If I asked you to name the richest NFL player on earth, I bet most people would guess Tom Brady. After all, he earned $330 million in salary during his career and another $100-200 million from endorsements.

Another good guess might be Aaron Rodgers, who's still playing and currently holds the record for the highest career earnings in NFL history, at about $380 million and counting.

Or maybe you'd point to Patrick Mahomes, whose 10-year, $503 million contract with the Chiefs is one of the largest contracts in sports history, literally doubling Peyton Manning's all-time career earnings of $248 million. Peyton himself would be a solid guess.

If you're a longtime reader of CelebrityNetWorth, you might even pick Roger Staubach, the legendary 1970s Cowboys quarterback who built a real-estate empire in his off-seasons, which he sold for $650 million in 2008.

But none of those answers would be correct. And in fact, I bet a bunch of readers have never even heard of this person.

Ok, enough dancing around.

The richest NFL player in the world is a quarterback from the 1960s who parlayed just $1.2 million in total career earnings into an extraordinary second act as a technology entrepreneur and investor.

His name is Fran Tarkenton. How extraordinary has Fran's second act been? Well, let's put it this way: Fran Tarkenton is one of the largest individual shareholders in a little company called Apple…

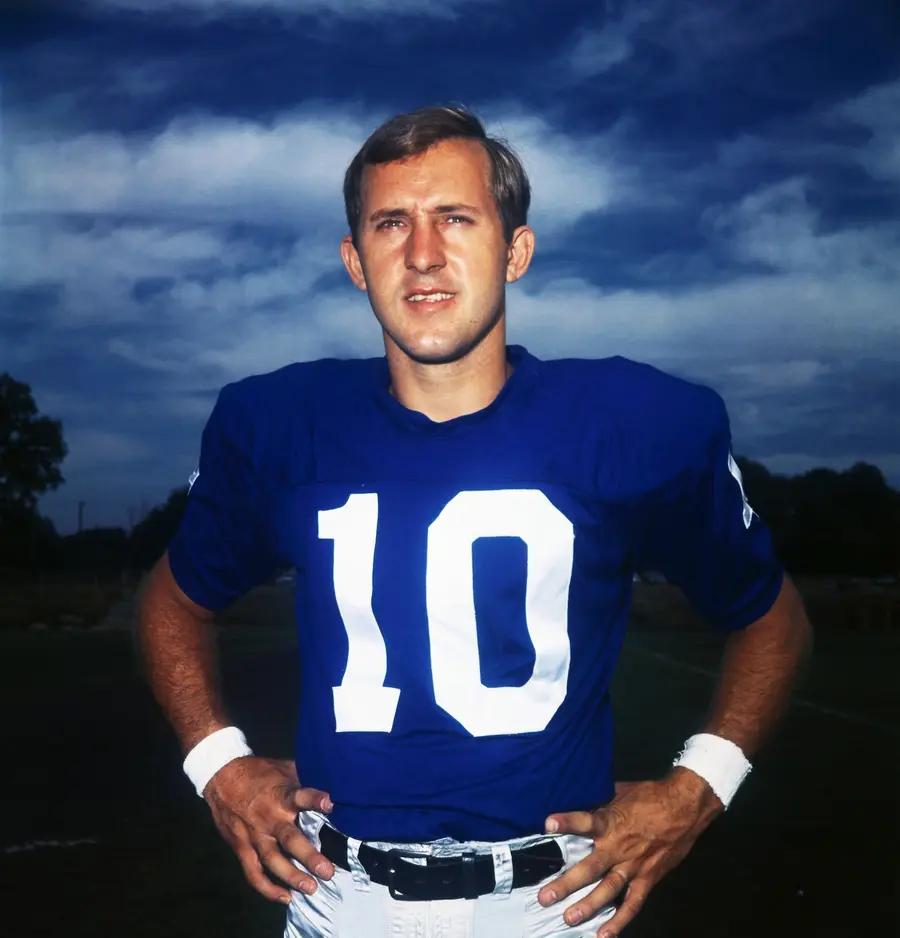

Fran Tarkenton (via Getty)

NFL Career and Meager Earnings

Fran Tarkenton was one of the most exciting quarterbacks in NFL history. Over 18 seasons with the Minnesota Vikings and New York Giants, he turned improvisation into an art form. Nicknamed "The Scrambler," he extended plays with his legs long before that became a standard part of the position. He threw for 47,003 yards and 342 touchdowns, earned nine Pro Bowl selections, and was named NFL MVP in 1975.

