Back in November 2022, Larry Ellison's net worth stood at an extremely respectable $80 billion. That made him roughly the 20th richest person in the world. That same month, OpenAI released its first version of ChatGPT to the public and, within weeks, the AI arms race was officially underway.

So what does that have to do with Larry Ellison? Quite a lot, actually. The vast majority of Ellison's fortune is tied to his 42% stake in Oracle, the enterprise software giant he co-founded in 1977. For decades, Oracle was seen as a powerful but relatively conservative tech company—dominant in databases, but far removed from the buzz of consumer apps or social media.

But as AI demand exploded, Oracle found itself in the right place at the right time. Its cloud infrastructure—once considered an afterthought compared to AWS, Azure, or Google Cloud—suddenly became a critical resource for training and deploying massive AI models. OpenAI, among others, began leasing enormous blocks of compute power from Oracle. Wall Street took notice.

In less than three years, Oracle's stock has quadrupled. And with it, Ellison's net worth has soared. On July 16, 2025, Larry officially overtook Mark Zuckerberg to become the second richest person on Earth, for the first time in his life. And today, September 10, 2025, Larry overtook Elon Musk to secure the #1 top spot for the first time in his life. Oracle's stock is up 40% today alone after releasing especially positive cloud growth projections. Larry's net worth has increased $100 billion in the LAST 24 HOURS ALONE.

Oh, and beyond being an insanely rich tech tycoon, Larry also happens to be my favorite living billionaire. A real-life Tony Stark. The kind of billionaire you dream of becoming when you're a teenager: unapologetically extravagant, fiercely competitive, and completely unbothered by modesty. He collects oceanfront mansions in Malibu and Florida like trading cards. He owns fleets of aircraft, including decommissioned military jets. He funds a world-class sailing team. He owns 1.4% of Tesla. He runs one of the most prestigious professional tennis tournaments in the world. And, yes, he owns an entire Hawaiian island.

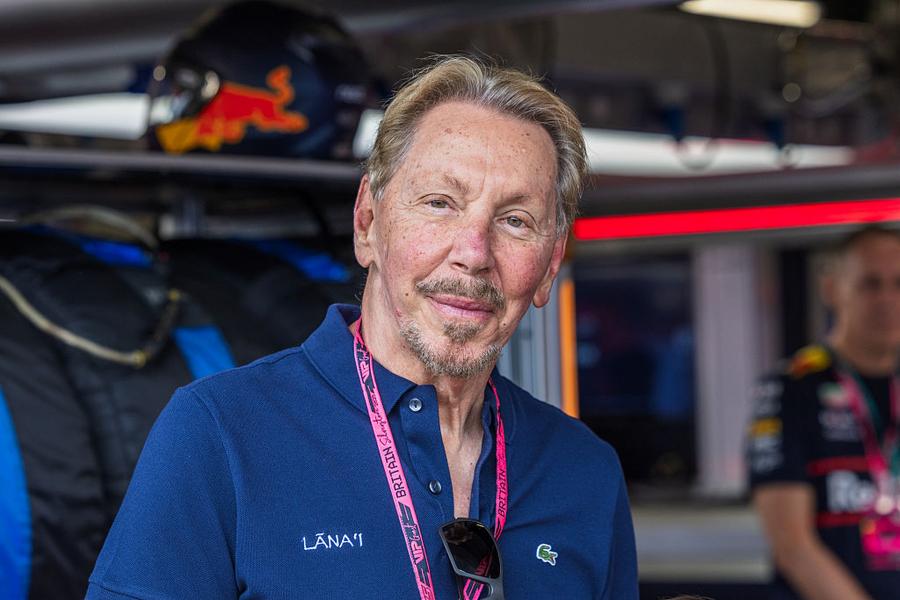

(Photo by Jay Hirano/SOPA Images/LightRocket via Getty Images)

The Richest Person in the World

As I type this article, Larry Ellison's net worth stands at $400 billion. His net worth has increased by more than $200 billion since the beginning of 2025.

