What is Donald Trump's net worth?

Donald Trump is an American politician, tech entrepreneur, real-estate developer, author, and television personality who has a net worth of $5 billion. In November 2016, Donald Trump defeated Hillary Clinton to become the 45th President of the United States. In November 2020, Donald was defeated in his reelection campaign by Joe Biden. In November 2024, Donald defeated Kamala Harris to become the 47th President of the United States.

Before becoming President of the United States, Donald was known primarily for being the owner of The Trump Organization, a real estate and licensing conglomerate. The Trump Organization owns commercial and residential properties around the globe, notably golf courses in the United States, Scotland, and Ireland. The Trump Organization owns portions of 40 Wall Street in New York City and 555 California Street in San Francisco. Many of his most visible real estate assets are not actually owned by Trump or his business. For example, Trump International in NYC is owned by General Electric and the Galbreath Company. In 1996, Trump's name was licensed to give the building a bit more glitz. Trump does own one condo in the building as well as the parking garage, lobby bathrooms, a restaurant, and the room service kitchens that service the building. The Trump Organization owns the retail and commercial portions of Trump Tower, but the majority of the residential units are privately owned condos, including Donald's 10,000-square-foot gold-plated penthouse.

Most importantly, as we detail in the next paragraph below, Donald owns roughly 60% of the publicly traded entity that owns his social media company, Truth Social. In March 2024, the week his tech company went public through a SPAC, his holdings were worth around $5 billion on paper. And finally, campaign filings showed that Donald has earned hundreds of millions of dollars since 2000, licensing his name for a myriad of products and real estate development projects around the world.

(Photo by Justin Sullivan/Getty Images)

Trump Media/DWAC Stock Holdings

Twitter banned Donald on January 9, 2021. He subsequently launched his own Twitter-like social media platform, Truth Social, through his newly created tech company, Trump Media & Technology Group (TMTG). In October 2021, it was announced that TMTG would go public via SPAC merger with the publicly-listed holding company Digital World Acquisition Corp (DWAC). After a series of regulatory setbacks and various other delays, the SPAC merger did not happen in 2022 or 2023.

On March 22, 2024, DWAC shareholders approved the merger. At the time the vote was approved, Donald's stake was worth $3 billion. When the merger was finalized, the ticker symbol was changed from DWAC to DJT.

According to the company's covenants, Donald is not able to sell or lend his shares for six months. That magic lockup expiration date is September 25, 2024.

Another term of the merger deal allowed that if at any point the company maintains a price per share above $17.50 for "any 20 trading days in a 30-day trading period," Donald would receive 36 million additional shares as a bonus. He hit that milestone in April 2024. As of this writing, Donald Trump personally owns 114 million shares of DJT.

In the days after the merger, the company had a market cap of $9 billion. Donald's stake was worth $5.4 billion at that point. That made Donald one of the 500 richest people in the world for the first time in his life. By mid-April, the company's market cap dropped roughly in half. For example, on April 12, with the stock trading at $30, the company's market cap was $4.3 billion. At that level, Donald's stake was worth $2.6 billion. However, Donald did achieve his 36 million share "earnout bonus" on April 23, 2024. On that day, the additional 36 million shares were worth around $1.3 billion. By early September 2024, the company's stock price had slid all the way back down under $18 a share, the lowest level since the public offering/merger. At $17.89 a share on September 3, the company's stock was down roughly 80% since hitting a high of $79.38 on March 26. At $17.89, Donald's 114 million shares were worth a bit more than $2 billion.

Apprentice Earnings

When Donald teamed up with Mark Burnett to produce "The Apprentice," NBC offered a deal that was almost too good to be true. Donald's Apprentice deal entitled him to 50% of all profits generated by the show. In his peak year, 2005, he earned a little under $48 million. Between 2000 and 2018, Donald earned $197.3 million in Apprentice income from NBC.

He then parlayed his newfound fame from "The Apprentice" into an additional $230 million worth of endorsement and licensing deals.

Presidential Salary

As President, Donald was entitled to an annual salary of $400,000. Every year, while in office, he donated all but $1 of that salary to charity. As an ex-President, he will earn a $211,000 annual pension. Ex-Presidents also receive up to $1 million per year in travel expense reimbursements, Secret Service for life, $150,000 for staff expenses, and an office space reimbursement. Bill Clinton's annual office space reimbursement costs US taxpayers north of $500,000 per year.

