successor, Steve Ballmer, who owns around 4% of the company today. Thanks to Microsoft's $3 annual dividend, every year Bill receives $309 million in dividends. Ballmer receives close to $1 billion every year.

Over the decades, Bill has received nearly $60 billion in the form of stock sales and dividends from Microsoft and other investments. The proceeds of his sales and dividends have funded Cascade Investment LLC, the vehicle Gates uses to invest in hundreds of other companies, including 270,000 acres of American farmland, significant stakes in public stocks, including Apple, Canadian National Railway, Republic Services, Ecolab, Waste Management, and Berkshire Hathaway. Cascade also controls the Four Seasons Hotels and Resorts.

For much of the period between 1997 and 2008, Bill was the richest person in the world, uninterrupted. He traded spots with Carlos Slim for a few years before regaining the crown uninterrupted again until July 2017, when he was overtaken by Amazon founder Jeff Bezos. In the last decade, Bill has consistently been one of the five richest people on the planet.

Microsoft began as a conversation between two young men who had been friends since elementary school: Bill Gates and Paul Allen. After basically lying their way into an interview with MITS, the corporation behind the Altair 8800 computer, the two men convinced the company to build and sell their interpreter, and in 1975, MITS launched the Altair BASIC. This initial success allowed the pair to develop their own company, which they named Microsoft. By 1977, they had their first international office in Japan and relocated their domestic office to the state of Washington. In 1980, they won a bid to develop an operating system for IBM, and MS-DOS was born. From the mid-80s to the mid-90s, the company established itself as a technological powerhouse, and not long after it went public in 1986, 12,000 of its employees became millionaires, and another four became billionaires. They were also hit with a number of antitrust lawsuits around this time due to business practices that appeared to monopolize the computer market. The mid-90s brought an expansion in products, including networking and World Wide Web applications, such as the popular browser Internet Explorer. In 2000, Bill Gates retired from the position of CEO, and Steve Ballmer, a long-time employee, took over. Today, Satya Nadella is the CEO.

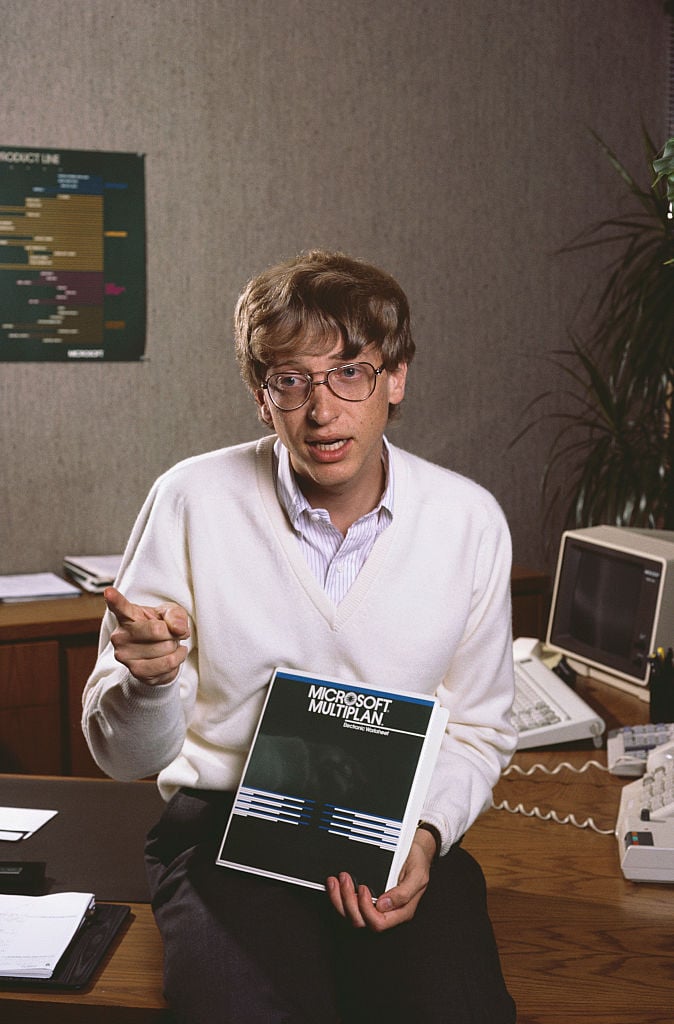

Microsoft Co-founder Bill Gates in 1984 (Photo by Doug Wilson/CORBIS/Corbis via Getty Images)