Despite all that, Fran Tarkenton never won a Super Bowl. He led the Vikings to the big game three times — Super Bowls VIII, IX, and XI — but lost each one. FYI: Tom Brady has seven rings, Patrick Mahomes has three, Peyton Manning and Roger Staubach each have two, and even Aaron Rodgers has one. Tarkenton? Zero.

When Tarkenton signed his first NFL contract in 1961, the deal paid $12,500 — about $111,000 in today's dollars. Even at his peak, he never earned more than $250,000 per season. In total, over an 18-year career, he made about $1.2 million in salary — roughly $8 million after adjusting for inflation.

Like Roger Staubach (and most NFL players of the time), Fran had to work side jobs in the off-season to make ends meet. He spent one off-season working for a trucking company in Idaho, another working for a printing firm in Minnesota, and even taking a desk at the New York ad agency BBD&O.

Those early off-season jobs may not have been glamorous or glory-filled, but they taught Fran some extremely valuable skills for his eventual second career: how to sell, how to manage clients, and how to build relationships. More importantly, they convinced him that when football ended, he wanted to be more than a former quarterback. He wanted to build something of his own.

Early Business Ventures and Lessons Learned

While many of his peers spent their off-seasons resting or playing golf, Fran Tarkenton was already thinking about life after football. Even in the late 1960s, when few athletes had business ambitions, he was experimenting with entrepreneurship. His first attempt came when he borrowed $50,000 to open a fast-food restaurant near Minneapolis. Naturally, he named it "The Scrambler."

The business didn't last. It failed within a few years, leaving him in debt — a tough lesson for a young quarterback still in the middle of his playing career. But instead of discouraging him, that failure became a turning point. Tarkenton realized that relying on borrowed money had made him complacent, so he made a vow: every future business would be funded with his own cash. If his own money was on the line, he'd work harder and think smarter.

That mindset became the foundation of his post-football empire. In the early 1970s, while still playing for the New York Giants, he launched a management consulting firm in Atlanta, followed by an insurance brokerage and several real estate investments. These ventures gave him firsthand experience in sales, finance, and customer relationships — skills that would serve him far better in the long run than any passing record.

By the mid-1980s, less than a decade after retiring from the NFL, Tarkenton's businesses were generating more than $11 million a year in revenue. He had gone from running for his life on the football field to running a growing portfolio of companies. And his next move would take him from Main Street to Silicon Valley — long before most people even knew what software was.

Tarkenton Software and KnowledgeWare

By the late 1970s, as personal computers began creeping into offices, Fran Tarkenton was paying close attention. He wasn't a programmer, but he understood that technology would transform the business world — and he wanted in early. Drawing on the operational and management experience from his consulting firm, Tarkenton founded Tarkenton Software, a company focused on developing computer program generators for businesses.

His timing couldn't have been better. While most retired athletes were signing autographs or starting car dealerships, Tarkenton was building a company in one of the fastest-growing sectors in America. He began promoting CASE (Computer-Aided Software Engineering) tools across the country, even teaming up with tech pioneer Albert F. Case Jr. to host seminars explaining how businesses could use software to work smarter.

In 1986, Tarkenton made his boldest move yet when he merged his young company with a struggling Atlanta-based software firm called KnowledgeWare. Most investors thought he was crazy — an ex-quarterback running a tech company in an industry dominated by engineers. Tarkenton believed otherwise. He invested $3 million of his own money ($9 million in today's dollars) to take control and set out to prove he could build a winning team off the field just like he had on it.