Donald Trump's Most Valuable Assets

Below is a list of Donald Trump's most valuable real estate assets, their respective values, and his estimated ownership stake in each one. Please note that many of these buildings carry some amount of debt in the form of mortgages and other borrowings. Also, the values listed below were calculated in 2021. The values may have fluctuated in the years since.

- 40 Wall Street: A 71-story skyscraper located in Manhattan, New York. Estimated value: $500 million. Ownership stake: 100%.

- Trump Tower: A 58-story skyscraper located in Midtown Manhattan, New York City. Estimated value: $555 million. Ownership stake: 100%.

- Trump International Hotel and Tower: A 98-story mixed-use skyscraper located in Chicago, Illinois. Estimated value: $350 million. Ownership stake: 30%.

- Trump National Doral: A luxury resort located in Miami, Florida. Estimated value: $250 million. Ownership stake: 100%.

- Mar-a-Lago: A 128-room mansion located in Palm Beach, Florida. Estimated value: $160 million. Ownership stake: 100%.

- Trump International Golf Club: A collection of high-end golf courses located throughout the United States, including properties in New Jersey, Virginia, and California. Estimated value: $200 million. Ownership stake: 100%.

- Trump Park Avenue: A luxury apartment building located in Manhattan, New York. Estimated value: $400 million. Ownership stake: 30%.

- 555 California Street: A 52-story office tower located in San Francisco, California. Estimated value: $1.9 billion. Ownership stake: 30%.

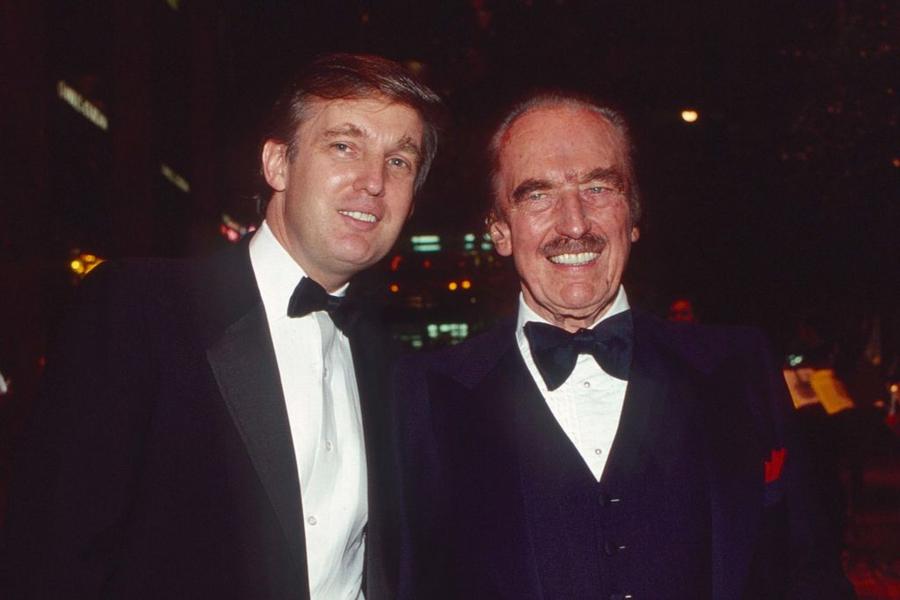

(Photo by Sonia Moskowitz/Getty Images)

Early Life

Donald John Trump was born on June 14, 1946, the son of millionaire low-income real estate tycoon Fred Trump. Fred Trump and Donald's grandmother, Elizabeth, started out in home construction and sales. The company, which was incorporated as Elizabeth Trump & Son in 1927, built large swaths of single-family homes in Queens. The company grew to own and manage more than 27,000 rental units along the East Coast, primarily in New York City's neighboring boroughs.

Donald briefly attended the Kew-Forest School in Forest Hills but, at 13, was sent to the New York Military Academy. For college, he attended Fordham University and The Wharton School of Finance at the University of Pennsylvania, where he graduated in 1968 with a degree in economics.

