Imagine being the first employee at a tiny internet auction startup at the very beginning of the World Wide Web revolution. I'm talking pre-Google, pre-Facebook, pre… everything. It was 1996, and the internet still felt like a science experiment. Dial-up modems screeched, "You've Got Mail" was cutting-edge technology, and people were still figuring out what a "website" actually was. Now picture taking a leap of faith on a startup that let people buy and sell Beanie Babies online—and watching that decision turn into one of the greatest financial windfalls in history.

That's the story of Jeffrey Skoll. As eBay's first employee and its original president, Skoll helped transform a quirky side project built by Pierre Omidyar into one of the most valuable companies of the dot-com boom. When eBay went public in 1998, Skoll's stock made him a billionaire almost overnight. He could have done what most people do with that kind of wealth—retire, build mansions, buy a sports team, or spend the rest of his life expanding his fortune. Instead, he made a decision that still sets him apart from nearly every tech billionaire who followed.

Jeffrey Skoll walked away. He decided that money wasn't the goal—it was the fuel. He left eBay with billions in stock and committed to using that fortune to "heal the world," a phrase he grew up hearing in the Jewish concept of tikkun olam. Over the next two decades, he poured his time, intellect, and fortune into social entrepreneurship, environmental reform, and storytelling that could move hearts and minds. And as if that wasn't enough, in one of the most unusual second acts in business history, the man who helped build eBay ALSO launched a film production company that has won 21 Academy Awards… SO FAR!

Early Life

Jeffrey Skoll was born in 1965 in Toronto, Canada, to a middle-class Jewish family. His mother was a teacher, and his father owned a small industrial-chemicals business. When Jeff was fourteen, his father was diagnosed with cancer. One day, his father confided that he regretted never having enough time to do the things he dreamed of. That moment stuck with Jeff and shaped his life philosophy.

After earning a degree in electrical engineering from the University of Toronto in 1987, Skoll spent months backpacking around the world before returning home to try his hand at entrepreneurship. His first ventures—computer-rental and IT-consulting firms—taught him the mechanics of running a business, even if they weren't big successes. In 1993, he left Canada for Stanford's Graduate School of Business, looking for a bigger challenge.

Joining eBay

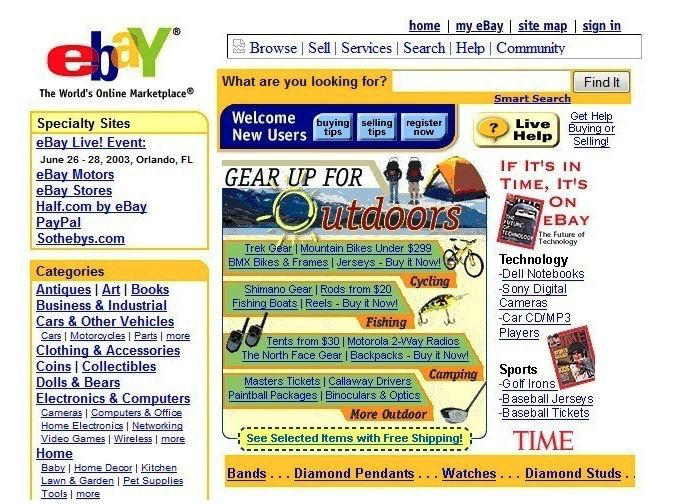

While studying at Stanford, Skoll met a soft-spoken computer programmer named Pierre Omidyar, who was working on an online experiment he called AuctionWeb. Omidyar had launched the site in September 1995 from his home in San Jose as part of his personal domain, pierre.net. The idea was simple but revolutionary: an open marketplace where anyone could sell almost anything to anyone else in the world.

Legend has it that the first item ever sold was a broken laser pointer. When Omidyar emailed the buyer to make sure he knew it didn't work, the man replied, "I'm a collector of broken laser pointers." That single transaction told Omidyar he was onto something powerful—the internet could connect niche buyers and sellers in ways no one had imagined.

By 1996, the site was taking off. Hundreds of new auctions were being posted daily, mostly collectibles, computer parts, and toys. Omidyar's personal internet service provider suddenly started charging him commercial hosting rates because of the traffic volume. He realized he needed help turning this side project into a real company.

A mutual friend introduced him to Skoll, who was just finishing his MBA. Omidyar offered him a chance to join as the company's first employee and president. Skoll initially hesitated—online auctions sounded frivolous—but the data convinced him. He officially came aboard in late 1996 and immediately began writing eBay's first business plan, laying the groundwork for an organized, profitable internet company at a time when most startups had no revenue at all.

Building The eBay Empire

In those early years, eBay was barely more than a handful of people. The company didn't hold inventory; it simply provided the platform and collected fees from sellers. Skoll focused on building the infrastructure, business model, and community policies that kept users loyal. Under his guidance, eBay adopted a feedback system that let buyers and sellers publicly rate one another—a simple idea that created trust in a world of total strangers.

The timing couldn't have been better. By 1997, the site's popularity exploded thanks to the Beanie Babies craze. At one point, more than 10% of eBay's sales came from those stuffed animals alone. The company even had to list "a dependence on the strength of the Beanie Babies market" as a risk factor in its IPO filing.

Skoll's blend of analytical thinking and social awareness helped eBay grow rapidly without losing its sense of community. By 1998, the company had millions of registered users, hundreds of employees, and real revenue—something rare for a dot-com at the time. Omidyar and Skoll decided to bring in an experienced CEO to lead the next phase of growth, hiring Harvard Business School graduate Meg Whitman to run the company. Skoll transitioned out of day-to-day management but remained a major shareholder and guiding voice.

