- Category:

- Richest Business › Wall Street

- Net Worth:

- $80 Million

- Birthdate:

- May 8, 1929 - Jan 16, 2019 (89 years old)

- Birthplace:

- Montclair

- Gender:

- Male

- Profession:

- Investor

- Nationality:

- United States of America

What was John Bogle's Net Worth?

John Bogle was an American businessman and executive who had a net worth of $80 million at the time of his death in 2019. John Bogle is best known for founding the Vanguard Group, one of the world's largest investment management companies. Index funds were Bogle's revolution. It was his theory that an average investor would do far better owning a small piece of the entire market as opposed to paying a mutual fund manager endless fees to frequently perform WORSE than the market. Over the course of his career, Bogle was a fierce advocate for low-cost index funds and was recognized as one of the most influential figures in the world of finance. He is also known for his 1999 book "Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor," which became a bestseller and is considered a classic.

Bogle's $80 million net worth might be surprising given that the company he founded, Vanguard, managed around $5 trillion at the time of his death. However, in a 2012 interview Bogle confirmed that he wasn't a billionaire, nor a hundred-millionaire and that his net worth was in the "double digit millions." Had he decided to run Vanguard as a more traditional mutual or hedge fund, he surely could have been worth many many billions of dollars. However Bogle decided he wanted his investment managers to work more to help customers as opposed to charging big management fees or fees on gains that took away from customers. He is arguably a hero to millions of everyday working investors. Today Vanguard manages more than $8 TRILLION.

In 1997, Bogle was appointed by then-U.S. Securities and Exchange Commission Chairman Arthur Levitt to serve on the Independence Standards Board. He also received honorary doctorate degrees from Princeton University, University of Delaware, University of Rochester, New School University, Susquehanna University, Eastern University, Widener University, Albright College, Pennsylvania State University, Drexel University, Immaculata University, Georgetown University, Trinity College and Villanova University. In 2004, TIME magazine named Mr. Bogle one of the world's 100 most powerful and influential people and Institutional Investor presented him with its Lifetime Achievement Award. John Bogle died on January 16, 2019 at the age of 89.

Early Life

John Bogle was born May 8, 1929 in Montclair, New Jersey. He grew up in a middle-class family and attended Blair Academy, a boarding school in New Jersey. Bogle went on to attend Princeton University, where he studied economics and graduated with honors in 1951.

Vanguard

After graduating from college, John Bogle was hired by Wellington Management Company. He eventually rose to President and then CEO of the company. Bogle was actually fired from Wellington in 1974. After getting fired, he put together a new fund which he called Vanguard.

Under Bogle's leadership, Vanguard became known for its low-cost index funds, which were designed to provide investors with broad exposure to the market at a lower cost than traditional actively managed funds. Bogle's philosophy of low-cost investing was based on the idea that most actively managed funds fail to outperform the market over the long term, and that investors would be better off investing in a low-cost index fund that tracks the market.

Today The Vanguard Group is the largest mutual fund organization in the world with just over $8 trillion in assets under management. Headquartered in Malvern, Pennsylvania, Vanguard is made up of more than 160 mutual funds. The Vanguard 500 Index Fund, the largest fund in the group, was founded by Mr. Bogle in 1975. It was the first index mutual fund.

In 1997, he was named one of the "Financial Leaders of the 20th Century" in Leadership in Financial Services (Macmillan Press Ltd., 1997). In 1999, FORTUNE designated him as one of the investment industry's four "Giants of the 20th Century." In the same year, he received the Woodrow Wilson Award from Princeton University for "distinguished achievement in the nation's service."

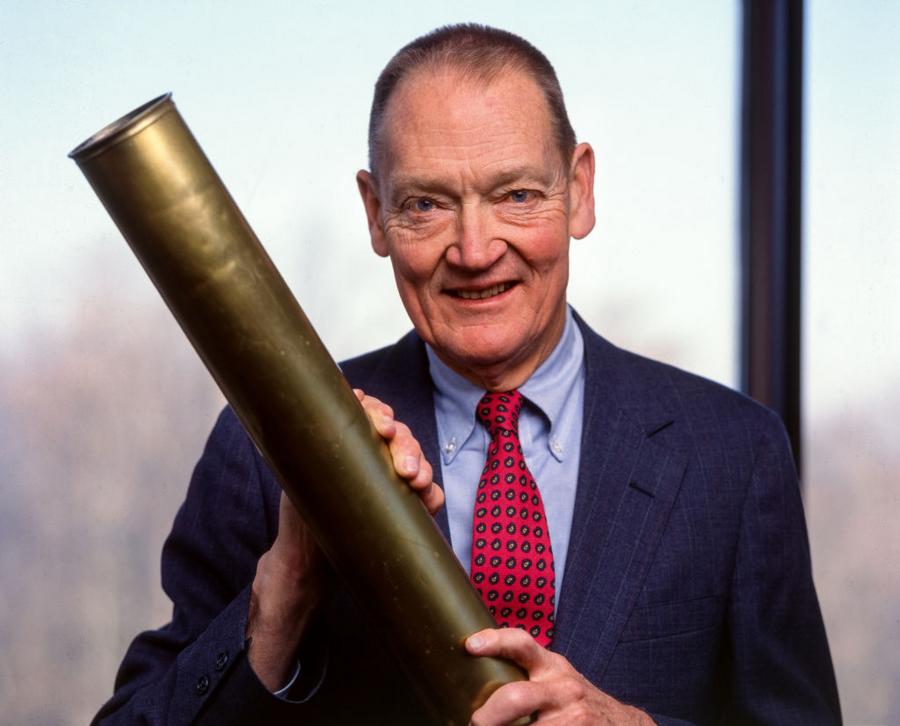

(Photo by Leif Skoogfors/Getty Images)

Later Career and Legacy

John Bogle continued to lead Vanguard for several decades, and remained an outspoken advocate for low-cost investing and the importance of long-term thinking in investing. He also authored several books on investing, including "The Little Book of Common Sense Investing" and "Enough: True Measures of Money, Business, and Life."

Bogle's impact on the world of finance was profound, and his philosophy of low-cost investing has become widely adopted by investors around the world. He was recognized as one of the most influential figures in finance, and was awarded several prestigious honors and awards throughout his career, including the Woodrow Wilson Award for Corporate Citizenship and the George S. Eccles Prize for Excellence in Economic Writing.

In addition to his work with Vanguard, Bogle was also involved in several other business ventures and philanthropic organizations. He was a vocal critic of executive compensation and corporate governance practices, and was known for his advocacy on behalf of investors and shareholders.

Personal Life and Philanthropy

John Bogle was known for his personal integrity and his dedication to philanthropy. He was an active supporter of several charitable organizations, including the Bogle Foundation, which he founded in 1998 to support education and community service.

In his personal life, Bogle was an avid reader and a lover of classical music. He was also known for his dedication to his family, and was a devoted husband, father, and grandfather.

Death and Legacy

John Bogle passed away on January 16, 2019, at the age of 89. His death was widely mourned in the world of finance, and he was recognized as a visionary leader and a champion for investors.