After graduating from college, Donald returned to New York, where he went to work for his father's company, which would later be known as The Trump Organization. In the 1970s, the Trumps earned a fortune owning and renting middle and lower-class housing in New York City's neighboring boroughs like Brooklyn, Staten Island, and Queens.

Through shares in his father's company that were set aside for each child at various ages, Donald Trump was technically a millionaire on paper in 1954 when he was just eight years old.

In 1976, Fred Trump set up $1 million trust funds for each of his five children and three great-grandchildren. That's the same as around $5 million in today's dollars. The trusts paid yearly dividends from profits earned through Elizabeth Trump & Son's rental income and property sales.

In 1982, Donald and Fred were co-featured on the inaugural Forbes 400 list of the richest Americans, with a combined net worth of $200 million, the same as around $500 million today. After adjusting for inflation, each Trump sibling received around $413 million from Fred Trump through inheritance and dividends by the time he died in 1999.

Independent Success

Keen to move the family empire away from the outer boroughs and into Manhattan, in 1976, with his newly established trust fund and an additional loan from his father, Donald struck out on his own. Over the next few decades, Fred would loan at least $60 million to Donald for various projects, much of which were loans that were never paid back.

One of his big early independent successes was the 1976 renovation of the Commodore Hotel into today's Grand Hyatt, New York. At the time, New York was in the midst of a deep economic depression. In the previous year, the Commodore lost more than $1.5 million on its operations. The Trump Organization, at Donald's direction, spent $100 million renovating the property over the next four years. It was generally viewed as an extremely successful and positive renovation for the property and the city at large. Donald sold his 50% stake in the building to his partners, the Pritzker family, for $142 million in 1996.

In 1982, Donald began construction on what would become a 58-floor skyscraper on Fifth Avenue that today is known as Trump Tower. Trump Tower has 238 residential units, three restaurants, and several first-floor retail businesses. The top three floors are a triplex unit that has served as Donald's personal residence in New York City for decades. In 2006, Forbes valued Trump Tower at $318 million, or $288 million, after you removed Trump's $30 million mortgage on the property. In 2015, thanks to the flagship luxury store Gucci, the value of the building had roughly doubled to $600 million. Today, with a slight downturn in NYC real estate values and a $100 million mortgage, the property is likely worth $400-$500 million.

In New York City, he also owns Trump World Tower and Trump Place Trump International. He previously owned The Plaza Hotel. Many of the hotels and condo complexes that carry the Trump name today are licensing deals where other owners pay the Trump Organization a fee to use the name Trump and frequently to operate the building's leasing/sales/operations.

In the late 1980s, Donald expanded his portfolio to Atlantic City, where he built a number of casino properties. His flagship, Trump Taj Mahal Casino, opened in 1990. The casinos were consistently money-losing ventures that required financial bailouts from Fred Trump. The Trump casino and resort ventures filed for bankruptcy several times between 1991 and 2009.

Other notable Trump real estate assets today include:

- Trump Winery in Charlottesville, Virginia, which also serves as a boutique hotel

- Trump Doral – a golf club in Miami

- Trump Chicago – a luxury hotel/condo complex

- 40 Wall Street in NYC

- Trump International Golf Links in Aberdeen, Scotland

- Additional golf courses/resorts in Ireland, Ferry Point, New York, Turnberry, Scotland, Los Angeles, Dubai, and Bedminster, New Jersey, among others…

His May 2016 Personal Financial Disclosure showed at least $1.4 billion in assets, $300 million in income from the golf courses and resorts, $100 million in rental income, and at least several hundred million in mortgage liabilities.

In 2022, Trump launched the social media platform Truth Social after being banned from Twitter. Elon Musk reinstated his Twitter account in November 2022, but Trump said he planned to stay on Truth.

(Photo by Sarah Silbiger/Getty Images)

Books and TV Shows

Donald has authored a number of books, including the bestsellers "The Art of the Deal," "Trump 101: The Way to Success," and "The America We Deserve".

In 2004, Donald teamed up with Mark Burnett Productions to create a reality show for NBC called "The Apprentice." The show premiered in January 2004 and eventually spawned several spinoffs and reboots, including "The Celebrity Apprentice." Trump also earned two Emmy Awards for his work on The Apprentice.

Lawsuit declarations would later reveal that Donald earned $60 million per season of The Apprentice from NBC. He received a star on the Hollywood Walk of Fame in 2007.

