In the last 24 hours, Twitter and a bunch of low-quality financial blogs have exploded with the claim that Michael Burry — the hedge fund manager made famous by "The Big Short" — has placed a $1 BILLION bet that the stock market is about to crash. The claims are attributed to Twitter posts made by Burry himself. I'll share and explain the Tweets in a moment.

Specifically, some people on social media claim that Burry paid $1 billion to place a short bet that NVIDIA and Palantir are about to crash. At least partly because of these headlines, NVIDIA's stock is down 4% and Palantir is down 9% as I type this article (Tuesday afternoon).

That's not really what happened…

(via Getty)

What's Actually Going On

Ok, so first off, yesterday, Michael published the following tweet:

These aren't the charts you are looking for.

You can go about your business. pic.twitter.com/ICldNUp2OI

— Cassandra Unchained (@michaeljburry) November 3, 2025

The chart on the left (the one with the black and red bars) shows that Amazon, Alphabet, and Microsoft's Cloud growth have seen sharp declines comparing 2018-2022 vs. 2023-2025. The chart on the right shows that, while cloud growth is cooling, capital expenditures on cloud and other AI technology are accelerating to levels not seen since the dot-com bubble (1999–2000). The 2025 CapEx growth rate nearly mirrors the pre-crash highs, suggesting a speculative surge in AI and tech spending. These are indeed very alarming signals (and I personally do believe we're in a massive AI bubble).

So why does everyone think Michael placed a $1 billion short bet against the AI bubble?

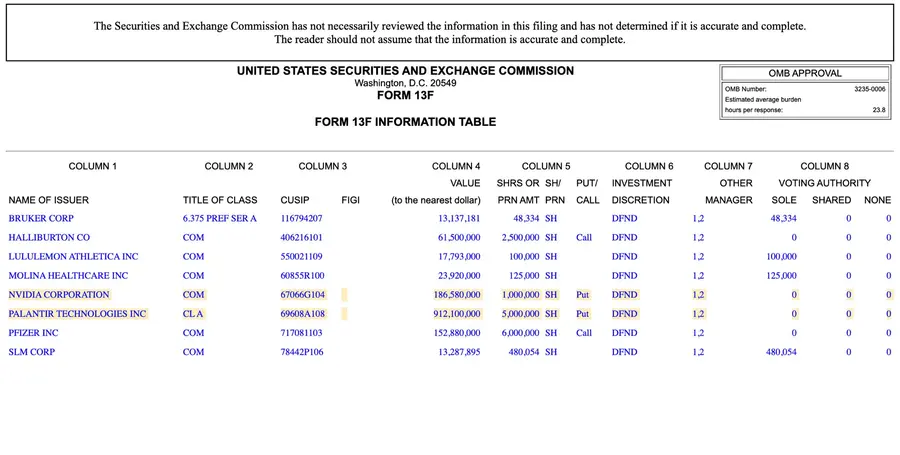

If a hedge fund manages more than $100 million, every quarter it is required to file a Form 13F with the SEC. The document simply lists the firm's long U.S. equity positions and long options as of the filing date. It does not show short sales, cash balances, foreign holdings, or the other side of complex trades. In other words, it's only a partial snapshot of a fund's portfolio — and it's often misunderstood by people looking for drama. Here is Scion's 13F that people are misinterpreting:

As you can see, the 13F filing shows that Scion Asset Management holds put options tied to Nvidia and Palantir Technologies. The positions are listed with notional values of about $186 million for Nvidia and $912 million for Palantir, which add up to roughly $1.1 billion. That's where the viral "$1 billion bet" headline comes from. But that number represents the total value of the underlying shares those contracts are linked to — not the amount of money Burry actually spent.

Think of it like this: when you buy a put option, you're essentially paying for the right to sell shares at a specific price in the future. You don't have to own the shares, and you don't have to spend anywhere near their full value. You just pay a small upfront premium, similar to how you might pay for an insurance policy.

So if Burry's puts give him exposure to roughly $1.1 billion worth of stock, he likely only had to put down a tiny percentage of that — maybe 1-5% of the total notional value. That means his actual cost could have been anywhere from $10 million to $50 million.

That's why this isn't some apocalyptic billion-dollar gamble. It's a highly leveraged, asymmetric trade — small money up front for the potential of a very large payoff if things go his way.

If Nvidia and Palantir were to fall sharply, say 25 to 40%, the puts could explode in value, easily doubling or tripling the amount Burry spent. If the stocks stay flat, the options would slowly lose value until they expire worthless, leaving Burry out the premium he paid. And if the AI boom keeps running hot and the stocks keep rising, he loses that same premium faster — but nothing more.

In every scenario, his downside is limited and defined, while his upside is theoretically unlimited. That's the type of asymmetric risk Burry has built his reputation on — spending a small amount to protect against or profit from what he sees as bubbles forming in plain sight.

Who Is Michael Burry and Why Do People Care?

If you're not exactly sure who Michael Burry is — or why every move he makes sends financial Twitter into a frenzy — here's a quick refresher. Remember Christian Bale's character in "The Big Short"? The awkward, brilliant loner who spent years buried in spreadsheets, convinced that the U.S. housing market was built on sand while everyone else laughed him off? That was Michael Burry. And he was right.

In the mid-2000s, Burry was running a small hedge fund called Scion Asset Management when he discovered that Wall Street's mortgage-backed securities were packed with loans that were almost certain to default. Acting on that conviction, he persuaded big investment banks to sell him credit default swaps — essentially insurance policies that would pay out if those mortgage bonds collapsed. It was a highly unconventional move for a relatively unknown fund manager, and it looked like a disaster for nearly two years as housing prices kept rising. His investors were furious, many demanded their money back, and Burry was portrayed as a lunatic.

Then, in 2007, the housing market imploded — exactly as he had predicted. The swaps paid off spectacularly. Scion earned roughly $600 million for its investors, and Burry personally took home about $100 million. After closing out those trades, he shut down the fund, returned outside capital, and largely disappeared from public view for several years.

Today, Burry quietly runs a privately held version of his old firm under the name Scion Capital. He manages his own fortune along with a small pool of external money. Because Scion files quarterly SEC disclosures, we know the fund manages at least $100 million, which is the minimum threshold required for those filings. Beyond that, no one outside the firm really knows.

What's clear is that investors and media outlets still hang on his every move because of what happened in 2008. He saw the housing crash coming when almost no one else did — and made one of the greatest contrarian trades in history. So when he takes a bearish position, no matter how small, people notice.

/2024/06/jensen-1.jpg)

/2025/07/nancy-pelosi.jpg)

/2025/07/pelosi.jpg)

/2014/04/money.jpg)

/2020/09/GettyImages-622170374.jpg)

/2022/06/GettyImages-1398138070.jpg)

/2019/04/rr.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2019/10/denzel-washington-1.jpg)

/2017/02/GettyImages-528215436.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2020/06/taylor.png)

/2009/09/Brad-Pitt.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2020/01/lopez3.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2009/11/George-Clooney.jpg)

/2018/03/GettyImages-821622848.jpg)

/2020/04/Megan-Fox.jpg)

/2020/02/Angelina-Jolie.png)