The IPO

On September 21, 1998, eBay went public on the NASDAQ under the ticker symbol EBAY. The stock was initially priced at $18 per share. It opened at $53.50 and closed its first trading day at $47.38, pushing eBay's value just over $1 billion. It was one of the most spectacular tech IPOs of the decade and an early sign that the internet economy had arrived.

Pierre Omidyar, who owned about 30% of the company, saw his stake jump to roughly $300 million. Jeffrey Skoll, holding close to 10%, was suddenly worth around $100 million on paper. Within months, the stock kept climbing—fueled by investor euphoria over the internet's potential. By April 1999, eBay's market cap had rocketed to roughly $25 billion, officially making both Omidyar and Skoll multi-billionaires.

eBay continued to grow through the early 2000s, expanding globally and acquiring PayPal in 2002. By December 2004, its market capitalization hit an astonishing $78 billion, which actually still stands as the company's all-time high. Over the following two decades, eBay's valuation has fluctuated with the market and changing competition. Today, the company's market cap sits around $36 billion. Even after all those ups and downs—and despite giving away billions to charity—Jeffrey Skoll's net worth remains about $7 billion. Pierre Omidyar, who has also given billions away, has still managed to maintain a net worth of $12 billion.

While the dot-com bubble would eventually burst for many internet startups, eBay kept growing, proving that its peer-to-peer marketplace had real staying power. Skoll, however, was already looking beyond Silicon Valley. His mind had turned to a question that had shaped his entire life: how do you use wealth to actually make the world better?

Getty

Choosing A Different Path

Haunted by his father's regrets and guided by tikkun olam—"to heal the world"—Skoll decided to devote his fortune to solving global problems.

In 1999, he created the Skoll Foundation, focused on what he called "social entrepreneurship"—funding innovators who tackle issues like poverty, disease, education, and environmental sustainability with the creativity of a startup founder. The foundation invests in organizations that blend idealism with practical business models. Over time, it's become one of the largest and most influential of its kind, backing more than a hundred social-impact ventures and hosting the annual Skoll World Forum at Oxford University.

He also endowed the Skoll Centre for Social Entrepreneurship at Oxford's Saïd Business School, helping train the next generation of change-makers. In 2010, he launched the Skoll Global Threats Fund to address five existential issues: climate change, water security, pandemics, nuclear proliferation, and Middle East conflict.

Over the years, Skoll's foundation and affiliated charities have given away billions of dollars to address urgent global challenges. In 2020, he personally donated more than $120 million to help distribute medical supplies and equipment to underserved countries during the pandemic—one of the largest private humanitarian responses to COVID-19. To date, his philanthropic network has supported projects improving public health, climate resilience, education, and women's empowerment across more than 130 countries.

Participant Media: Changing Minds Through Movies

Skoll realized that storytelling could be just as powerful as philanthropy. In 2004, he founded Participant Media to produce films that entertained but also inspired audiences to act. It was a bold experiment—Hollywood backed by a social mission. The results were extraordinary.

Participant helped bring to life:

- The Help

- Syriana

- Contagion

- An Inconvenient Truth

- Lincoln

- Bridge of Spies

- Spotlight

- Roma

- American Factory

Collectively, those films have won 21 Academy Awards and more than 70 nominations. Few entertainment companies have blended activism and artistry as successfully. Skoll viewed it as another form of leverage—using stories to shift public consciousness on issues from climate to civil rights.

He later donated millions to create the Skoll Center for Social Impact Entertainment at UCLA, cementing his belief that film could be a vehicle for progress.

Impact Investing

Even as he gave away his money, Skoll looked for ways to make capitalism itself a tool for good. Through Capricorn Investment Group, the fund that manages his fortune, he became one of the earliest major backers of impact investing—directing capital toward companies that aim to generate both profits and measurable social or environmental benefits.

Capricorn has managed roughly $10 billion in assets and has invested heavily in clean-energy and sustainable-tech companies, including Tesla, long before it became a household name. In 2016, Skoll teamed with U2 frontman Bono and private-equity firm TPG to launch The Rise Fund, dedicated to scaling businesses improving agriculture, education, and healthcare in developing regions.

A Legacy Of Purpose

Jeffrey Skoll signed the Giving Pledge in 2010, committing to donate the vast majority of his wealth during his lifetime. "If I die today, everything goes to the foundations."

It's a simple statement, but one that encapsulates his worldview: wealth is a means, not an end. Skoll could have spent his life building more companies or chasing ever-higher returns. Instead, he has spent decades trying to heal the world—one grant, one film, one idea at a time.

Most people dream of making a fortune. Jeffrey Skoll's dream was to make one, then use it to make things better. He's proof that it's possible to win at capitalism—and then redefine what winning means.

/2010/07/Jeffrey-Skoll.jpg)

/2021/09/pierre.jpg)

/2020/06/jb2.jpg)

/2014/08/sp2.jpg)

/2015/07/GettyImages-1324210.jpg)

/2010/05/Peter-Thiel.jpg)

/2009/11/George-Clooney.jpg)

/2020/01/lopez3.jpg)

/2020/02/Angelina-Jolie.png)

/2019/10/denzel-washington-1.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2019/04/rr.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2009/09/Brad-Pitt.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2020/04/Megan-Fox.jpg)

/2020/06/taylor.png)

/2009/09/Cristiano-Ronaldo.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2017/02/GettyImages-528215436.jpg)

/2018/03/GettyImages-821622848.jpg)