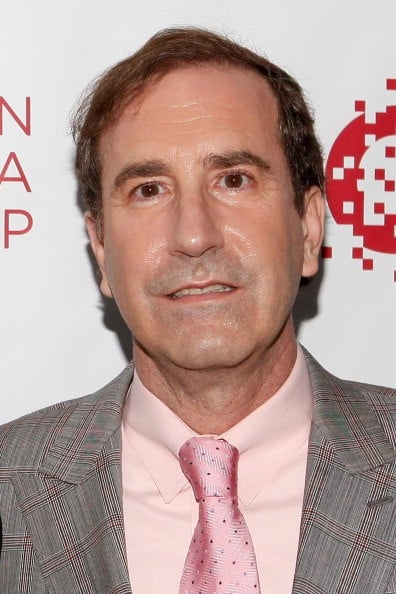

What is Harry Markopolos's Net Worth?

Harry Markopolos is an American financial fraud investigator and retired securities executive who has a net worth of $2.5 million. Harry Markopolos is best known for uncovering Bernie Madoff's massive Ponzi scheme, resulting in Madoff's conviction and sentencing to prison in 2009. The following year, he published his book about the scandal, "No One Would Listen: A True Financial Thriller."

Early Life and Education

Harry Markopolos was born on October 22, 1956, in Erie, Pennsylvania to Greek-American restaurateurs Georgia and Louis. He is the eldest of three children, with his siblings being Louie and Melissa. Markopolos attended Roman Catholic schools growing up, graduating from Cathedral Preparatory School in 1974. He later went to Loyola College in Maryland, from which he earned his BA in 1981. Markopolos would go on to obtain a Master of Science in finance from Boston College in 1997. He also became a Chartered Financial Analyst and Certified Fraud Examiner.

Securities and Finance Career

In 1987, Markopolos began his career on Wall Street as a broker for the small Erie-based brokerage Makefield Securities. The next year, he became an assistant portfolio manager with Darien Capital Management in Connecticut. In 1991, Markopolos began working as a portfolio manager at the Boston-based options trading company Rampart Investment Management. He remained there until 2004, during which time he became the company's CIO. Markopolos went on to become a forensic accounting analyst working for attorneys who sue companies under the False Claims Act.

Bernie Madoff Investigation

In 1999, while working at Rampart Investment Management, Markopolos discovered that one of the company's frequent trading partners, Access International Advisors, was dealing with a hedge fund manager who was consistently bringing net returns of 1% to 2% every month. The hedge fund manager was found to be Bernie Madoff, who was operating a massive wealth management business for his clients. Markopolos noticed something was off when he obtained a copy of Madoff's revenue stream and saw that the return stream rose at a near-perfect 45-degree angle on the chart, an impossibility in finance. Through this and other evidence, he eventually concluded that Madoff was either running a Ponzi scheme or a front.

Markopolos enlisted the help of two of his Rampart colleagues and continued to investigate Madoff. The results were so concerning that he filed a formal complaint with the Boston office of the US Securities and Exchange Commission in 2000. However, the SEC ignored him. In lieu of government action, Markopolos received help from journalist Michael Ocrant, who published an article questioning Madoff's returns. Another investigative article was published a week later by Erin Arvedlund. Markopolos again alerted the SEC to Madoff's fraud in 2001, this time with a more detailed submission, but was again ignored.

Following his second submission to the SEC, Markopolos went to Europe with Access CEO René-Thierry Magon de La Villehuchet with the aim of securing investors for a product he developed for Rampart. In Europe, Markopolos discovered that 14 different funds across various firms were invested with Madoff, and that each fund manager thought they were the only one from which Madoff was taking new money. This convinced Markopolos that Madoff was operating a Ponzi scheme. His belief was confirmed when he learned that many of the funds invested with Madoff were offshore. Markopolos continued his investigation after leaving Rampart in 2004. His work culminated in a 21-page memo he sent to the SEC in late 2005 that was titled "The World's Largest Hedge Fund is a Fraud." In mid-2008, Markopolos and his team found evidence that Madoff was accepting leveraged money, signaling that he was running out of cash. At the end of the year, Madoff was publicly revealed to be a fraud after his sons contacted the FBI, leading to his arrest. His Ponzi scheme collapsed, with his clients having lost anywhere from $10 billion to $35 billion in the fraud. Among the victims was Markopolos's associate René-Thierry Magon de La Villehuchet, who took his own life as a result.

Cindy Ord/Getty Images

Congressional Testimony

In early 2009, Markopolos testified before the US Congress's House Financial Services Committee's capital markets panel. He sternly denounced the SEC for ignoring his warnings about Madoff's fraud, saying that it was "an abject failure by the regulatory agencies we entrust as our watchdog." Markopolos also testified that he was afraid for his and his family's safety due to fear of possible reprisal from Madoff and his criminal associates.

Other Work

In 2010, Markopolos published the book "No One Would Listen: A True Financial Thriller," focusing on his investigation of the Madoff scandal and the SEC's failure to do anything about it. Since then, he has continued to do forensic accounting analysis and financial fraud investigations. In 2019, he published a report claiming fraudulent accounting within General Electric, although the claims were ultimately dismissed. Markopolos has also investigated the hedge fund Bridgewater Associates.

Personal Life & Real Estate

With his wife Faith, who also works in the financial industry, Markopolos has three sons, two of whom are twins.

In 1999, Harry and Faith paid $343,000 for a home in Whitman, Massachusetts. They still own this home, and today it is worth around $700,000.

/2014/06/GettyImages-121987096.jpg)

/2009/09/GettyImages-85333747.jpg)

/2016/02/Ruth-Madoff.jpg)

/2015/09/Martin-Shkreli.jpg)

/2017/08/Steven-Mnuchin.jpg)

/2020/06/taylor.png)

/2020/01/lopez3.jpg)

/2018/03/GettyImages-821622848.jpg)

:strip_exif()/2015/09/GettyImages-476575299.jpg)

/2019/11/GettyImages-1094653148.jpg)

/2009/09/Jennifer-Aniston.jpg)

:strip_exif()/2009/09/P-Diddy.jpg)

/2017/02/GettyImages-528215436.jpg)

/2019/04/rr.jpg)

/2009/09/Cristiano-Ronaldo.jpg)

/2020/04/Megan-Fox.jpg)

/2009/09/Brad-Pitt.jpg)

/2014/06/GettyImages-121987096.jpg)

/2009/09/GettyImages-85333747.jpg)

/2016/02/bernie.jpg)

/2015/05/will.jpg)

/2009/10/GettyImages-118334611.jpg)

/2019/07/Allen-Stanford.jpg)

/2014/08/GettyImages-84294097-e1559066156789.jpg)

/2019/07/GettyImages-85333488.jpg)

/2020/02/Angelina-Jolie.png)

/2009/11/George-Clooney.jpg)