- Category:

- Richest Business › Richest Billionaires

- Net Worth:

- $5 Billion

- Birthdate:

- Feb 16, 1936 (88 years old)

- Birthplace:

- Queens

- Gender:

- Male

- Profession:

- Businessperson, Financier, Investor

- Nationality:

- United States of America

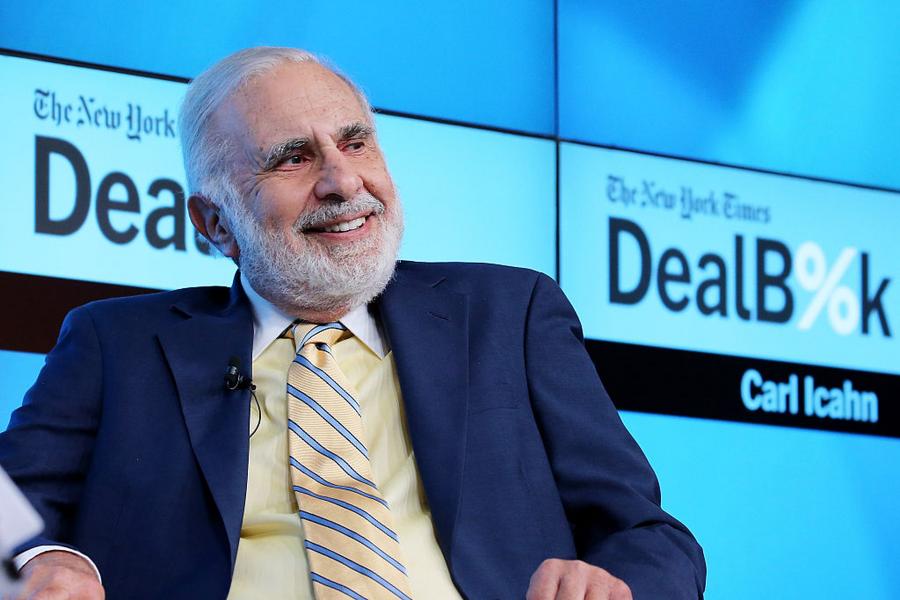

What is Carl Icahn's Net Worth?

Carl Icahn is an American businessman, investor, and activist shareholder who has a net worth of $5 billion. Carl Icahn is best known as the founder and controlling shareholder of the holding company Icahn Enterprises in New York City. His investment strategy, which has become mainstream for hedge funds, involves buying large stakes in companies that he then pressures to make corporate policy changes that will benefit shareholders. In the 1980s, Icahn was criticized for being a "corporate raider" when he profited from the hostile takeover of Trans World Airlines, and since then, has attempted a number of other mercenary takeovers and asset strips.

Wealth Drop

The majority of Carl Icahn's fortune is derived from his 86% stake in Icahn Enterprises. He also owns an additional 2% of the company indirectly.

As recently as February 2023, Carl Icahn's net worth was as high as $25 billion when his company's stock was trading in the $50+ range. Unfortunately for Carl, in May 2023 his company became the target of a short-seller's attack. In the aftermath the company's stock price dropped from $50 to $20. As a result, Carl's net worth dropped from $25 billion to $6 billion.

Early Life and Education

Carl Icahn was born on February 16, 1936 in the Brooklyn borough of New York City to Bella, a schoolteacher, and Michael, a cantor and later substitute teacher. Raised in Queens, Icahn went to Far Rockaway High School. Later, he attended Princeton University, graduating with an AB in philosophy in 1957. Icahn went on to enroll at New York University's School of Medicine, but dropped out after two years to join the military reserve.

Career Beginnings in Business

Icahn entered the world of business affairs in 1961 when he became a stockbroker for Dreyfus Corporation. A couple years later, he worked as an options manager for Tessel, Patrick & Co., and then for Gruntal & Co. In 1968, Icahn used $150,000 of his own savings plus a $400,000 investment from his uncle to purchase a seat on the New York Stock Exchange. He subsequently formed Icahn & Co., which focused on options trading and risk arbitrage. Icahn's first takeover attempt came in 1978, when he took a controlling stake in the appliance company Tappan and forced its sale to Electrolux, effectively doubling his investment. The next year, he bought Bayswater Realty & Capital Corporation. In the early 80s, Icahn acquired AFC Industries; selling his shares to Phillips Petroleum in 1985, he made a profit of $50 million.

Trans World Airlines Controversy

Icahn attracted much controversy in the mid-to-late 80s, when he pooled his funds with both borrowed and investor funds to purchase 50% of Trans World Airlines, before acquiring the company completely via a leveraged buyout. He then sold the company's assets to repay his own debts, causing many to label him as a "corporate raider" engaged in asset stripping. Icahn went on to sell TWA's London routes to American Airlines for $445 million, making him a profit while sending TWA into $540 million worth of debt.

Neilson Barnard/Getty Images for New York Times

Further Business Career

Beyond the TWA debacle, Icahn has been prolific in his mercenary business affairs. In 1986, he attempted an unsuccessful, $8 billion hostile takeover of U.S. Steel. He made a $200 million profit five years later when he sold his stake for $1 billion. Icahn also made a huge profit from his sale of his stake in Texaco in 1989. Later, in 1997, he made a profit from selling his 7.3% interest in RJR Nabisco, and also took control of Marvel Comics.

In 2004, Icahn started raising $3 billion to form his hedge fund Icahn Partners; he also took ownership stakes in Time Warner and Blockbuster Video. Among his other investments, he bought shares in such companies as Take-Two Interactive, Telik, Motricity, BEA Systems, Biogen, Yahoo!, Lawson Software, Mentor Graphics, Netflix, Nuance Communications, Hologic, Lyft, and many more. Additionally, he attempted a failed takeover of Lionsgate Films in 2011. Icahn has also invested hundreds of millions in Apple.

Political Career

In the 2016 presidential election, Icahn endorsed Donald Trump. He also announced the creation of a super-PAC pledging $150 million for tax inversions on corporations. Following the election, Icahn became Special Advisor to the President on Regulatory Reform, a position he held until August of 2017. The next year, Icahn avoided millions in losses when he sold holdings in steel-price sensitive stock days before the Trump administration announced a tariff on steel imports.

Philanthropy

Despite his ruthless, often immoral corporate practices, Icahn has also done some philanthropic work. He has made significant donations to Mount Sinai Hospital, New York and to his alma mater of Princeton University, which created a genomics laboratory in his name. He also has a foundation called the Children's Rescue Fund, which built a 65-unit complex in the Bronx for homeless single pregnant women and single women with children; it also operates two other homeless shelters. Additionally, Icahn Stadium, the Carl C. Icahn Center for Science, and the Icahn Scholar Program at Choate Rosemary Hall are all named after him.

Personal Life

In 1978, Icahn met Czech ballerina Liba Trejbal; when she became pregnant eight months later, he offered to wed her on the condition that she sign a prenuptial agreement. The two married in 1979, and had two children named Brett and Michelle. Later, in 1993, Trejbal filed for divorce and sued to invalidate the prenuptial agreement on the grounds that she signed it under duress. The couple finally divorced in 1999. Subsequently, Icahn married his longtime assistant Gail Golden, giving him two stepchildren in the process.

Icahn is an avid fan of thoroughbred horse racing. In 1985, he established the horse breeding operation Foxfield Thoroughbreds. Five years later, his horse Meadow Star won the Breeders' Cup Juvenile Fillies. In 1992, he became a commercial breeder. Icahn ultimately shut down Foxfield in 2004, and sold all his weanlings and mares.