John D. Rockefeller became the world's first billionaire in 1916. That's without adjusting for inflation. Rockefeller's $1 billion fortune over a century ago was a truly mind-boggling amount. Adjusted for inflation — and accounting for shifts in economic power and the size of the global economy — his peak wealth would be worth roughly $350 billion in 2025 dollars. That made him the richest human in history (inflation-adjusted) for over 80 years until he was surpassed by Elon Musk in 2021.

Speaking of Elon. The Tesla/SpaceX boss is the richest person on earth today with a net worth of $385 billion. And that's off by $100 billion compared to his late 2024 highs. In December 2024, with Tesla stock in overdrive, Elon's fortune briefly topped $485 billion.

If anyone alive today has a legitimate shot at becoming the world's first trillionaire, you might assume Elon Musk is the obvious candidate. And YES, Elon does have a viable path towards trillionaire-land.

But there's a twist!

After crunching the numbers and layering in a few critical factors, Elon is not actually the titan with the clearest path to a trillion-dollar net worth.

When you strip away the hype and focus purely on the math — ownership stake, current company valuation, and the market cap needed to cross the trillion-dollar threshold — the picture changes dramatically. The race isn't just about having the biggest company or the fastest-growing stock. It's about how much of that company you actually own, and how much it would need to grow to get you there.

And here's the twist: the billionaire with the clearest path to a trillion-dollar fortune isn't Elon Musk, Jeff Bezos, or Mark Zuckerberg. It's Larry Ellison.

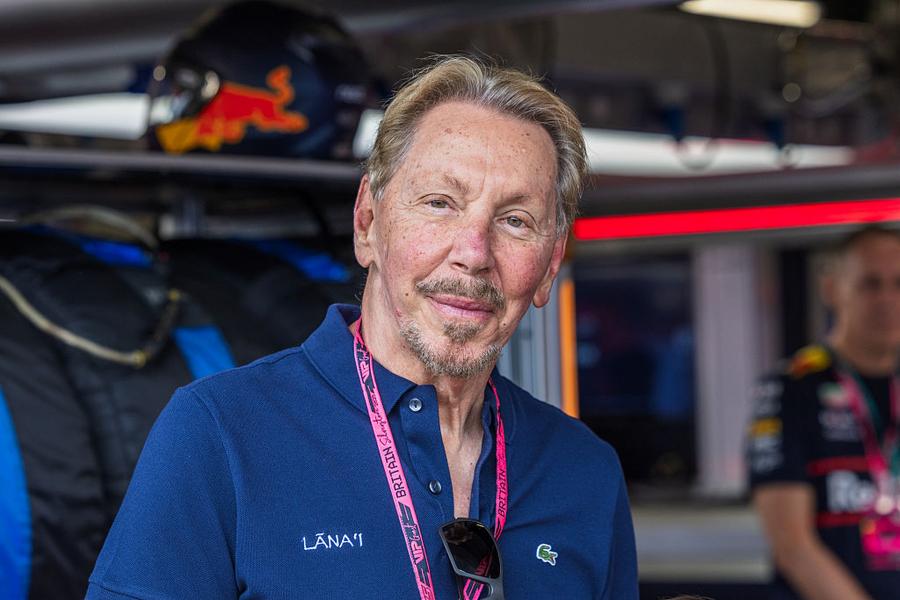

Larry Ellison

Larry Ellison is the co-founder and chairman of Oracle. Oracle went public in March 1986, ONE DAY before Microsoft went public. But here's the difference: Today, Bill Gates only owns around 1.3% of Microsoft. At the IPO, he owned 45%. Over the last two decades, Gates has aggressively sold his shares to diversify his fortune, which now stands at around $130 billion. Had he diversified but maintained a 30% stake in Microsoft, today Bill would be the world's first trillionaire with a net worth of $1.1 TRILLION based on Microsoft's $3.88 trillion market cap.

When Oracle went public, Larry Ellison owned 39% of the company. So how much has he sold off?? Actually, he's increased his stake over the last 40 years. Today, Ellison owns 41% of Oracle, which has a market cap of $700 billion. That stake is worth around $380 billion. Throw in another $20 billion in net worth from real estate investments and a fairly large stake in Tesla, and today Larry's net worth is $400 billion, enough to make him the richest person in the world.

For Ellison to join the trillionaire club, Oracle's market cap would need to climb to $2.39 trillion, or about 2.5× its current size. Is that realistic? Consider this:

Oracle's market cap has grown by more than that in just the last five years. And here are the current top three companies by market value:

- NVIDIA – $4.455 trillion

- Microsoft – $3.880 trillion

- Apple – $3.403 trillion

If Oracle can keep riding the AI and cloud computing wave, Ellison may have the strongest shot at becoming the world's first trillionaire. The only real obstacle is time — at 80, he's the oldest contender in the race. But Ellison has poured hundreds of millions into life-extension and health research, and even owns a Four Seasons resort on his private Hawaiian island of Lanai dedicated to wellness. Short of a private jet mishap or yacht race accident, Ellison could easily live to 100, giving him two more decades to hit the trillion-dollar milestone.