(Photo by Vinnie Zuffante/Michael Ochs Archives/Getty Images)

Relationships and Children

Donald married Ivana Zelnickova (later Ivana Trump) in 1977. Together, they had three children: Donald Jr., Ivanka, and Eric. The couple split in 1992, and in 1993, he married his much-publicized mistress, Marla Maples, who gave birth to a daughter, Tiffany. They divorced in 1999. In 2004, Trump married supermodel Melania Knauss, who gave birth to his fifth child, William Barron Trump, in 2006.

(Photo by Aaron P. Bernstein/Getty Images)

Donald Trump's Net Worth – Is It $3 Billion? $9 Billion? $15 Billion?

In June 2015, Donald announced that he was running for President. With his announcement, he released an estimate of his personal wealth, which pegged his net worth at $8 – 10 billion. The main reason this net worth differs from most generally accepted evaluations of his wealth has to do with how Donald values his personal brand. In his net worth estimate, Donald valued his personal brand at $3.3 billion. Other analysts value the brand at closer to $50 or $100 million.

As we mentioned previously, in 1982, Donald and his father were listed among the richest Americans with a combined net worth of $200 million, roughly $500 million in today's dollars. Financial problems and real estate downturns in the 1980s caused Donald to drop off the list of 400 richest Americans throughout much of the 1990s.

As of this writing, his $2 billion net worth makes him roughly the 720th richest person in the world and the 260th richest person in America.

Over the years, Trump's net worth, as reported by Forbes and outlets like Celebrity Net Worth, has earned scorn from Trump himself. In 2009, an author named Timothy O'Brien released a book called "TrumpNation: The Art of Being The Donald," in which he estimated that Donald's true net worth was not in the billions but was closer to $150 – $250 million. Trump was furious over the claim and sued O'Brien and his publisher for $5 billion for committing "actual malice" by citing three unnamed sources for his vastly lower net worth estimation. While Trump's lawyers asserted that their client's net worth was "proven conclusively" to be $7 billion, Trump himself was not so confident when under deposition. During the deposition, Trump stated:

"My net worth fluctuates, and it goes up and down with markets and with attitudes and with feelings, even my own feelings… Yes, even my own feelings, as to where the world is, where the world is going, and that can change rapidly from day to day. Then you have a September 11th, and you don't feel so good about yourself and you don't feel so good about the world and you don't feel so good about New York City. Then you have a year later, and the city is as hot as a pistol. Even months after that it was a different feeling. So yeah, even my own feelings affect my value to myself."

Forbes's net worth estimate of Donald Trump's net worth peaked at $4.5 billion in 2017. Forbes lowered its estimate to $3 billion in 2019. Forbes has reported that the value of Donald's brand and real estate holdings has declined since he became President due to his personal controversies. Fortune Magazine has claimed the opposite, pegging his net worth at $3.3 billion, an increase of $300 million since the day he was elected.

When Celebrity Net Worth first began tracking Donald's wealth in 2009, we estimated his fortune at $1.5 billion.

(Chip Somodevilla/Getty Images)

Personal Real Estate Holdings

Prior to becoming President and moving to the White House, Donald's longtime primary residence was a 30,000-square-foot triplex penthouse at the top of his eponymous Trump Tower on Fifth Avenue in New York City. The apartment is famously covered in gold, marble, and diamonds, with Italian frescoes on the ceiling. This condo is worth at least $100 million. Perhaps more like $150-200 million, thanks to the luxurious fixtures and notoriety.

Not far away from Trump Tower, Donald owns several units in a building called Trump Park Avenue, overlooking Central Park.

Donald Trump's Seven Springs Estate (Johnny Milano via Getty Images)

He also owns a 213-acre estate called Seven Springs, located in Westchester County, New York. He bought this property in 1995 for $7.5 million. He famously once rented the estate to Libyan dictator Muammar Gaddafi, who planned to sleep in a large Bedouin-style tent on the lawn when he was in town for the United Nations General Assembly. After a local uproar, Gaddafi stayed elsewhere.

In the 1980s, Trump paid $10 million for a 17-acre estate in Florida called Mar-a-Lago, which he has referred to as "The Winter White House" during his time as President. Technically, he acquired the property over two transactions totaling $10 million, as we'll explain in a moment.

