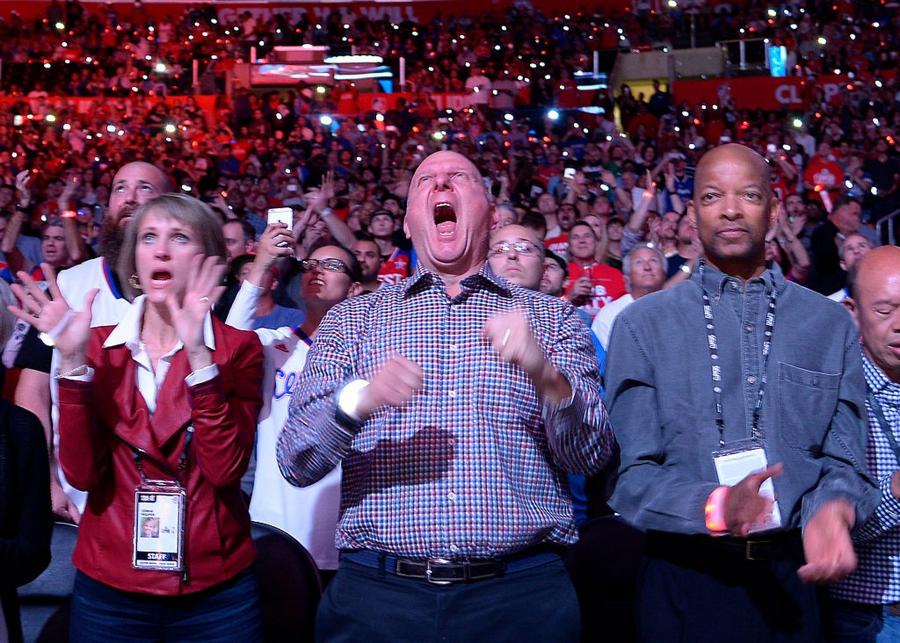

As I type this article, Steve Ballmer is the fifth-richest person on the planet with a net worth of $183 billion. Funnily enough, Steve is probably best known today as the high-energy owner of the Los Angeles Clippers. But I bet most people have some idea that his fortune originated from Microsoft.

What I don't think most people realize, especially given the sheer size of his net worth, is that Steve Ballmer was not a founder of Microsoft. The company was founded in 1976 by Bill Gates and Paul Allen. Ballmer didn't join until 1980. He wasn't even a particularly early hire. He was employee #30.

"Ok, fine," you might say, "but early employees usually get huge stock grants, especially if they were college buddies with the CEO, right?" Nope. When Steve Ballmer joined Microsoft, he wasn't given a single solitary share of equity.

And here's the real kicker: for years, Steve Ballmer was often dismissed as a loud, awkward figure whose tenure as Microsoft CEO was viewed as underwhelming—even a flop in some circles.

So, how did Microsoft's 30th employee—someone who started with zero equity—end up as one of the five richest people on the planet? Several slots ahead of his former boss, Bill Gates?

It all comes down to a quirky bonus structure… and one of the most underestimated traits in business: unshakable loyalty.

Photo by Kevork Djansezian/Getty Images

Meeting Bill Gates

Steve Ballmer met Bill Gates in 1973 when they were both students at Harvard. They lived in the same dorm — Currier House — and bonded over a shared love of math, puzzles, and competition. Gates was already immersed in computers and prone to skipping classes to code. Ballmer was more of a social sparkplug, loud and animated even then, but razor-sharp when it came to numbers and logic.

Their paths diverged after college. Gates famously dropped out of Harvard to start Microsoft (in New Mexico at first!) with Paul Allen. Ballmer, on the other hand, graduated with degrees in applied math and economics, then took a job at Procter & Gamble before enrolling at Stanford Business School.

In 1980, Gates called Ballmer and asked him to join Microsoft. At the time, the company was still relatively small, and Gates needed someone to bring order to the business side of the operation. Ballmer accepted and dropped out of Stanford. He became Microsoft's 30th employee with the vague title of "business manager" and a starting salary of $50,000.

A Quirky Bonus Unravels

Steve may not have gotten any equity, but Bill and Paul did give him a sweetener: At the end of each business year, Steve would get a bonus equal to 10% of the incremental profit growth he drove.