Larry's longtime friend, Elon Musk, now has to make do with being the world's second richest person. And if you'll recall from a moment ago, Larry owns 1.4% of Tesla. He paid $1 billion over several transactions in 2018 to acquire his shares. Today, that stake is worth around $14 billion.

Here are the richest people in the world right now:

- Larry Ellison – $400 billion

- Elon Musk – $385 billion

- Mark Zuckerberg – $267 billion

- Jeff Bezos – $258 billion

- Larry Page – $210 billion

- Sergey Brin – $196 billion

How Oracle Became an AI Powerhouse

Oracle's AI transformation didn't happen by accident. In the wake of ChatGPT's release, tech companies scrambled for high-performance cloud infrastructure—specifically, access to GPU clusters powerful enough to train massive language models. While AWS, Microsoft, and Google had long dominated the cloud market, Oracle quietly spent years building data centers optimized for high-performance workloads. The company's Oracle Cloud Infrastructure (OCI) suddenly became an attractive option—cheaper, faster, and more flexible for specialized AI needs.

And then came the partnerships. OpenAI, the very company that triggered the AI gold rush, signed a massive deal with Oracle in 2024 to lease large swaths of GPU capacity—reportedly among the largest single infrastructure deals in Oracle's history. That agreement, part of a broader "Stargate" initiative also involving SoftBank, positioned Oracle as a key behind-the-scenes player powering the most advanced AI models in the world. Other AI startups and enterprise clients followed, drawn by OCI's low-latency performance and cost advantage over bigger-name cloud providers.

Oracle's ability to deliver this capacity wasn't luck—it was the result of a years-long bet Ellison had made on vertical integration and hardware efficiency. Rather than mimicking the strategies of AWS or Azure, Oracle focused on designing custom data centers optimized for AI and database performance. The gamble paid off. Revenues from cloud infrastructure surged, Wall Street revised its valuation assumptions, and suddenly, a company once seen as a legacy enterprise dinosaur was being rebranded as an AI-era powerhouse.

Since late 2022, Oracle stock has quadrupled, driven in large part by its repositioning as a critical enabler of generative AI.

My Favorite Billionaire

As I said in the opening, Larry Ellison is the billionaire you'd invent if you were 15. While other billionaires talk about "quiet luxury" or modest living, Larry buys $175 million mansions, then buys the luxury resort next door just to complete the vibe. You know how lots of billionaires brag about not leaving any of their fortune to their children? Larry gave his kids $200 million on their 25th birthdays. Larry then also funded his daughter Megan Ellison's career as a producer, and his son David Ellison's dual career as a film producer and soon-to-be studio mogul if he successfully acquires Paramount (and survives an upcoming multi-billion-dollar lawsuit from the South Park guys).

Let's talk about Larry's personal residences first.

Larry's longtime estate in Silicon Valley is a $200 million Japanese-style estate that is unlike anything in existence outside of Japan. He owns a $100 million golf estate in Rancho Mirage, California. Over the last few years, Ellison has gone on a Florida real estate bender that makes Monopoly look understated. In 2022, he paid $80 million for a 7.35-acre oceanfront mansion in North Palm Beach. That was just the warm-up. In 2023, he bought the Gemini Estate in Manalapan for $175 million—a mind-bending 16-acre compound with 1,200 feet of Atlantic beachfront, 1,300 feet of Intracoastal frontage, a private golf course, underground tunnel system, 62,000-square-foot main house, and 47 bathrooms. It was the most expensive home ever sold in Florida and the third most expensive residential sale in U.S. history.

Then, in 2024, Ellison bought the luxury Eau Palm Beach Resort & Spa, also in Manalapan and located directly next to Gemini. The resort has 309 rooms and a Gilded Age pedigree that once attracted Vanderbilts and Roosevelts. Though the sale price was undisclosed, estimates peg it around $300 million. Why did he buy it? Maybe to build an empire. Maybe just because he could.