Andrew H. Walker/Getty Images

Mar-a-Lago

Mar-a-Lago in Palm Beach, Florida, is Donald's primary residence. The property was constructed from 1924 to 1927 by cereal heiress Marjorie Merriweather Post. She spent $7 million in 1920s dollars constructing the mansion. That's the same as $101 million in today's inflation-adjusted dollars. Upon her death in 1973, Post donated the 17-acre estate to the United States Government, hoping it would be used as a Winter White House. The Federal government soon realized the cost of maintaining such a property was enormous and decided to decline the gift. The Post Foundation attempted to sell the property in 1981 for $20 million, the same as $56 million in today's dollars. Post's daughters did not maintain the property at all, and it quickly fell into disrepair.

Around this time, Trump had unsuccessfully attempted to buy a series of properties nearby. Having learned of Mar-a-Lago through friends, he offered the Post Foundation $15 million, but they declined.

Trump proceeded to purchase the land between Mar-a-Lago and the ocean for $2 million from Jack Massey, the former owner of KFC. He then announced his intention to build a large mansion on the parcel. Had he gone through with this plan, Mar-a-Lago's ocean views would have been totally obstructed, and as such, all remaining interest in the sale died. Trump ended up successfully buying Mar-a-Lago for $7 million in 1985. He proceeded to renovate the estate at a cost of many millions of dollars. He added a 20,000-square-foot ballroom, a waterfront pool, and five clay tennis courts.

After facing steep financial problems in the wake of a divorce and a precipitous decline in New York real estate values, in the 1990s, Trump briefly attempted to make a deal with his creditor bankers that would sub-divide the property into private residences, which he would sell off to raise funds, roughly $15 million. When Palm Beach residents learned of this plan, they were furious and pressured the city council to reject this concept. As a consolation, he decided to turn the estate into a private club. Actually, there's a bit more to that story. Palm Beach officials agreed to allow Trump to turn the home into an income-producing private club on the condition that he agree to give the property a permanent conservation easement that would protect the estate from development.

Today, the 126-room, 62,500-square-foot mansion is a members-only club with hotel-like amenities, including guest rooms and a spa. If it were to be put up for sale in an average market, it would fetch at least $160 – 200 million.

Mar-a-Lago (Photo by Joe Raedle/Getty Images)

Impeachment & Investigations

Donald Trump is the only American president to have been impeached twice. He was impeached in December 2019 by the House of Representatives for abuse of power and obstruction of Congress after trying to pressure Ukraine to investigate Biden. He was acquitted by the Senate in February 2020. Trump was impeached a second time by the House for incitement of insurrection, and he was acquitted the next month. In December 2022, the House January 6 Committee recommended criminal charges against him for obstructing an official proceeding, conspiracy to defraud the U.S., and inciting an insurrection.

In November 2022, Trump announced his candidacy for the Republican nomination in the 2024 presidential election. In March 2023, a Manhattan grand jury indicted him on 34 counts related to his handling of classified documents. This made him the first former president to be indicted.

/2009/09/donald.jpg)

/2019/09/djtjr.jpg)

/2010/01/Ivanka-Trump.jpg)

/2022/08/fred-trump.jpg)

/2020/01/michael-bloomberg-1.jpg)

/2009/11/Joe-Biden.jpg)

/2022/06/joey-chestnut.png)

/2012/09/Takeru-Kobayashi-1.jpg)

/2019/03/Karol-G.jpg)

/2011/03/Rickie-Fowler-1.jpg)

/2016/06/GettyImages-494820822.jpg)

/2009/11/Sigourney-Weaver.jpg)

/2010/05/Carla-Gugino-1.jpg)

/2025/05/Aryna-Sabalenka.jpg)

/2014/04/Keith-David.jpg)

/2019/04/Kathy-Griffin.jpg)

/2010/12/virginia-madsen.jpg)

/2009/09/donald.jpg)

/2009/11/Joe-Biden.jpg)

/2024/03/trump-1.jpg)

/2021/02/GettyImages-1197856943.jpg)

/2024/03/trump.jpg)

/2024/04/donald.jpg)

/2021/02/palm.jpg)

/2015/07/Donald-Trump.jpg)