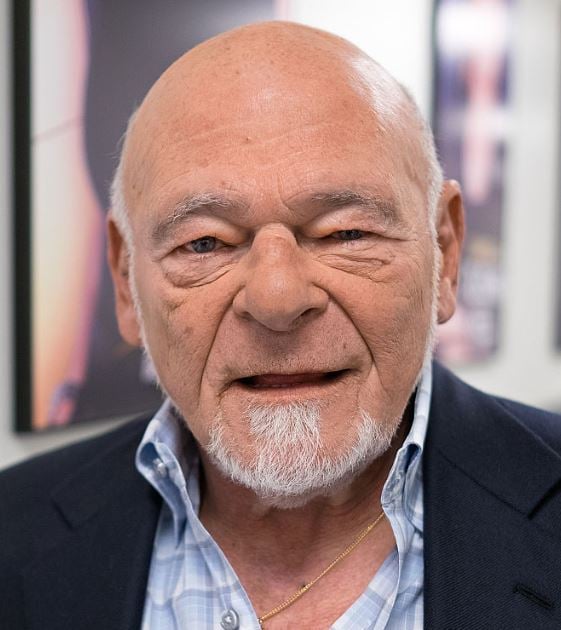

What was Sam Zell's Net Worth?

Sam Zell was an American businessman who had a net worth of $6 billion at the time of his death in May 2023 at the age of 81. Sam Zell earned his fortune buying distressed commercial properties and then either holding them or selling them when their values had increased substantially. His primary investment company was called Equity Group Investments (EGI). In 2007, he sold his office building business, Equity Office Properties Trust, to Blackstone Group for $39 billion.

Early Life

Sam Zell was born September 28, 1941 in Chicago, Illinois. Zell was born into a Jewish family in Chicago, Illinois, shortly after his parents emigrated from Poland to escape the Nazi occupation. This family history of resilience and entrepreneurship played a vital role in shaping Zell's ambitious nature.

Zell attended the University of Michigan, where he received a Bachelor of Arts degree and later, a Juris Doctor degree from the university's law school. His foray into real estate investment began while he was still a student, managing and owning student apartment buildings with his fraternity brother, Robert H. Lurie.

Equity Group Investments

In 1968, Zell and Lurie co-founded Equity Group Investments, marking the beginning of Zell's formal real estate investment career. The company initially focused on acquiring distressed real estate assets, aligning with Zell's "contrarian" investment strategy. He sought out undervalued properties, confident in his ability to transform them into profitable ventures.

Zell sold Equity Group Investments to Blackstone in 2007 for $39 billion. His timing would prove to be brilliant/extremely lucky. Within a year the real estate market collapsed and the world entered the Great Recession of 2008/2009. Had he attempted to sell the business a year later, it would have fetched a fraction of the value.

Expansion and Diversification

Equity Group Investments expanded rapidly under Zell's leadership, eventually growing into a vast empire of publicly traded companies, including Equity Residential, the largest apartment owner in the U.S. His investment interests also diversified into other sectors, such as energy through Covanta Holding Corp., logistics through Prologis, and healthcare through CareTrust REIT.

Getty

Tribune Company Acquisition

In 2007, Zell made a foray into the media industry by acquiring the Tribune Company, a multimedia conglomerate that owned the Chicago Tribune, Los Angeles Times, and several television stations. While the $8.2 billion deal initially seemed promising, the company filed for bankruptcy within a year due to excessive debt and declining advertising revenues. Despite the bankruptcy, Zell's reputation as a shrewd and risk-taking investor remained intact, and he continued to thrive in his other business ventures. Zell ultimately lost more than $300 million on the deal.

Philanthropy and Civic Involvement

Beyond his business accomplishments, Zell was involved in various philanthropic endeavors. He and his wife, Helen, established the Zell Family Foundation, which donates to a wide array of causes, including education, medical research, and the arts. The couple also funded the Zell Entrepreneurship Program at the Interdisciplinary Center Herzliya in Israel.

Zell's civic involvement also includes serving as the former chairman of the board of trustees for the Art Institute of Chicago, and as a committed supporter of his alma mater, the University of Michigan.

Death

Sam Zell died on May 18, 2023 at the age of 81.

/2010/09/sz.jpg)

/2014/05/GettyImages-961408306.jpg)

/2014/01/Bruce-Karsh.jpg)

/2014/04/GettyImages-578544824.jpg)

/2014/09/art-falcone.jpg)

/2014/05/GettyImages-83363095.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2020/01/lopez3.jpg)

/2009/09/Brad-Pitt.jpg)

/2020/04/Megan-Fox.jpg)

/2017/02/GettyImages-528215436.jpg)

/2019/04/rr.jpg)

/2009/11/George-Clooney.jpg)

/2020/02/Angelina-Jolie.png)

/2009/09/Cristiano-Ronaldo.jpg)

/2018/03/GettyImages-821622848.jpg)

/2020/06/taylor.png)

/2010/09/sz.jpg)

/2014/05/GettyImages-83363095.jpg)

/2014/01/Bruce-Karsh.jpg)

/2014/09/art-falcone.jpg)

/2023/04/bill-marriott.jpg)

/2025/11/Hussain-Sajwani.jpg)

/2010/08/kaiser.jpg)

/2014/01/GettyImages-692816322.jpg)

/2019/10/denzel-washington-1.jpg)

/2009/09/Jennifer-Aniston.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)