He owns a fleet of private planes, including several decommissioned military jets, a 288-foot superyacht, an America's Cup-winning sailing team, and the BNP Paribas Open—one of the most prestigious tennis tournaments in the world, often called the "fifth Grand Slam." The tournament takes place at the Indian Wells Tennis Garden in Indian Wells… which he owns.

And we haven't even mentioned his coolest asset yet.

Lanai

Let's talk about Larry Ellison's crown jewel. In 2012, he bought 98% of the Hawaiian island of Lāna'i for $300 million. Not a house on Lāna'i. Not a resort. Not some big parcel of undeveloped land. He bought the island. All 140 square miles of it. Sixth-largest in the Hawaiian chain. Population: about 3,000. Ownership: Larry.

And he didn't just let it sit there like some idle billionaire flex. Over the last decade, Ellison has pumped more than $500 million into transforming Lāna'i into what he calls a sustainable utopia. He overhauled the island's infrastructure, power grid, and water systems. He invested in hydroponic farming, solar arrays, and waste-to-energy technology. He even launched a wellness company on the island that promotes longevity through data-tracked lifestyle optimization.

And then there's the luxury. Lāna'i is home to two Four Seasons resorts, both of which are owned (and constantly upgraded) by Ellison. One is perched above Manele Bay with sweeping ocean views. The other is a high-altitude retreat tucked into the island's misty interior, surrounded by Cook pines and designed to feel like a private billionaire's lodge—because that's essentially what it is.

When Bill and Melinda Gates got married on Lāna'i in 1994, it was considered remote, rustic, and charmingly underdeveloped. Today, thanks to Ellison, it's a billionaire's sandbox—a living test case for luxury, sustainability, wellness, and infrastructure innovation.

It's kind of impossible to place a value on Lāna'i today. So much has changed since 2012. When Larry bought Lāna'i, the richest person in the world was Bill Gates with a net worth of $60 billion. Not that he would ever sell, but what would it take? $2 billion? $5 billion? $10 billion?

Future Trillionaire?

Even with everything I've just mentioned, I still haven't told you my favorite fact about Larry Ellison. When Oracle went public back in 1986, he owned 39% of the company. When Microsoft went public, THE DAY AFTER Oracle's IPO, Bill Gates owned 45%. Over the next 15 years, Bill sold his shares as fast as he could, reducing his current stake to 1.4%. By contrast, Larry never sold. He actually bought more. Today, he owns 42% of Oracle. According to my quick calculations, if Oracle's market cap climbs to $2.4 trillion, Larry Ellison will become the world's first trillionairee – a feat Bill Gates should have accomplished last year when Microsoft first topped $3 trillion.

The only thing that might get in Larry's way is time. He's 80 years old. But he's obsessed with health and literally founded an institute on extending human lifespan. So if the world's first trillionaire also happens to own an island, a tennis empire, a fleet of jets, and a blueprint for cheating death—well, of course it's Larry Ellison. Who else would it be?

/2025/09/musk-ellison2.png)

/2021/01/Larry-Ellison.jpg)

/2024/08/Screenshot-2024-08-19-091358.jpg)

/2015/05/ellis.jpg)

/2021/04/larry.jpg)

/2015/03/GettyImages-456302694.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2020/01/lopez3.jpg)

/2018/03/GettyImages-821622848.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2009/11/George-Clooney.jpg)

/2020/04/Megan-Fox.jpg)

/2009/09/Brad-Pitt.jpg)

/2019/04/rr.jpg)

/2017/02/GettyImages-528215436.jpg)

/2019/10/denzel-washington-1.jpg)

/2020/02/Angelina-Jolie.png)

/2020/06/taylor.png)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2009/09/Jennifer-Aniston.jpg)