Early Life

William Henry Gates III was born on October 28, 1955, in Seattle, Washington. Gates was bullied as a child. He preferred to stay in his room, where he would shout, "I'm thinking," when his mother asked what he was doing. When he was 13, he enrolled in the private Lakeside prep school, and he wrote his first software program. He was in eighth grade during his first year at Lakeside, and the school's Mothers' Club used proceeds from a fundraiser to buy a Teletype Model 33 ASR terminal and time on a GE computer for the school's students. Gates became interested in programming the GE computer in BASIC. He wrote his first program — a tic-tac-toe game– on this computer. Players played the game against the computer. Eventually, Gates and his friends Paul Allen, Ric Weiland, and Kent Evans were banned from using the school's computer after they were caught exploiting bugs in the operating system to get free time on the machine. The four students formed the Lakeside Programmers Club to make money.

When their ban was over, the boys offered to look for bugs in the software in exchange for extra time on the computer. Gates began studying code for the programs that ran on the computer, including Fortran, Lisp, and machine language. In 1971, a Lakeside teacher asked Gates and Evans to automate the school's class scheduling system. The friends wrote software with one twist–Gates changed the code so that he was in classes with a higher number of interesting girls. Gates and Evans wanted to have the new system up and running by senior year. Then, at the end of their junior year, Evans was killed in a mountain climbing accident. Gates turned to Allen to help him finish the project for Lakeside.

During their senior year, Gates and Allen formed a company called Traf-O-Data and made traffic counters on the Intel 8008 processor. He graduated from Lakeside School in 1973 and enrolled at Harvard in the fall of 1973. At Harvard, Gates took math and graduate-level computer science classes. He met Steve Ballmer at Harvard. Gates dropped out of college at the end of his sophomore year.

(Photo by Mike Cohen/Getty Images )

Microsoft

With the release of the MITS Altair 8800, based on the Intel 8080 CPU, Gates and Paul Allen saw this as the opening they needed to create their own computer software company. The creators of the new microcomputer, Micro Instrumentation and Telemetry Systems (MITS), formed a partnership with Gates and Allen using their Altair emulator that ran on a minicomputer and then the BASIC interpreter. The trade name Microsoft was registered on November 26, 1976. During the first five years of Microsoft, Gates personally reviewed every line of code the company shipped, often rewriting code as needed. On November 20, 1985, Microsoft launched its first retail version of Microsoft Windows.

Microsoft went public in 1986. The opening stock price was $21. After the trading day, the stock closed at $27.75, and Bill's 45% was worth $350 million. Less than a year later, after the stock surged, he was a billionaire. He was 31 years old.

Gates announced on June 15, 2006, that he would transition out of his day-to-day role at Microsoft over the next two years in order to dedicate more time to philanthropy.

On March 13, 2020, Gates announced he would step down as Microsoft's Chairman.

Cascade Investments

Over the years, Bill has earned more than $50 billion from dividends and stock sales, which he then used to fund Cascade Investment, his private investment vehicle. Today, Cascade reportedly has more than $200 billion in assets under management, which it has invested in a diverse and substantial investment portfolio. Some of its largest and most prominent investments include:

- Farmland: Cascade Investment is the largest farmland owner in the United States, owning 269,000 acres through a network of shell companies. This investment has been countercyclical to the stock market

- Technology Stocks: Cascade holds significant investments in major technology companies. Its largest investments include Apple Inc. and Microsoft

- Equity Holdings: The five largest publicly disclosed equity holdings of Cascade Investment are Canadian National Railway, Republic Services, a waste removal company, Ecolab, a disinfectant maker, Femsa, a drinks group, and others not specifically mentioned

- Berkshire Hathaway: Cascade's largest holding is in Berkshire Hathaway, representing over 50% of its portfolio. Berkshire Hathaway is a conglomerate owning a variety of businesses, including insurance, energy, and retail

- Waste Management: The company's second-largest holding is in Waste Management, a company that provides waste disposal and environmental services

- Four Seasons: Starting in 2007, Bill and Cascade entered into a roughly 50/50 partnership with Saudi Prince Alwaleed bin Talal to control 70% of the hospitality brand Four Seasons Hotels and Resorts. In September 2021, Bill/Cascade acquired Prince Alwaleed's stake of $2.21 billion. This transaction raised Cascade's ownership to 71.3% and valued the hotel chain at $10 billion.