(Photo by Jay Hirano/SOPA Images/LightRocket via Getty Images)

Elon Musk

Elon Musk's fortune rests on two massive pillars: his stake in Tesla and his stake in SpaceX. Between the two, he controls more personal wealth on paper than anyone in history — but also carries more volatility risk than any other contender in the trillionaire race.

Musk directly owns about 13% of Tesla (412 million shares) and holds another 304 million exercisable options, giving him an effective stake of around 21%. At Tesla's current $1.02 trillion market cap, that stake is worth roughly $214 billion.

He also owns about 43% of SpaceX, which was most recently valued at $350 billion — though just days ago, reports surfaced that SpaceX is eyeing a fundraising round at a $400 billion valuation. If that round happens, Musk's stake would instantly jump from about $150 billion to roughly $172 billion without him selling a single share.

What would it take for Musk to reach $1 trillion?

- Tesla's market cap hitting $3.5 trillion, making his 21% stake worth about $735 billion.

- SpaceX's valuation climbing to $600 billion, giving his 40% stake a $240 billion value.

That combination would push his net worth to around $975 billion before factoring in xAI and other ventures, essentially making him a trillionaire on paper.

Larry vs. Elon

Stepping back, what do you think is more likely?

- That Tesla will triple in value from $1 trillion to $3.5 trillion AND SpaceX will nearly double..

- OR will Oracle increase from $1 trillion to $2.4 trillion?

And here's another fun twist – When Tesla's fortunes rise… so do Larry Ellison's because he owns 15 million shares in the electric carmaker! That's equal to roughly 1.5% of the company. So if Tesla goes to a $3.5 trillion market cap, Larry's net worth will increase by $50 billion 🙂

(Photo by Antonio Masiello/Getty Images)

Mark Zuckerberg

Mark Zuckerberg owns about 13% of Meta, a stake worth roughly $251 billion at today's $1.93 trillion market cap. Add in around $26 billion in other assets, and his net worth sits at about $277 billion, making him the fourth-richest person in the world.

For Zuckerberg to become a trillionaire on paper, Meta's market cap would need to rise to about $7.46 trillion — roughly 3.9× its current size. That would require sustained dominance in social media, deeper monetization of WhatsApp and Instagram, and significant payoffs from Meta's investments in AI and mixed reality. At just 41 years old, Zuckerberg has the advantage of time — and with Meta already showing an ability to pivot and reinvent itself, his path to $1 trillion is more plausible than most.

The Long Shots

While they're among the richest people alive, these five would need their companies to grow to nearly unthinkable market caps to join the trillionaire club:

- Jeff Bezos – 9.5% of Amazon, age 61, needs ~$10.05 trillion Amazon market cap.

- Steve Ballmer – 4% of Microsoft, age 69, needs ~$24.88 trillion Microsoft market cap.

- Sergey Brin – 5.5% of Alphabet, age 51, needs ~$18.09 trillion Alphabet market cap.

- Larry Page – 5.5% of Alphabet, age 52, needs ~$18.09 trillion Alphabet market cap.

- Jensen Huang – 3.5% of Nvidia, age 62, needs ~$28.49 trillion Nvidia market cap.

Trillionaire Contenders Snapshot

| Name | Primary Company | Ownership % | Age | Current Net Worth ($B) | Current Company Market Cap ($T) | Required Market Cap for $1T Net Worth ($T) |

|---|---|---|---|---|---|---|

| Larry Ellison | Oracle | 41.0% | 80 | 305 | 0.70 | 2.39 |

| Elon Musk | Tesla/SpaceX | 21.0% | 54 | 368 | 1.02 | 3.94 |

| Mark Zuckerberg | Meta | 13.0% | 41 | 277 | 1.93 | 7.46 |

| Jeff Bezos | Amazon | 9.5% | 61 | 204 | 1.90 | 10.05 |

| Steve Ballmer | Microsoft | 4.0% | 69 | 169 | 4.00 | 24.88 |

| Sergey Brin | Alphabet | 5.5% | 51 | 153 | 2.30 | 18.09 |

| Larry Page | Alphabet | 5.5% | 52 | 153 | 2.30 | 18.09 |

| Jensen Huang | Nvidia | 3.5% | 62 | 118 | 3.00 | 28.49 |

/2021/01/Larry-Ellison.jpg)

/2009/09/Larry-Ellison-1.jpg)

/2021/04/larry.jpg)

/2020/01/GettyImages-1183284102.jpg)

/2020/08/GettyImages-456302756.jpg)

/2017/09/GettyImages-456302756.jpg)

/2019/10/denzel-washington-1.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2009/09/Brad-Pitt.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2020/06/taylor.png)

/2009/11/George-Clooney.jpg)

/2020/04/Megan-Fox.jpg)

/2018/03/GettyImages-821622848.jpg)

/2017/02/GettyImages-528215436.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2020/02/Angelina-Jolie.png)

/2020/01/lopez3.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2019/04/rr.jpg)