The year before Steve joined the company, Microsoft generated $1 million in revenue (unclear what that equated to in profit). By 1984/1985, the company was generating $15-20 million per year in profit, much of which was driven by Ballmer's enthusiastic sales efforts. That meant he was essentially clipping off 10% of total profits every year.

With an IPO on the horizon and profits projected to continue exploding, this quirky deal quickly became an albatross for Gates, Allen, and Microsoft's bankers.

The simple solution? Convert the bonus deal into equity.

Understanding his value and leverage, Ballmer wanted 8% of the company. Paul Allen, who had a frosty relationship with Steve over the years, flat-out refused to let him have more than 5%. In the end, Gates agreed to bridge the gap himself, giving Ballmer the full 8% by transferring an additional 3% from his own stake.

Microsoft went public on March 13, 1986. On that day:

- Bill Gates owned 45% of the equity.

- Paul Allen owned 25%.

- Steve Ballmer owned 8%.

At the end of its first day of trading as a public company, Microsoft's market cap was $780 million. Therefore, Bill ended the first day of trading with a paper net worth of $350 million, Paul was worth $195 million, and Ballmer was worth $62.4 million. Also note that it would have cost you around $8 million to buy 1% of MSFT in March 1986. That 1% stake would be worth $35 billion today 🙂

Kimberly White/Getty Images

Bill and Paul Dump Their Shares

In the decades following Microsoft's IPO, Bill Gates and Paul Allen sold like the shares were burning a hole in their pockets. Gates used his sales to fund the Bill & Melinda Gates Foundation and to build a diversified portfolio called Cascade Investments. Cascade owns significant stakes in public stocks, including Apple, Canadian National Railway, Republic Services, Ecolab, Waste Management, and Berkshire Hathaway. Cascade also controls the Four Seasons Hotels and Resorts. Today, Bill Gates owns around 1.4% of Microsoft, roughly 100 million shares.

Paul Allen sold his shares even faster than Gates. By 2000, he owned less than 5% of the company. At the time of his death in October 2018, Paul was worth $20 billion, and only a small fraction was derived from his Microsoft stake.

Ballmer Becomes CEO

Bill Gates stepped down as CEO in January 2000, handing the reins to Steve. Ballmer's tenure as CEO was seen, at the time, as fairly blunderous—marked by a string of high-profile missteps like the disastrous Nokia acquisition, the $6 billion write-off of aQuantive, the failure of Zune, and Microsoft's inability to compete in mobile and search, all while Apple and Google surged ahead in the consumer tech revolution.

At the peak of Bill Gates' time as CEO, Microsoft's market cap was $613 billion. When Steve Ballmer took over, the company's market cap was around $260 billion. During Ballmer's reign, Microsoft dropped as low as $160 billion in the washout from the 2008 Great Recession, then peaked at $315 billion right before he handed over to Satya Nadella.

Satya Nadella took Microsoft's market cap to $1 trillion in less than five years. And while he absolutely deserves a great deal of credit, much of that growth—driven primarily by the cloud—was built on the muscles and initiatives Steve Ballmer had already set in motion.

Microsoft-CEO-Steve-Ballmer / Stephen Brashear/Getty Images

Loyalty Pays Dividends… LITERALLY

Meanwhile… STEVE NEVER SOLD. When he stepped down as CEO, he still owned most of his original 8% stake!

His first significant stock sale happened in 2014 when he bought the LA Clippers for $2 billion. He has since sold some more shares to buy and build the Clippers' new stadium and to fund his philanthropic efforts.

Today, Microsoft's market cap is $4 trillion. Steve owns 333 million shares, equal to around 4% of the company. As I type this article, Microsoft trades at $533.50 per share. So, 333 million shares equate to $177 billion. Remember, his net worth is $183 billion.

While most billionaires employ dozens of employees in "family offices" to manage incredibly complicated and diverse portfolios filled with thousands of stocks, bonds, crypto, real estate, hedge fund stakes, and other private assets, 96% of Steve Ballmer's stock portfolio consists of stock in a single company. If he uses something like eTrade, his portfolio page would literally have one entry.

It gets better.

Microsoft pays a $3-per-share dividend. As the owner of 333 million shares, every year Steve gets $1 billion direct deposited in his bank account ($250 million per quarter).