Personal Life

In 1987, Melinda French went to work in the product development division of Microsoft. At some point, she and Bill were seated next to each other at a work dinner. They hit it off, and Bill was soon calling Melinda to ask her out. Melinda eventually rose to the position of General Manager of Information Products. She stayed with Microsoft until 1996.

Bill and Melinda married on a golf course on the Hawaiian island of Lanai on January 1, 1994. They have three children: Phoebe Adele, Rory John, and Jennifer Katharine.

Gates purchased the Codex Leicester, a collection of scientific writings by Leonardo da Vinci, for $30.8 million at an auction in 1994.

Gates and his wife combined three family foundations to create the charitable Bill & Melinda Gates Foundation in 2000, the largest transparently operated charitable foundation in the world.

On December 9, 2010, Bill and Melinda Gates and investor Warren Buffett each signed a commitment they called the Giving Pledge, which is a commitment by all three to donate at least half of their wealth, over time, to charity.

Scott Olson/Getty Images

Bill Gates' Incredible Seattle Mansion

Bill Gates owns a number of impressive properties around the US. He likely owns residences abroad as well, though less is known about these purchases.

In Washington, Bill Gates owns an unbelievably amazing mansion nicknamed "Xanadu 2.0". After acquiring the lakefront property in 1988 for $2 million, Bill spent seven years and $63 million constructing what became one of the most impressive private residences in the world. He also spent $14 million acquiring neighboring properties to create more privacy.

The house is considered a modern "Pacific lodge" style design, with many classic and high-tech amenities. To build Xanadu 2.0, all timber and woodwork were flawless, with acoustics being a priority. More than seven types of stone were used. All flooring is heated, including walkways and even the driveway. There were 300 workers in total to complete the home, with one hundred being just electricians.

Located on the side of a hill overlooking Lake Washington in Medina, Washington, the main house alone is 66,000 square feet. The estate has a 60-foot swimming pool with an underwater music system, a 2,500-square-foot gym, a 1,000-square-foot dining room, six kitchens, and a dining hall that can seat 200 people. The room has a wall made of 24 40-inch video screens that combine into one giant image. He also has a more intimate dining room at 1,000 square feet that can sit 24 people by a fireplace.

The home features all kinds of automation, with over 52 miles of optic cables. Family members and visitors are set up with a microchip tag that can control the setting for each room they walk into, controlling lighting, heating, music, and even their preference for art on digital displays. All rooms also have their own touchpad to control every aspect of the room.

Intensive home security is present, with hidden cameras and floor sensors everywhere. There are no visible electric outlets, and every door handle was custom-made at a cost of $2,000 apiece. Some interior passageway doors weigh over 800 lbs but are balanced for easy opening.

Bill Gates has several interesting areas in his home. He has a domed library, which has two secret bookcases, with one hiding a bar. The pool house is 3,900 square feet with a 17-foot by 60-foot swimming pool. The pool is also outfitted with an underwater sound system. The home has one underground parking lot, which measures 6,300 square feet and can hold ten cars and two above-ground garages. Gates is an avid reader, and the ceiling of his large home library is engraved with a quotation from The Great Gatsby. The library features priceless works, including pieces by Da Vinci. The annual property taxes on the mansion are reported to be $1.063 million, on an assessed value of $150 million.

(Photo by Dan Callister/Newsmakers)

More Bill Gates Real Estate

Rancho Santa Fe, CA: In October 2014, the Gates family paid $18 million for a 228-acre ranch property in Rancho Santa Fe, California (near San Diego). They acquired the property from weight loss tycoon Jenny Craig. The property, dubbed "Rancho Paseana," is a horse ranch. Gates' daughter, Jennifer, is an avid rider. The property has a racetrack, orchard, five barns, and even a suite for a full-time veterinarian.

Del Mar, CA: In April 2020, Bill and Melinda paid $43 million for a stunning oceanfront mansion in Del Mar, California, roughly 15 minutes from their Rancho Santa Fe ranch. They bought the home from the widow of the late oil billionaire/investor T. Boone Pickens.

Wellington, Florida: In 2013, Gates paid $8.7 million for a second horse ranch, this one in Wellington, Florida. The family had rented the mansion on several previous occasions when in town for Jennifer Gates' competitions. They liked the house so much that they bought it.