Within two years, he did exactly that. Tarkenton struck a partnership with IBM to bundle KnowledgeWare's software with IBM's hardware offerings, instantly boosting the company's credibility and sales. Revenues exploded, growing from losses to tens of millions in annual sales almost overnight. In 1989, he took KnowledgeWare public. The stock surged alongside fellow newly public software companies Microsoft, Sun Microsystems, Adobe, and Oracle.

By 1991, KnowledgeWare was generating around $100 million in annual revenue, and Tarkenton's 13% ownership stake was worth roughly $50–60 million on paper. His initial $3 million investment had multiplied more than tenfold.

Over the next few years, he gradually sold portions of his stake as the stock matured. In 1994, he finalized the company's sale to Sterling Software for $73 million, personally earning about $6 million from that deal and securing a five-year consulting contract worth $300,000 annually.

That windfall gave Tarkenton the capital to expand his business empire — and to make the long-term investment that would quietly become his greatest financial decision of all…

Elsa/Getty Images

The Apple Investment

After selling KnowledgeWare in the mid-1990s, Fran Tarkenton had something most retired athletes never achieve: liquidity, patience, and a deep understanding of how business cycles work. He also had his eye on another technology company — one that, at the time, was in serious trouble: Apple Inc.

Tarkenton began buying Apple stock more than 30 years ago, at a time when the company was locked in a near-death struggle for survival against rival behemoth Microsoft. His timing could not have been better. More importantly, he never sold — in fact, he kept adding to his position year after year. He also consistently reinvested his dividends into more shares.

Here's what we know:

In mid-2019, it was confirmed that, at that time, Fran owned $40 million worth of Apple shares. A year later, Apple performed a 4-for-1 stock split. To own $40 million worth of shares in mid-2019, pre-split, implies that he held roughly 200,000 shares.

After the split, those 200,000 shares became 800,000 shares.

As I type this article, Apple's stock is sitting at an all-time high of $270. Assuming he has not sold any shares, and there's been no indication he has, Fran Tarkenton's Apple shares are worth around $216 million.

But let's not forget about the dividends!

Apple's quarterly dividend of $0.26 per share generates about $208,000 every quarter for someone who owns 800,000 shares. That's roughly $830,000 per year in dividend income. And Fran has historically reinvested his dividends into more Apple shares.

When you do the math on 800,000 shares owned in July 2021 with automatic dividend reinvestment, that adds another 18,000 shares over the following four years, depending on the stock price at the time each dividend was paid.

Those additional shares would push his total ownership close to 818,000 shares today. At Apple's current price of $270 per share, that's about $220 million worth of stock — and counting.

Assuming Fran owns 818,000 shares, that would place him among Apple's top 10 individual shareholders. He might even be in the top 5.

Legacy of a Gridiron Entrepreneur

Fran Tarkenton's life story reads like a masterclass in long-term thinking. On the field, he built his legacy through creativity, resilience, and leadership. Off the field, he used those same traits to build wealth on a scale that few athletes — or even executives — ever reach.

He may not have ever won a Super Bowl, but with a net worth of $350 million, Fran Tarkenton is the richest NFL player on earth and perhaps the greatest athlete investor of all time.

/2010/09/Fran-Tarkenton.jpg)

/2025/11/roger-staubach-image.png)

/2010/03/GettyImages-96411842.jpg)

/2015/04/old.jpg)

/2009/09/Bill-Gates.jpg)

/2020/04/Shaquille-ONeal.jpg)

/2020/02/Angelina-Jolie.png)

/2019/04/rr.jpg)

/2020/06/taylor.png)

:strip_exif()/2009/09/P-Diddy.jpg)

/2020/04/Megan-Fox.jpg)

/2020/01/lopez3.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2009/11/George-Clooney.jpg)

/2018/03/GettyImages-821622848.jpg)

/2017/02/GettyImages-528215436.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2019/10/denzel-washington-1.jpg)

/2009/09/Brad-Pitt.jpg)