Bill Gates' Trillion-Dollar Blunder

Some stock sales were probably inevitable, but let's run a quick hypothetical. Let's say instead of dropping down to 1.4%, Bill Gates reduced his equity stake to 35%. At today's $4 trillion market cap, a 35% stake in Microsoft would be worth a little over $1.4 trillion. That's the bag that Bill dropped.

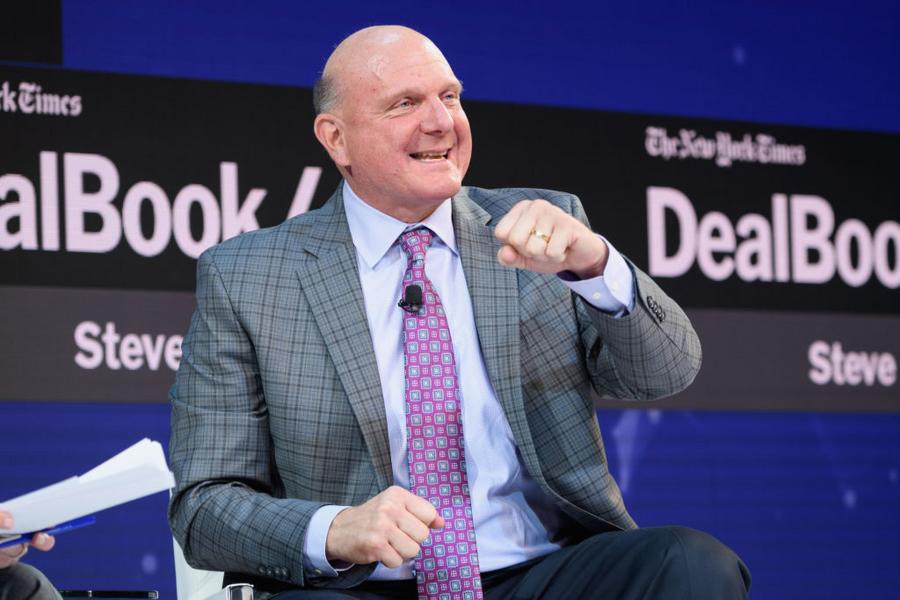

Jeff Gross/Getty Images

The Greatest Investor Nobody Saw Coming

In a recent interview on the "Acquired" podcast (a personal favorite by the way), Steve shared a fantastic anecdote involving the late, great Charlie Munger — Warren Buffett's longtime business partner at Berkshire Hathaway.

At some point in the last few years (Charlie died in late 2023), Ballmer agreed to participate in a Q&A at a private country club where both he and Munger were members. Just before Ballmer took the stage, the wheelchair-bound nonagenarian waved him over. Charlie told Steve he planned to ask a question during the session, so keep an eye out for his hand. Considering Charlie's famously sharp tongue and inability to hold back blunt criticism, this may not have been welcome news.

The Q&A went on for a while without a peep from Munger. Then, at the very end, sure enough, a 90+ year-old hand popped up in the air. Unable to resit, Ballmer called on him and braced for a sting. Here's what Munger asked:

"Steve, I'm wondering why you held onto your Microsoft stock when your partners over there [Bill Gates & Paul Allen] didn't. I know you're not that smart."

The room erupts in laughter, and then Ballmer replied:

"No, Charlie, but I'm loyal."

Michael Cohen/Getty Images

/2024/07/Steve-Ballmer.jpg)

/2022/10/GettyImages-1187708883.jpg)

/2025/11/GettyImages-2202985860.jpg)

/2024/01/bill-gates.jpg)

/2009/09/Bill-Gates.jpg)

/2019/04/GettyImages-948065808.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2019/10/denzel-washington-1.jpg)

/2020/06/taylor.png)

/2020/02/Angelina-Jolie.png)

/2019/11/GettyImages-1094653148.jpg)

/2020/01/lopez3.jpg)

/2009/09/Jennifer-Aniston.jpg)

/2019/04/rr.jpg)

/2009/11/George-Clooney.jpg)

/2020/04/Megan-Fox.jpg)

/2018/03/GettyImages-821622848.jpg)

/2009/09/Brad-Pitt.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2017/02/GettyImages-528215436.jpg)