Cody, WY: In 2009, Gates bought a 492-acre ranch in Cody, Wyoming, for an undisclosed price. The ranch, which was once owned by William "Buffalo Bill" Cody, was initially listed for $12 million. It was listed at $8.9 million just before Bill became the owner. The ranch has only had three owners in roughly 150 years.

Commercial Properties: Through his investment fund Cascade, Gates owns interests in several prominent hotels. He owns part of the Charles Hotel in Cambridge, Massachusetts. He owns around half of all Four Seasons hotels around the world. With a group of investors, he owns the Ritz-Carlton in San Francisco.

Mario Tama/Getty Images

Bill Gates's Net Worth Over Time

- 1986 – $350 million

In March 1986, Microsoft made its IPO. At the end of the first day of trading, Gates owned 45% of the company he co-founded 11 years earlier, giving him a net worth of $350 million.

- 1987 – $1.25 billion

Bill Gates became the world's youngest self-made billionaire in 1987 after growing excitement for the software industry drove Microsoft's stock higher.

- 1990 – $2.5 billion

In 1990, Microsoft released Windows 3.0. By the end of the year, nearly two million copies had shipped, making Microsoft the first personal computer software company with sales over $1 billion annually. This is the year Bill described his strategy as putting "Windows everywhere."

- 1995 – $14.8 billion

Throughout the early 90s, Gates' fortune rose alongside Microsoft's share price. The company released Windows 95, which sold more than one million copies during its first four days on the market.

- 1997 – $39.8 billion

Gates' net worth more than doubled in 1996. He is now the richest man in the world and $19 billion richer than the second-richest person, Warren Buffett.

- 1999 – $85 billion

Tech stock frenzy hits an all-time high, boosting Bill's net worth to $85 billion. His increase from the previous year is more than $25 billion. That's roughly $3 million per hour. At one point in 1999, his net worth was briefly more than $100 billion.

- 2000 – $63 billion

The year 2000 marked the first year Gates saw a significant decline in his wealth. The tech bubble burst, and the antitrust trials against Microsoft took a toll on the company's stock price. Gates stepped down as CEO. Steve Ballmer becomes CEO of Microsoft.

- 2008 – $58 billion

2008 marked the first time in 13 years that Gates was not the richest person. He slipped to the third spot behind Warren Buffett and Carlos Slim Helu. Gates chose to stop working full-time at Microsoft so that he could devote more time to charity.

- 2009 – $40 billion

- 2010 – $53 billion

- 2011 – $63.4 billion

- 2014 – $76 billion

- 2020 – $110 billion

- 2023 – $138 billion

- 2024 – $156 billion

Lintao Zhang/Getty Images

| Bill Gates Net Worth Milestones: | |

| 1986 | $350 million |

| 1987 | $1.25 billion |

| 1990 | $2.5 billion |

| 1990 | $15 billion |

| 1997 | $40 billion |

| 1999 | $85 billion |

| 2000 | $63 billion |

| 2008 | $58 billion |

| 2009 | $40 billion |

| 2014 | $76 billion |

| 2020 | $130 billion |

| 2021 | $145 billion |

| 2022 | $118 billion |

| 2023 | $138 billion |

| 2023 | $154 billion |

*** At one very brief point in 1999, his net worth topped $100 billion. After adjusting for inflation, that was the same as being worth $153 billion today.

/2009/09/Bill-Gates.jpg)

/2020/08/melinda.jpg)

/2009/09/Warren-Buffett.jpg)

/2010/06/Elon-Musk.jpg)

/2022/12/GettyImages-1341554748.jpg)

/2009/09/Steve-Jobs.jpg)

/2021/02/barry-sanders.jpg)

/2021/03/ben.jpg)

/2019/10/Paulina-Porizkova.jpg)

/2009/10/Peyton-Manning-1.jpg)

/2012/07/GettyImages-508683722.jpg)

/2020/01/Patrick-Duffy.jpg)

/2010/12/fm.jpg)

/2015/09/Eli-Manning.jpg)

/2020/01/akon2-1.jpg)

/2018/10/Jensen-Huang.jpg)

/2019/02/Rachel-Brosnahan-1.jpg)

/2009/09/Bill-Gates.jpg)

/2009/09/Steve-Jobs.jpg)

/2019/04/GettyImages-948065808.jpg)

/2019/04/GettyImages-499436010.jpg)

/2014/11/GettyImages-781927.jpg)

/2016/12/Bill-Gates.jpg)

/2014/11/GettyImages-118395307.jpg)

/2020/09/GettyImages-1151703682.jpg)